Metaverse Projects Attract 44% Of 2023 Web3 Investments

Sector Pulled In Over $700M Despite Brutal Bear Market

By: Samuel Haig • Loading...

NFTs & Web3

Investors are continuing to pour money into metaverse projects, with nearly half of this year’s VC investments going to the sector.

According to a new report from DappRadar, venture capital firms invested $707M into metaverse projects in the first half of 2023, accounting for 44% of all web3 investments.

“The industry continues to attract significant investments… this continuous funding and development hint towards an exciting future in the metaverse space,” DappRadar said.

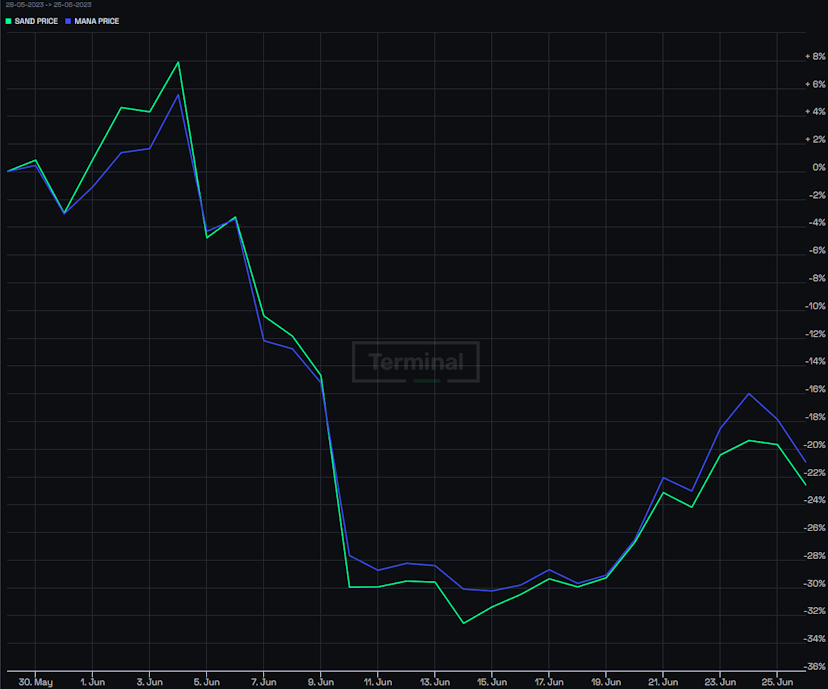

The report also predicts the growing augmented reality/virtual reality (AR/VR) sector could provide a boost to the metaverse sector, noting that metaverse tokens SAND and MANA rose roughly 5% when Apple launched its Vision Pro headset on June 5.

However, both tokens buckled the following week after being labeled as securities by the U.S. Securities and Exchange Commission.

Digital Land Bust

The markets for digital land, a key commodity in many metaverse ecosystems, started 2023 with a bang. Trade volume nearly quadrupled to $311M in Q1, marking its strongest showing since May 2022. The number of digital land sales also increased by 83%, posting a record high of 146,690.

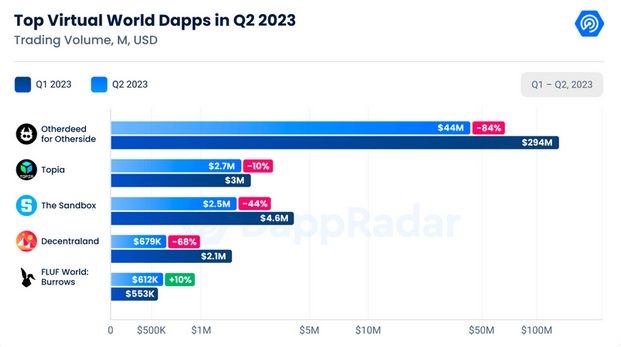

But volumes crashed by 81% during the second quarter, with the number of trades also shrinking by three quarters.

DappRadar attributes the sharp decline in virtual land sales to the recent resurgence in memecoin speculation and renewed interest in DeFi protocols. “These alternative avenues within the blockchain ecosystem became more enticing, leading to a significant decrease in virtual world trading activities,” the report said.

However, much of the pullback can be attributed to the top virtual world project by trade volume, Yuga Labs’ Otherdeed for Otherside, with its quarterly volume plummeting to $44M from $294M amid tumultuous.

For comparison, Topia ranked second with $2.7M after a 10% drawdown, followed by The Sandbox with $2.5M despite falling 44%, and Decentraland with $679,000 following a 68% drop.

Floor prices for leading digital land projects have also posted violent drawdowns from their 2022 all-time highs. Land prices for the Sandbox and Otherside are down roughly 85%, while Decentraland crashed 95%, and Topia has cratered 99.6%.

Uneven Growth

However, Yat Siu, co-founder of Animoca Brands, told The Defiant that much of the metaverse industry continues to grow despite trade volumes recently dipping.

“The metaverse is not one entity and not one system but a multitude, and this aggregation is growing in various ways,” Siu said. “While specific aspects of the metaverse (e.g., trade volume) may appear down, the industry is still large and growing.”

Siu noted the recent emergence of Bitcoin Ordinals, which use an inscription technique to create NFT-like assets on the Bitcoin blockchain.

Last week, Animoca announced the formation of a strategic partnership with Mitsui, a Japanese trading firm founded in 1947 with $115B in total assets, for promoting the metaverse and web3 in Japan.

In April, Japan’s government outlined plans for a national strategy intended to position itself as a leading jurisdiction for web3.

Identity Solutions To Bolster GameFi

Gabby Dizon, the co-founder of web3 gaming collective Yield Guild Games, told The Defiant that web3 identity solutions would underpin a resurgence in growth in the metaverse and GameFI sectors.

“Having blockchain-based identity and reputation solutions will be critical for anyone looking to build a future for themselves in the open Metaverse,” he said.

Dizon said YGG is working on NFT-based identity solutions that track a user's contributions and accomplishments within the guild.

“This is really important because, in things like yield farming, we didn’t really segregate between useful people or people who were just there to extract money,” Dizon said. “While there are many projects solving for asset liquidity in web3, there are very few solving for reputational liquidity, and YGG believes this is the key to unlocking a user-owned internet.”

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.