PancakeSwap Adopts Vote Escrow Tokenomics

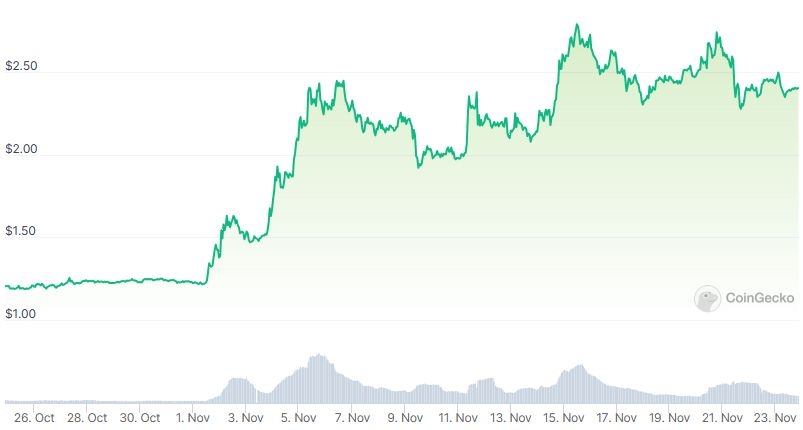

Governance overhaul aims to improve liquidity while driving value to the CAKE token, which has doubled over the last month.

By: Tarang Khaitan • Loading...

DeFi

PancakeSwap, the largest decentralized exchange on the BNB Chain, has successfully passed a proposal that introduces veCAKE (vote-escrowed CAKE) and gauge voting to the protocol.

veCAKE lockers will be able to vote on governance proposals and will direct CAKE token emissions to their liquidity pools of choice.

“This strategic update is designed to empower CAKE holders with increased governance influence, boost liquidity across PancakeSwap pools, and increase rewards for CAKE stakers.” Chef Cocoa, PancakeSwap’s marketing manager, told The Defiant.

CAKE is up 100% in the past 30 days.

Users can lock up their CAKE tokens for up to 4 years to receive veCAKE. This model was pioneered by Curve with veCRV in 2020 and has been adopted by a plethora of DeFi protocols since.

At launch, veCAKE holders will be able to vote on farms on the Ethereum, BNB Chain and Arbitrum, with support for other chains being rolled out gradually.

To ensure the health of the protocol, the team has allocated 40% of the emissions generated from the gauges to provide liquidity for core LP pairs that include ETH, BTC, BNB, stablecoins, and CAKE.

The PancakeSwap team intends to gradually reduce the 40% allocation as more participants engage in the governance process.

veCAKE holders also have the option to earn third-party ‘bribes’ for providing incentives to specific liquidity pools, similar to Curve and Convex.

Last week, PancakeSwap launched its new gaming marketplace. The platform launched with two titles, which the team developed in collaboration with other GameFi studios.

PancakeSwap is the second-largest DEX by volume. It processed more than $3.22B of trades in the past 7 days, according to a Dune query.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.