Polygon’s Fee And Transaction Volumes Diverged In Q2

Transaction Fees Jumped 225% In April Despite Activity Dropping By 33%

By: Samuel Haig • Loading...

DeFi

Transaction fees on Polygon PoS Chain, the most popular network in the Polygon ecosystem, suffered extreme volatility last quarter despite activity trending within a narrow range.

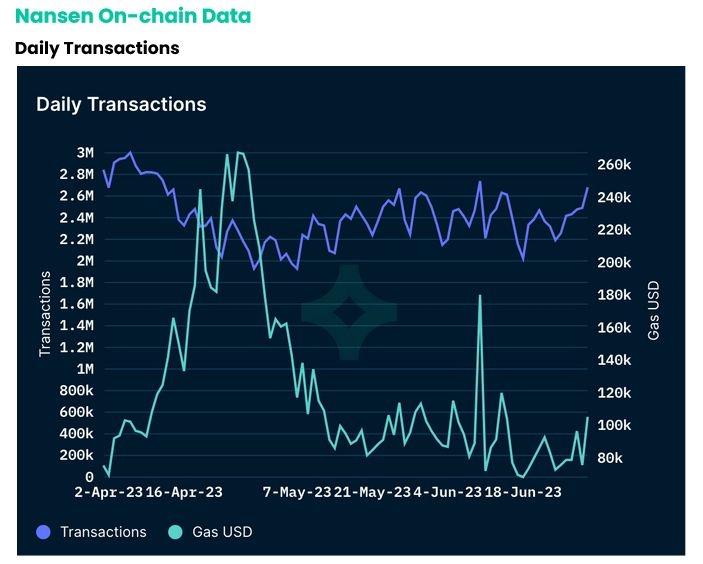

According to a new report from Nansen, the daily gas fees expended by the network spiked from $80,000 to $260,000 during April, despite coinciding with transaction volume falling from 3M to 2M.

Fees then largely trended between $90,000 and $120,000 throughout the quarter, with the exception of a sudden spike to $185,000 in mid-June. Transaction volume was range-bound between 2M and 2.5M throughout May and June.

Polygon 2.0

The second quarter saw major milestones for the Polygon ecosystem. Polygon Labs unveiled its Polygon 2.0 roadmap, which includes the introduction of a new network token, revamped governance, and unifying the PoS Chain with zkEVM, Polygon’s latest scaling solution.

Nansen also noted the v0.9 launch of Supernets, Polygon’s framework for launching Layer 3 appchains.

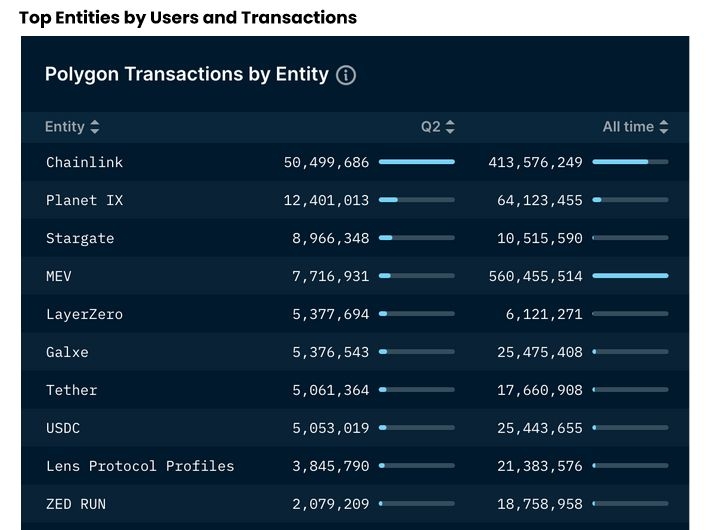

Chainlink, a leading web3 oracle provider, was the network’s most active protocol with 50.5M transactions during the quarter. Planet IX, an NFT-powered strategy game, ranked second with 12.4M, followed by the Stargate cross-chain bridge with nearly 9M, and activity from MEV bots with 7.7M.

MEV Bots Dominate Activity

MEV bots have been the largest single source of transactions on the network since its inception with 560M, followed by Chainlink with 414M.

Top stablecoins USD Coin and Tether topped the protocol rankings by active users with 1.4M each, followed by XEN Crypto with 1M.

Despite the fee volatility, transacting on the sidechain was still 99% cheaper than Ethereum’s mainnet over the same period.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.