Solend to Not Freeze Whale's $216M Account After Move Decried as 'Opposite of DeFi'

The Money Market dApp on Solana is Anxious About Liquidation Exposure

By: Samuel Haig • Loading...

Markets

Solend, a money market dApp and the largest Solana-based protocol, is scrambling to address exposure from a whale that’s holding 5.7M SOL worth $215.7M, according to governance proposals.

Over the last three days, Solend’s community has approved a plan to take control of the whale’s account, then reversed course after the move was criticized by decentralization advocates, and is now weighing a third proposal to introduce account limits that will result in borrowed positions exceeding $50M being progressively liquidated.

Fears of Liquidations

The flurry of action comes as fears of liquidations continue to roil the DeFi market. Solana has rallied alongside Ether, jumping 34% in the last seven days, according to CoinGecko. Yet investors and protocols remain jittery about fallout from loanbooks backed by digital assets. Solend’s token, SLND, has tumbled almost 16% in the last seven days.

That’s what spooked the Solend community. On June 19, the whale’s loans of 108M USDC and USDT were backed by $170M worth of SOL, meaning that a further drawdown of 20% would result in part of collateral being liquidated.

The Solend team estimated that the account represented 95% of SOL deposits, 88% of USDC borrowed, and a quarter of the total value locked in the dApp’s protocol.The team said if SOL’s price fell to $22.30, a fifth of the whale’s account would be subject to liquidation.

With liquidations occuring in the form of market orders executed on decentralized exchanges with relatively thin liquidity, Solend worried that the price impact caused by liquidating the whale’s SOL may be so large that it could result in the protocol failing to recover enough USDC and USDT to pay down the account’s debts.

In the worst case, Solend could end up with bad debt.

Solend

“It’d be difficult for the market to absorb such an impact since liquidators generally market sell on DEXes. In the worst case, Solend could end up with bad debt,” Solend warned.

Solend is Solana’s largest protocol, representing 11% of the network’s total value locked (TVL) with a $286.4M TVL, according to DeFi Llama.

On June 19, Solend put together its first ever governance proposal suggesting it take control of the whale’s account, warning that its loan position could pose a systemic threat to Solend and the broader Solana ecosystem.

‘Opposite of DeFi’

Entitled SLND1, the proposal quickly passed with more than 97% support from SLND tokenholders. But the move was widely criticized by crypto investors as a blow to decentralization. Anthony Sassano of The Daily Gwei podcast described the proposal as “the very opposite of DeFi,” and “even worse” than TradFi.

“Normally you hear about accounts getting frozen in TradFi, you don’t really hear about accounts being taken over and the money being… seized unless it’s part of some criminal case,” he said.

Others weighed in. “I think it’s great we can vote to liquidate whales and take over their assets,” tweeted crypto_bitlord7. “This is what decentralisation is truly about.” Clickityclack5 commented “wasn’t Solana supposed to handle more tps than visa? Why tf is it getting crippled by one whale liquidation?”

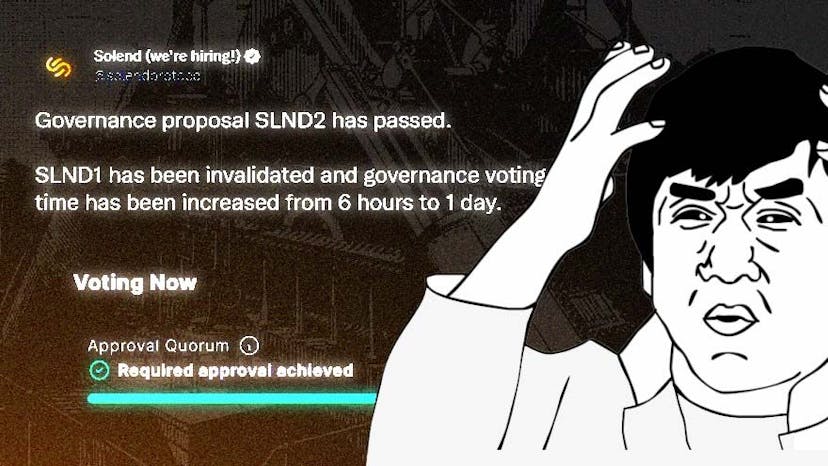

In response, the Solend team launched a second proposal seeking to reverse SLND1. It also extended Solend’s governance voting period to one day.

“The price of SOL has been steadily increasing, buying us some time to gather more feedback and consider alternatives,” the proposal said. It passed with 99.8% support.

The community is now voting on a third proposal advocating for the introduction of a $50M borrowing limit on accounts, with all positions exceeding the limit set to be progressively liquidated.

Voting Period

The account limit would be gradually introduced starting from $120M and reduced by $500,000 each hour. The proposal would also temporarily change the maximum amount of a position that can be liquidated from 20% to 1% to ease the impact of the liquidations on orderbooks.

“Due to the need to move quickly, consider the 24 hour voting period as notice for users to reduce their borrow positions,” the team added.

The proposal appears likely to pass, with 99% of 431,771 votes cast in favor so far.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.