SEC Alleges Richard Heart Used Investor Funds To Fuel Shopping Spree

US Regulator Filed Charges Against Hex, Pulsechain, PulseX, and Founder Richard Heart For Conducting Unregistered Securities Offerings

By: Jeremy Nation • Loading...

Regulation

On Monday, the Securities and Exchange Commission (SEC) filed a lawsuit against Richard Schueler, known in crypto circles as Richard Heart, and his startups Hex, Pulsechain, and Pulsex.

The lawsuit alleges that Heart conducted multiple unregistered securities offerings, raising more than $1 billion in total.

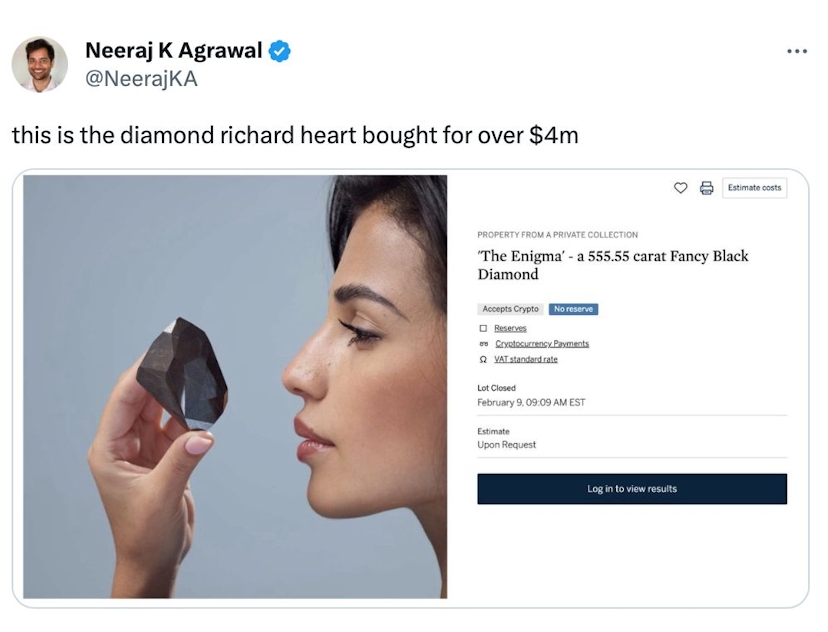

Instead of fulfilling his company’s development or marketing obligations, “Heart and PulseChain used at least $12.1 million of investor funds for Heart’s personal luxury purchases, including a 555-carat diamond, expensive watches, and high-end automobiles,” said the SEC filing.

Unregistered Securities

The SEC alleges that Heart and Pulsechain violated the antifraud provisions of federal securities laws.

Heart is said to have enticed investors who bought HEX tokens between December 2019 and November 2020 by claiming Hex was “the first high-yield ‘Blockchain Certificate of Deposit.’” Investors were drawn in with incentives and bonuses including a staking program that advertised a 38% annual return in HEX on staked HEX tokens, according to the complaint.

The filing goes on to allege that a majority of the 2.3 million (ETH) raised, worth $678M at the time, comprised of “‘recycling’ transactions directed by Heart or other insiders, which enabled Heart and others to gain control of a large number of Hex tokens, while creating the false impression of significant trading volume and organic demand for Hex tokens.”

In addition, from July 2021 to April 2022 Heart is said to have raised over $676M in connection with unregistered offerings related to PulseChain’s PLS token, and PulseX’s PLSX token, said the SEC filing.

Heart is accused of having misappropriated investor funds to fuel a shopping spree, buying top tier-sports cars, a 555-carat diamond, and luxury timepieces.

An address that isn’t explicitly named in the complaint but matches transactions mentioned in the suit against Heart holds just over $35M in DAI stablecoins and has sent $26.8M through the Tornado Cash mixer, according to Arkham Intelligence data.

‘A Long Time Coming’

Steven Lubka, Head of Swan Private at Swan Bitcoin, observed that Hex appeared to have characteristics more akin to a Ponzi scheme than a crypto platform based on speculative on-chain asset trading like Uniswap or meme-powered cryptocurrencies like Dogecoin.

“To players in the know, this was a long time coming. HEX was always primarily invested in, not by cryptocurrency investors, but by average people who had little knowledge or exposure to the broader industry,” Lubka told The Defiant.

“Hex branded itself as a certificate of deposit, but one which would deliver eye-popping returns. The founder, Richard Heart, flagrantly promoted it, and himself, donning luxury goods, expensive watches, and expensive sports cars,” said Lubka.

Advertisement

The Defiant Daily

“an industry must-read”

Get an edge in Crypto with our free daily newsletter

Know what matters in Crypto and Web3 with The Defiant Daily newsletter, Mon to Fri

90k+ Defiers informed every day. Unsubscribe anytime.