Micropayments for Content Refuse to Take Off and Crypto Isn’t Helping (Yet)

Have you ever you clicked through a captivating article headline only to be met by a paywall, looked at the subscription prices and wished, “if only I could pay for this single story,” before clicking away? We’ve all been there. In fact, you’re likely having this experience often lately as more websites turn to subscriptions…

By: R. D. Danes • Loading...

DeFi

Have you ever you clicked through a captivating article headline only to be met by a paywall, looked at the subscription prices and wished, “if only I could pay for this single story,” before clicking away? We’ve all been there. In fact, you’re likely having this experience often lately as more websites turn to subscriptions to make up for falling ad revenues.

If we pay per song or video we stream or download, why not do the same with written content? It makes sense to readers, and yet, micropayments for journalism refuse to take off. Credit card fees are often blamed, as they make microtransactions of about $0.30 per story infeasible.

Some are hailing crypto as a potential solution. SatoshiPay on the Stellar network, Raiden Network and Brave on Ethereum and Coil on Interledger Protocol are some of the projects leading the way. For strictly fiat, Axate is the one making the most headway. Results are mixed.

Global spending on subscriptions in 2019 was $66.2B, with $5.2B of that going to digital content, according to the 2019 World Press Trends report. Data on microtransactions for content is hard to come by. Some suspect online publications are leaving plenty of money on the table by turning away readers who just want to access a single story.

Blendle, whose CEO, Alexander Klöpping, stepped down in January, is an example of a company that tried and failed to make journalism micropayments profitable. Backed by millions in investments from The New York Times, Nikkei and others, the Netherlands-based news aggregator curated content from top titles from around the web on its app. For five years, it sold individual stories for under a dollar and even offered disappointed readers refunds. In 2019, Klöpping told the press it had still not made a profit and announced that it would pivot away from micropayments to subscriptions. Last July, the company sold to French competitor Cafeyn.

SatoshiPay Traction

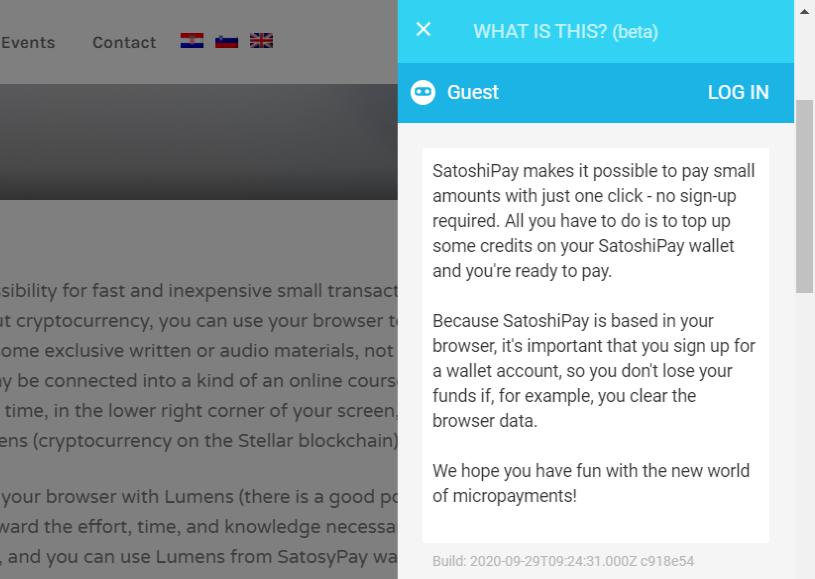

SatoshiPay executes micropayments on Stellar, an open-source, decentralized protocol for sending money maintained by the nonprofit Stellar Development Foundation. Transactions on the Stellar blockchain cost hundredths of a cent. SatoshiPay itself collects 3% per transaction. Credit cards and payment companies like PayPal and Square, on the other hand, typically charge about $0.30 + 2.9% per purchase.

Last August, SatoshiPay said it had processed over 1 million euros in payments for publisher clients over the previous two years.

SatoshiPay’s small blue widget appears on the bottom right of publishers’ websites. Readers click on it to open a wallet they can top up with USD, Stellar Lumens or any other Stellar-supported token.

Looking around online for publishers using SatoshiPay — or any micropayment system, to be fair — does not turn up a lot of results. But there are a few pretty high-profile examples. In 2018, Axel Springer, the largest publishing house in Germany, with titles like Rolling Stone and Business Insider, partnered with SatoshiPay. What became of this experiment is a bit of a mystery today, however. When asked how it panned out, the publisher had only this to say: “We used SatoshiPay in a pilot project, as we regularly try out alternative payment providers, and were pleased with the results. At this point, however, we do not plan to use the service on a permanent basis.”

Also in 2018, London paper CityAM tried SatoshiPay for per-article sales in its digital edition. But there’s no sign of the SatoshiPay widget on its site — which has a section titled CryptoAM — today.

According to WordPress.com, there are 70+ active installations of the SatoshiPay plugin on the platform (which are not searchable for privacy reasons). Roisin Cure, an EU-based artist, runs an eponymous wordpress site with content ranging from articles to art lessons. Cure gave the SatoshiPay plugin a try, but “Whilst the system worked okay, my customers weren’t into it at all,” she said. Her visitors — perhaps not the most technically inclined demographic, she admits — “mistrusted it and weren’t comfortable with anything to do with it. They frequently got in touch to complain and express their confusion and bafflement.”

Technology news site The Register used SatoshiPay to collect payments for an eBook called Geeks Guide to Britain. “I think we generated about $800 revenue. We were never going to use micropayments for our core content, and we decided we did not have enough use cases to justify extending this experiment,” said founder and one-time editor in chief, Drew Cullen. This is no reflection on the folks at SatoshiPay, who were “competent and helpful,” Cullen added.

There needs to be one or two ubiquitous cross-title wallets in order for micropayments to scale in publishing; that presents a big enough distribution and marketing issue, said Cullen. He points to aggregated payments, perhaps with partial use of crypto on the backend, as a possible means to reduce fees. But for the most part, crypto is a “needless complication,” he said.

Coinqvest Payments

Coinqvest also leverages Stellar to provide digital-currency checkouts. Users pay in any currency supported on Stellar, and merchants receive it in the currency of their choice, fiat or virtual. Coinqvest automates exchange and conversion in real time and charges a fee up to 1% for withdrawal. “Think of it as Stripe for crypto,” said co-founder Stefan Schneider. Coinqvest has hundreds of users, including SaaS companies, but no publishers, according to Schneider.

Besides Coinqvest, the most economic way to execute micropayments might be to use Stellar directly in a peer-to-peer fashion, Coinqvest’s other co-founder, Marcin Olszowy, said. “The big issue with that is that not enough people hold crypto or stablecoins on the Stellar Network yet and, thus, wouldn’t be able to make payment in the first place,” Olszowy said.

Raiden Network & Brave

Alongside Stellar, there are similar options, like the Raiden Network, an infrastructure layer on top of Ethereum — the most actively used blockchain. Its Microraiden payment channels enable near instant, near feeless off-chain payments and work with any ERC-20-compatible token. One company to build a micropayment solution on top of it was South African startup Wala. It shuttered due to lack of investments, rather than any problems with the underlying technology.

The Brave browser lets its users earn and spend its custom ERC-20 Basic Attention Token (BAT). And they can at least begin doing so without having to round the usual crypto learning curve. The tokens are held in a custodial wallet managed by Uphold and sent to websites as browsers consume their content. Brave charges a 5% fee on each consumer-to-creator payment. It claims to have over a million creators — publishers including The Washington Post and Vice, YouTubers, etc. — registered to collect BAT from internet users. Their level of actual participation is uncertain, however. When I told Cullen that The Register is on the list, he responded: “Are we? No one cares about Brave.”

Coil for Any Browser

Coil, like Brave, enables micropayments to stream to creators, but the extension can be installed on the user’s browser of choice. It was founded by Stefan Thomas, former CTO of Ripple, which in 2019 granted Coil $260 million. Free for creators, subscribers pay $5.00 per month for unlimited access to monetized content. Coil streams creators $0.36 for every hour a user spends on their content until the user’s balance dips to $0.50, and then it streams the remaining amount in smaller bits.

Built on the Interledger Protocol, Coil now collects USD only, but plans to accept crypto in the future. For creators, it’s feeless. Subscribers incur the credit card fee, and any money remaining in their balance at the end of a month goes to Coil the company.

Matt Saincome publishes news-satire site The Hard Times, which became part of the Coil platform in late 2019. The publication’s earnings from Coil subscribers are now at about $200 per month and growing, according to Saincome.

“Web monetization isn’t too much yet, but it’s thrilling to see it come in instantly when people visit the site,” said Saincome, who is actively encouraging others to join through Coil’s publisher affiliate program. “I think it’s the way forward,” he said.

Roll’s Social Tokens

Finally, Roll allows creators to issue their own ERC-20 tokens to gift or sell to consumers who in turn use them to access content. If they sell these “social tokens,” that will likely entail fees that someone must pay. Roll is curating users for its beta program, which is picking artists, influencers and entrepreneurs. Its fee is a 12% take of the social money, once minted.

While not exactly pay-per-article, the tokenized content model appears to be growing. Outpost Protocol is a web3 content platform where users pay for access to blogs or newsletters — which have their own tokens — with crypto. Titles include Jamm Session — token name: $JAMM — which examines the intersection of creators and crypto.

Friends With Benefits is a Discord channel that members pay 50 FWB tokens to join. They earn more tokens by sharing their content or working for the good of the community and can swap them in exchange for exclusive offers, like a Substack Sampler Pack, coupon codes for products and services, etc.

These options all offer something, but none can be said to be the Holy Grail: totally free, instant, one-time, per-piece, agnostic micropayments that don’t require a user to actually know anything about DeFi. Developers are working towards such a system, where virtual-currency payments will be as simple as email, but we’re not there yet. Also, fees for exchanging funds or transferring to a bank account remain until someone figures out how to eliminate those.

Axate for Fiat Payments

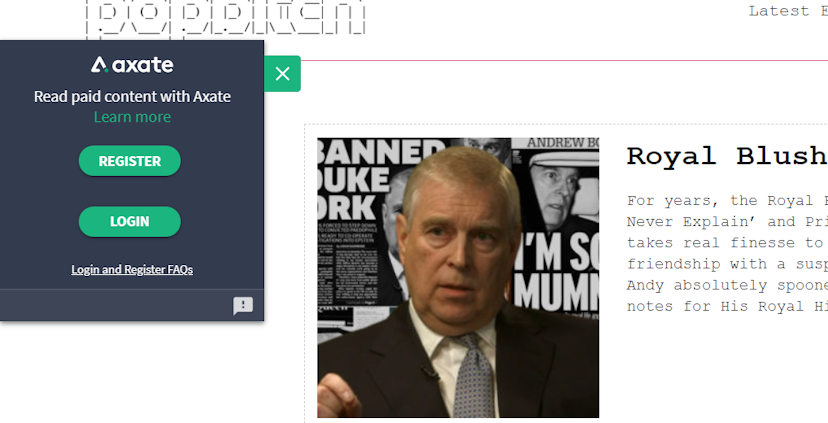

Axate is an up and comer on the fiat side. Like SatoshiPay, it shows up on customers’ sites as a tiny widget and operates with a top-up wallet.

Camilla Wright founded a newsletter and website called Popbitch popular in the UK. Covering a mash of pop culture news and political scandals, its main source of revenue is advertising from its free monthly newsletter. Axate, which it added to its site for per-article and per-day payments a few years ago, as its first beta user, has introduced an additional, smaller revenue stream.

About 10% to 20% of people clicking through the site now have a wallet, and overall revenue has increased since implementation, so there’s no evidence of it cannibalizing subscriptions to its premium weekly edition, Wright explained. “The overwhelming response to Axate is positivity. Readers have said they love the system and that this is how they want to be able to use the internet, and there’s general incomprehension that big media companies don’t understand this and won’t join such a simple and usable system,” she said.

Axate’s revenue sharing model is not explained in detail on its website. It is basically confidential between Axate and its publishers, Write told me. The use of virtual currency to lower fees for transactions, transfers and withdrawals is very much on Popbitch’s radar, she said. However, “From every survey of users (and potential users) we’ve done so far, we don’t see an appetite yet (or even willingness to explore) the use of crypto as the solution to the transaction-fee problem of micropayments – even if it would be spectacularly useful for us at Popbitch,” she said.

The Winnipeg Free Press has been using its own fiat system for pay-per-article purchases since 2015. It sees this as a funnel to subscriptions. In the small focus groups it has conducted, most readers read all the free articles they can, then leave rather than subscribe, the paper’s digital director, Christian Panson, told me. It generates 5k per month from micropayments, of which about $200 goes towards fees (fees for online purchases overall are a bit less than $500 per month). WFP has thought about virtual currency, “but we need to use systems that are simple and that people have. Credit card is currently the most universal payment method. We will add Google, Apple and Amazon Pay sometime in the future,” Panson said.

Axate founder and media veteran Dominic Young maintains that nothing online thrives that does not put the user first. That’s the simple idea behind micropayments — 95% of readers don’t want to buy a subscription out of the gate, so give them something they do want.

It’s also why Axate uses fiat for now. Young told me that Axate is continually thinking about how to address transaction fees, but won’t do anything to put off users. During its conceptual stage, Axate gave much thought to whether or not to leverage virtual tokens or cryptocurrencies to reduce friction or transaction costs. “The reason we haven’t done it yet is because anything that requires a sort of education and learning process by a consumer, anything that is unfamiliar, will increase the abandonment rates and make people more suspicious,” he said.

Axate is ultimately agnostic and will consider virtual currency in the future if there is increased customer demand. Young doesn’t favor the term “micropayments,” and Axate has a “free point” at which article payments over a given period accrue to unlock full access for a day, a week, etc. Pricing strategies such as this are more flexible and user-aware than strict pay-per-article, a belief Young shares with Jamatto founder, James Jardine.

Young added that Axate’s about to announce the onboarding of a couple of big titles. Is this a sign that the pendulum is starting to swing in favor of micropayments? One client in closed testing has revealed that its subscriptions have grown since implementing Axate, he said. “They track in a very sophisticated way so it was good to hear.”

For publishers in many places, transaction fees are at least tax deductible. Doing away with them entirely would mean different things to different publishers. For some online magazines charging for single articles and subscriptions amid dwindling ad revenue, money saved from transaction fees might pay the salaries of two full-time reporters.

Over its five years as, primarily, a micropayment business, Blendle sold $12.7 M in content. It kept 30% and paid out 70% — $9.7 million — to publishers. Prices ranged from $0.09 to $0.59 per article, and users had accounts with a $5.00 minimum that they topped up with credit cards. It also had a premium subscription option for about $11 a month. Taking all these transactions into account, it’s conceivable that eliminating fees, or reducing them to nominal levels, could have saved the company hundreds of thousands, perhaps as much as a $1 million, during that period. What could it have done with those extra funds? Maybe pocketed some profit, for one.

[CORRECTED ON 3/26 TO REFLECT SATOSHIPAY CAN BE TOPPED UP WITH ANY TOKEN]

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.