Stablecoin Wars Heat Up As Circle Asks Congress To Rein In Tether

Representatives from Circle and Coinbase are requesting U.S. legislators to empower the Treasury Department to clamp down on USDT issuer Tether.

By: Pedro Solimano • Loading...

DeFi

The stablecoin wars have reached Washington, D.C.

Representatives from Circle and Coinbase testified today in front of Congress, requesting that the legislative body grant additional powers to the U.S. Treasury to crack down against Tether and its U.S.-based banking partner, Cantor Fitzgerald.

“I personally believe no company should be allowed to reference the US Dollar without having democratic values inside their USD-backed stablecoin,” said Caroline Hill, Director for Global Policy and Regulatory Strategy at Circle, the company that issues the USDC stablecoin.

Hill’s words echoed those of Grant Rabenn, Director of Financial Crimes Legal for Coinbase, who claimed today that “criminals seek those off-shore platforms” that don’t offer the robustness of compliance that companies like Circle do. Tether dominates the stablecoin sector with its USDT stablecoin.

Rabenn and Hill vehemently insisted Congress take action and offer the U.S. Treasury more powers to investigate and clamp down on their number one competitor – accusing Tether of enabling money laundering and terrorist financing.

Stablecoins are digital currencies pegged 1:1 with a fiat currency, in most cases, the U.S. Dollar. Hong Kong-based USDT is the market favorite by a wide margin, commanding $51 billion in 24-hour volume, followed from afar by USDC with $7.1 billion.

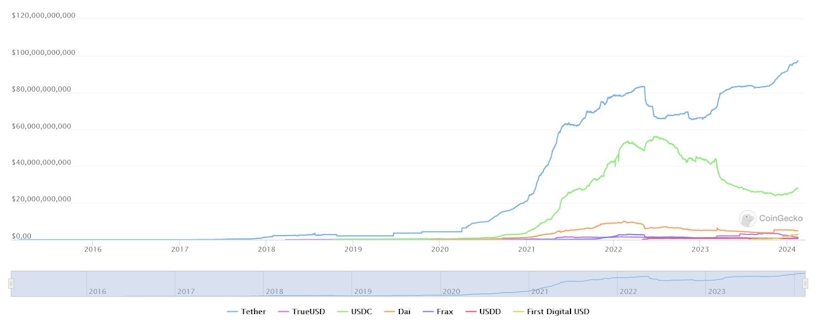

Today’s hearing comes amid a widening gap in market capitalization between Tether’s USDT and Circle’s USDC, considered a sign of interest from investors and traders. After bottoming out in mid-November 2023, USDC has bounced from $25 billion to $28 billion.

Meanwhile, USDT has been unstoppable since December 2022, with its market cap surging from $65 billion to $97 billion, according to Coingecko.

Stablecoins are a core component of the crypto industry, with many pundits calling them the killer use case for blockchain-based assets. An uptick in volume is normally considered a sign of renewed interest in the entire asset class.

Offshore versus on-shore

On-shore stablecoins, such as USDC, have taken a clear pro-regulatory stance, seeking compliance with U.S. regulators. However, that has not translated into more interest from investors around the world, who continue to transact with USDT – known for adopting a more laissez-faire approach.

“Those off-shore companies often play jurisdictional whack-a-mole attempting to avoid tough AML rules and expecting that regulators don’t care,” said Rabenn today, insisting that “the U.S. government should use all existing tools to go after these platforms.”

The comments from Hill and Rabenn are slightly confounding, given the industry’s goal of fighting claims from Congress that crypto is mostly used for illicit activities.

Crypto Twitter responds

As Circle and Coinbase cried foul to regulators, industry players lambasted these actions – with some calling out the hypocrisy.

“Treasury department should investigate Circle for all of the times they did not blacklist illicit funds when they had ample time instead of larping as the compliant centralized stablecoin,” wrote renowned on-chain sleuth ZachXBT.

His words reverberated across the platform, with many calling it “disgraceful” and “trash behavior.”

Coinbase and Circle appear to be playing a dangerous game at a time when Senator Elizabeth Warren and other prominent U.S. politicians seem intent on curtailing the crypto industry.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.