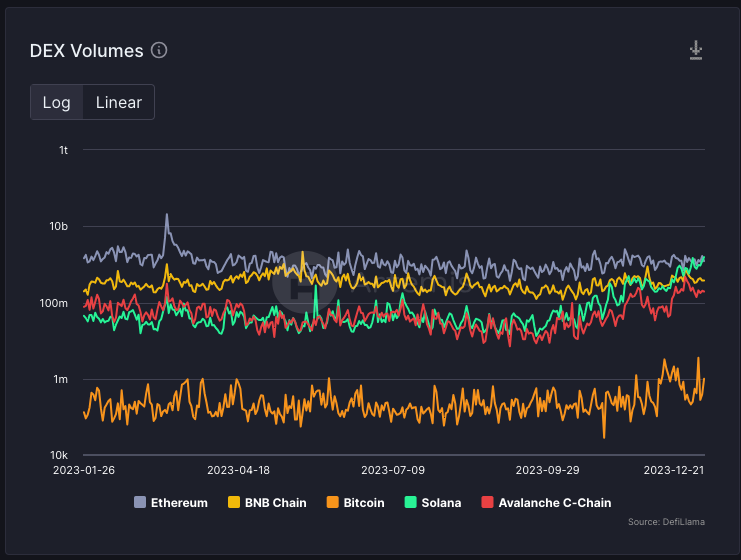

Solana Flips Ethereum in DEX Volume and NFT Sales

The network registered $10B in DEX volume in the past seven days, while Ethereum processed $8.8B.

By: Pedro Solimano • Loading...

Blockchains

Solana season is in full force with the network overtaking Ethereum for the first time in terms of decentralized exchange volume and non-fungible token sales over the past week.

DEX volume on Solana has skyrocketed in the past seven days, topping $10 billion according to DefiLlama., and shooting past Ethereum’s d $8.8 billion over the same time period. Solana also claimed first for 24-hour volume, with $2.1B against Ethereum’s $1.2B.

DEX volume isn’t Solana’s only victory. The network has processed $109 million NFT sales in the past seven days, Crypto Slam reports, eclipsing Ethereum by $30 million.

Solana’s token, SOL, has also been on a rocket ship. Its market capitalization reached $39.6B, placing it in the top five largest cryptocurrencies, surpassing XRP. The token is up 7.3% to $92.78 today, and has seen a whopping 670% increase this year.

Memecoin Frenzy

Memecoins seem to be fueling the current frenzy, with BONK going bonkers with a 300% increase in December. According to Coingecko, its market cap has surpassed the $1 billion mark. Another Solana-based memecoin, Dogwifhat, has also added to the frenzy, clocking a 428% gain in the past seven days.

With a flurry of traders trying to get in on the next BONK, tokens are being issued at an impressive pace. Almost 5,000 new tokens launched today alone.

SOL Landing

This past week, at least three web3 startups which were based on other Layer 1s made the jump to Solana, with Render, Ondo Finance, and Helium landing on the chain.

Just today Paxos said it received authorization by a NY regulator to issue its USDP stablecoin on the network. This represents the first stablecoin issuance on another network that isn’t Ethereum.

Large entities such as Visa and Shopify have also added support for Solana this year.

It’s a far cry from the state of the network just one year ago, when it was still reeling from the collapse of FTX after suffering several outages in the previous months.

The question traders must be asking after the rally is, can it keep it up?

Advertisement

The Defiant Daily

“an industry must-read”

Get an edge in Crypto with our free daily newsletter

Know what matters in Crypto and Web3 with The Defiant Daily newsletter, Mon to Fri

90k+ Defiers informed every day. Unsubscribe anytime.