Spark Protocol Users Max Out $200M DAI Debt Ceiling

Decentralized Stablecoin Sector Heats Up With crvUSD and GHO Growing Quickly

By: Samuel Haig • Loading...

DeFi

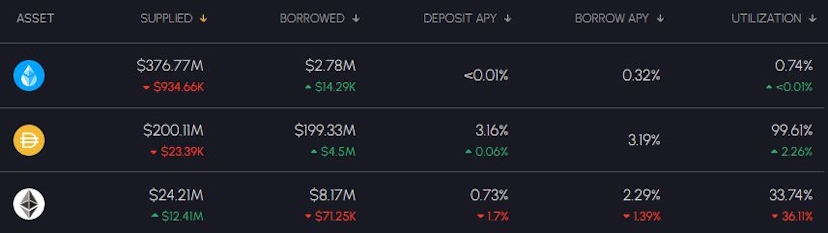

MakerDAO’s money market, Spark Protocol, is bumping up against its DAI debt limit less than two weeks after raising the ceiling from $20M to $200M.

Maker noted that it only took eight days for users to borrow $180M DAI. The pool's utilization currently sits at 99%, according to Blockanalitica.

Spark’s milestone comes as competition among decentralized stablecoins is heating up, with Maker hoping to protect DAI’s market share from new DeFi-native stable tokens issued by Curve and Aave.

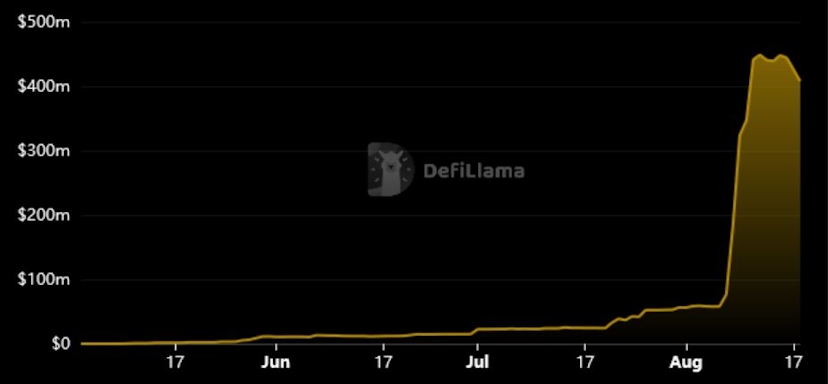

The surge in activity on Spark followed MakerDAO increasing its DAI Savings Rate (DSR) — which Spark users can access — from 3.3% to 8% in an explicit bid to drive up the adoption of both Spark and DAI. However, DSR yields will reduce as utilization increases.

The move was an immediate success, sending Spark’s total value locked (TVL) parabolic with a 674% gain from $58M to $449M in six days. The DSR’s TVL is also up more than 300%, currently sitting at $1.39B, according to Dune Analytics.

Spark Protocol launched in June after MakerDAO team members forked Aave v3, the leading DeFi lending protocol.

crvUSD Mounts Comeback

crvUSD, a competing stablecoin from leading stablecoin DEX, Curve Finance, is also gaining traction.

On Aug. 16, crvUSD’s supply hit all-time highs, with users borrowing more than $107M crvUSD against collateral assets deposited on Curve. This followed a brief decline in crvUSD utilization, with public confidence in the Curve protocol being shaken two weeks ago after an exploit targeting Vyper — the smart contract programming language used by Curve — resulted in hackers draining $25M from Curve’s liquidity pools. The majority of the stolen assets were later returned.

DeFi Lender Alchemix Says Vyper Hacker Returned Stolen Crypto

Affected protocols had offered a bounty if the attacker returned the funds.

crvUSD supply fell from $100M at the end of July to a local low of $65M just one week later following the incident. Curve first deployed crvUSD in May, and expanded its collateral assets and debt ceiling in June.

GHO Picks Up Steam

Aave is also looking to stake its claim on the decentralized stablecoin sector with the launch of GHO one month ago.

Despite deploying less than five weeks ago, Aave users have already minted 22.4M GHO tokens, outpacing the early growth of both crvUSD and Spark.

However, GHO has struggled to hold its peg to the U.S. dollar, with the token’s price consistently trending downward since its launch. According to Token Logic, GHO’s average price over the past 24 hours was $0.967.

Advertisement

The Defiant Daily

“an industry must-read”

Get an edge in Crypto with our free daily newsletter

Know what matters in Crypto and Web3 with The Defiant Daily newsletter, Mon to Fri

90k+ Defiers informed every day. Unsubscribe anytime.