One Group Doing Just Dandy This Week: MEV Extractors

Players in Arcane Corner of Crypto Raked in Up To 2,000 ETH on June 13

By: Samuel Haig • Loading...

Blockchains

While the bear market has wreaked havoc for many traders, there is one group in crypto that is doing just fine. They’re deploying an obscure tactic involving blockchain mechanics that’s paying off handsomely.

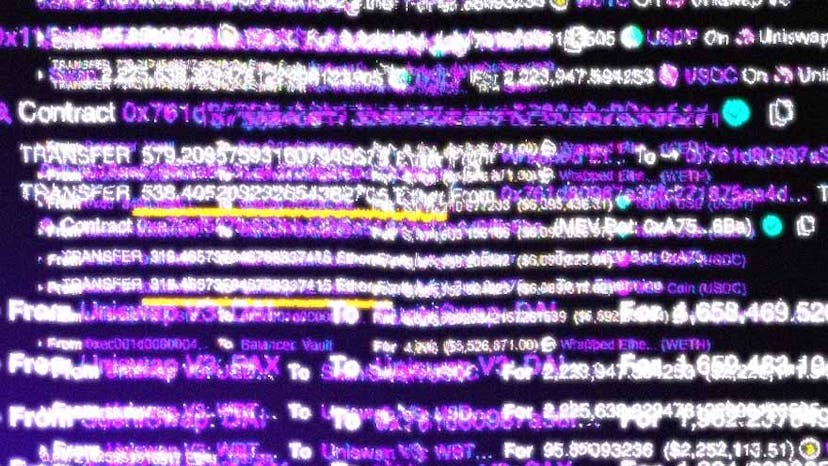

The practice is called Maximal Extractable Value, or MEV, where crypto miners, network validators, and bot operators manipulate the order of blockchain transactions to extract profits through arbitrage. Flashbots, an MEV-focussed research and development organization, estimates more than $600M has been extracted through MEV from November 2020.

‘Most Profitable Day Ever’

Bert Miller of Flashbots tweeted that June 13 was “probably the most profitable day ever” for Flashbots miners — miners using Flashbots’ tools to compete in MEV auctions. Miller said that between 1,500 to 2,000 ETH was paid out to participating miners across two to three blocks on June 13.

The recent record-breaking MEV opportunity appears to have been created when the owner of a MakerDAO vault sold off 65,104.18 ETH in order to reduce their risk exposure. Despite price oracles indicating that ETH was valued at $1,357 at the time of the transaction, the order was executed at an average cost basis of $1,155.59.

The vault previously contained collateral of 153,317.60 ETH, with the user reducing their liquidation price from $1,199.71 down to $874.51. The transaction netted nearly $152,000 in fees for the Oasis app.

The surge in activity on the Ethereum network during the ‘DeFi Summer’ of 2020 created an unprecedented opportunity for MEV extractors.

They operate by executing a transaction on a decentralized exchange with a significant slippage tolerance (slippage tolerance refers to the difference between the price that a trade is confirmed at and the actual price at which a transaction is executed). This enables bot operators searching for transactions with wide slippage margins to submit their own transactions in a bid to capture the spread between other exchanges.

Gas Wars

Exacerbating the situation, opportunistic miners could submit their own transactions intended to take advantage of the arbitrage. This resulted in gas wars between miners and MEV bot operators. The situation drove surging transaction fees and network congestion, with onlookers declaring that an MEV “crisis” was plaguing the Ethereum network.

Flashbots was founded in late 2020 to mitigate the increasing MEV crisis hampering the Ethereum network.

The team warned that an opaque MEV landscape could lead to centralization through the dominance and coalescence of large traders and miners scanning the network for MEV opportunities.

MEV Searchers

Flashbots sought to address the MEV crisis by creating a transparent ecosystem for MEV extraction. Flashbots describes its work as “frontrunning” the MEV crisis, with its tools eliminating competition between miners and MEV searchers for arbitrage by sharing profits between them.

The team first launched MEV-Geth, a modified version of the go-ethereum client enabling block space auctions for miners and traders competing for transactions that would prevent their bids from congesting the network.

Block Space

In October 2021, Flashbots launched the beta version of Flashbots Protect, allowing developers to protect users’ transactions against frontrunning, and eliminating costs for failed transactions.

In December, Flashbots asserted they had pushed most MEV bots out of Ethereum’s mainnet transaction pools, lowering gas fees and increasing block space. The team has also launched a working group exploring how to minimize the effects of MEV once Ethereum has transitioned to Proof-of-Stake.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.