Red Flag Alert: A Framework for Vetting Crypto Projects Part II

With hacks and exploits breaking every week in DeFi, participants are undoubtedly asking where to look for red flags, how to protect their investments and how to vet projects. In this three-part series, we provide a framework to help with just this. Part I analyzed Tokenomics, Part III will analyze mental frameworks, and Part II…

By: Eugenio Croitoru • Loading...

HacksWith hacks and exploits breaking every week in DeFi, participants are undoubtedly asking where to look for red flags, how to protect their investments and how to vet projects. In this three-part series, we provide a framework to help with just this. Part I analyzed Tokenomics, Part III will analyze mental frameworks, and Part II here, analyzes team, social media and backers. Let’s dive in.

- The Team

It’s important to analyze the team behind the project because they’ll be the people who will be building the core of the product. However, in crypto projects, it’s not always straightforward to analyze the team because in some cases they can be pseudonymous and still pump out the next top idea in this space. The team can also be a decentralized organization with multiple outside contributors. Multiple factors have to be weighed accordingly.

For projects with non-anonymous teams, you can usually find details about the team on their website or via a google search.

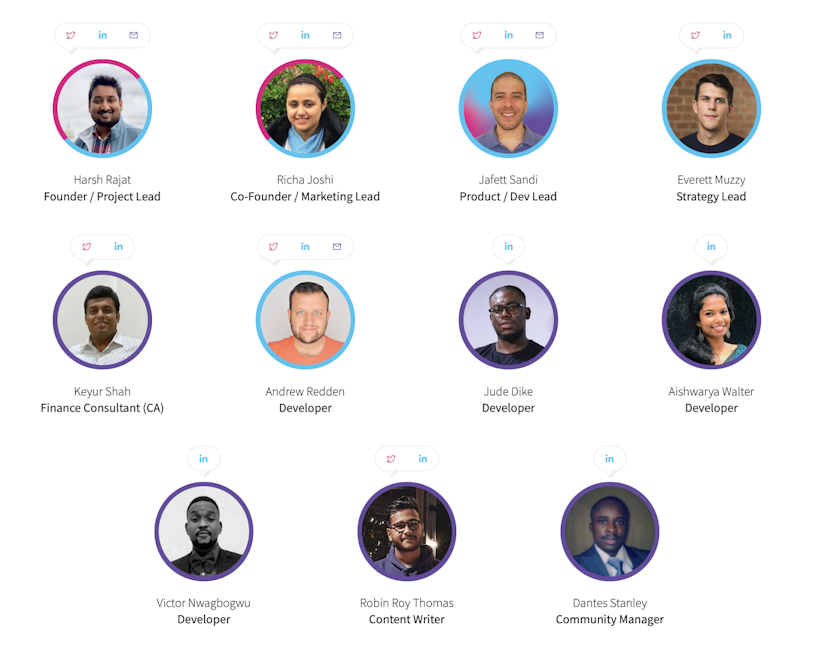

EPNS team along with their social media handles

The first thing that we want to look for is that the team members have valid social media handles (LinkedIn, Twitter etc.) and it helps if they have a fair amount of activity on their social media handles. It also helps if they have previous experience working in something related to what they’re building or have academic papers related to it. Now I know what you’re thinking, many times we make a social media account and never end up posting anything (I’m looking at you, lurkers ?). But it still helps to look at it just to ensure that it’s not a fake profile with a picture from somewhere like thispersondoesnotexist.

In some cases, the founders of a project will be pseudonymous, notably, Bitcoin, and more recently SushiSwap. In that case, it becomes more complicated to analyse the team and you want to look at other signals like an endorsement or detailed twitter threads from people or organisations who have a good reputation in this space. Twitter advanced search is your friend here.

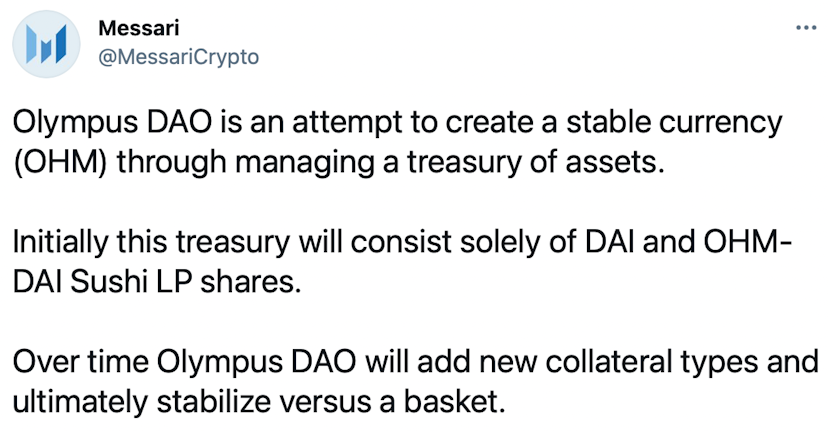

Star-studded line of investors in Compound

The second thing to look for here is the people backing the team. It’s great if the project has the backing of good investment firms who have invested in successful projects in this space. If you’re new to this space and find yourself flustered by constant flux, then it’s not a bad idea to piggyback on the judgment of VCs who have got experience navigating this field. But do know that VC’s are also wrong quite often, they just try that their right bets provide outsized returns as compared to their (many) failed bets.

- Whitepaper Analysis

In an ideal world, you’d want to read and fully understand the whitepaper of the project and even better, go into their code-base. But this is hard when investing in crypto is not your full-time job and going through these documents is very time-consuming. Also, most traders don’t have the skillset and technical knowledge to fully make sense of this information.

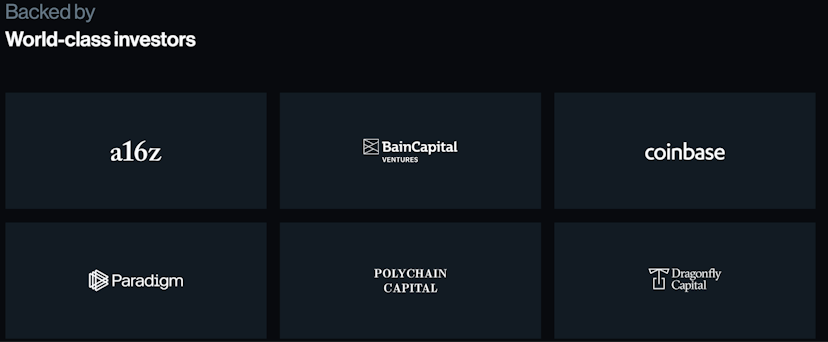

When reading the white paper, the first thing you should do is read the abstract and the conclusion. Just reading these two parts will give you a good idea of what the project’s vision and goals are. In the first pass, if there are errors in the grammar of the content or the paragraphs feel like a bunch of incoherent sentences mashed up together, then it’s a huge red flag.

(Chainlink Whitepaper)

After the first pass, we’ll check the paper for plagiarism. Low-effort scam tokens often copy other papers and just change the ordering of words at best. There are plenty of plagiarism checkers online like Grammarly but the paid versions often search better than the free ones.

But in my experience, I’ve found that Google does a way better job at detecting plagiarism. It does require a bit of patience and persistence, though. What you want to do is select a few lines or paragraphs and look for hits on google. If you find google linking you to files, then you should compare those by using something like draftable. Another trick is to use multiple search engines like DuckDuckGo and Bing to get slightly different results.

This is something that you’ll get better at with time as you scan through the paper and find something which stands out like a sore thumb in comparison to the rest of the content. This is because scammers are usually lazy and end up copying the same papers.

- The Social Aspect (Community)

This is a very broad topic but for this post, we’ll be focusing on the three most popular modes used for communication by crypto projects: Twitter, Discord and Telegram.

Let’s start with Twitter. Obviously, the first thing that we look at for measuring social proof is the number of followers the account has, but this is often a false metric. In many cases, the users can be bots who don’t really interact with posts. What you want to look for are genuine accounts that interact with the posts (by liking, retweeting or commenting.)

But sir? What’s stopping the bots from engaging with posts? ? Nothing. But if you lurk around twitter much, then you should be able to recognize some Twitter bots by the same repetitive comments, low activity other than with a few specific accounts and newer accounts.

You can go one step further and do a simple bot analysis of an account using Botometer which was built by the Observatory on Social Media (OSoMe) and the Network Science Institute (IUNI) at Indiana University. It uses a machine-learning algorithm to analyze the accounts which includes a variety of metrics. You can read more about the metrics here.

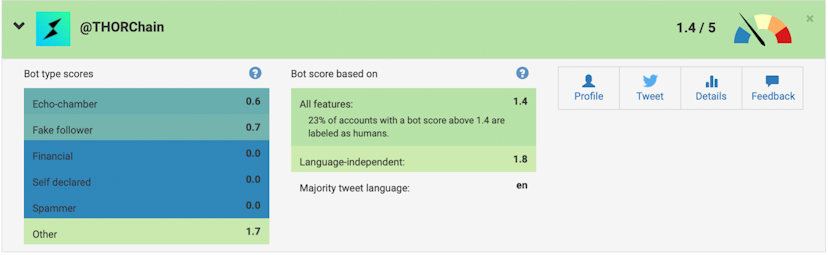

Botometer score for THORChain

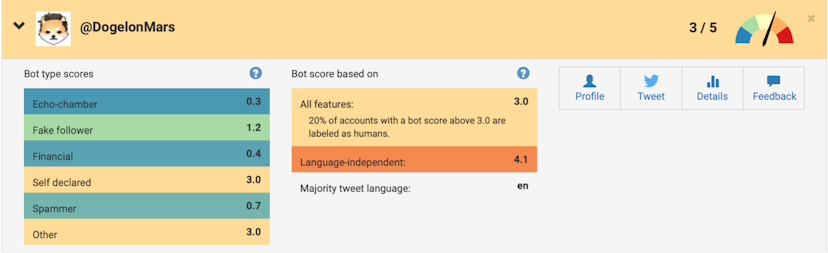

Botometer score for DogelonMars

The lower the score, the better it is as it indicates organic followers. Of course, take this with a pinch of salt because there’s little you can do to stop bots from following your account.

Moving on to Discord, the only thing that you want to look for over here is that there is an active and thriving community. Discord is great because it allows you to directly interact with the core team of the project. In general, the founding team should also be open to you DM’ing them to talk about something. This is because the founding team often has a big chunk of tokens pre-allocated to them and their success depends on the project succeeding.

Although I’d advise everyone to search for usual questions because if you have a question, then chances are someone else also had the same doubt.

The last communication channel that we want to focus on is Telegram. You might find many variations of this (moderated, unmoderated, announcement-only telegram).

Discord group of OlympusDAO

Social media is one of my favourite parts to look at because a project which gets this part right has a good organic community at the grassroots level that does the marketing for them. Sometimes this can feel like a cult, which can be good or bad depending on the analysis of tokenomics which we discussed in the previous article. Ric Burton’s article on Aliens, Jedi & Cults is a good read for identifying people and projects with potential. More on mental models in the next article. Be sure to follow me on twitter to learn more about crypto.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.