Merlin Chain’s Surging Growth Pushes Bitcoin’s DeFi TVL Past $2B

Users have piled nearly $1.6B into the launch campaign for the Merlin Chain Layer 2 and its MERL token.

By: Samuel Haig • Loading...

DeFi

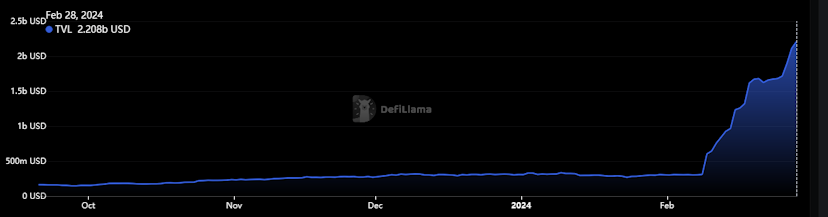

The combined total value locked in Bitcoin-based DeFi protocols has rocketed past $2B amid surging growth on the Merlin Chain Layer 2.

Data from DeFi Llama shows Bitcoin’s total value locked (TVL) surging 600% from $310M on Feb. 8 to $2.15B. The growth was driven by the explosive popularity of Merlin’s Seal — the fair launch campaign for Merlin Chain, a Bitcon Layer 2 launched by Bitmap Tech, and its upcoming MERL token.

Merlin’s Seal kicked off on Feb. 8, with Bitmap Tech reporting a $543M TVL from more than 1M depositors within 24 hours of the network’s launch. Merlin’s Seal now accounts for 71.6% of Bitcoin’s TVL with $1.58B.

On Feb. 27, Merlin Chain announced a strategic partnership with Tron DAO to develop interoperability between Merlin Chain and the Tron network.

Bitcoin’s booming Layer 2 ecosystem

Bitmap Tech describes Merlin Chain as a Bitcoin Layer 2 that combines a zero-knowledge rollup, decentralized oracle network, and on-chain BTC fraud proofs. Bitmap Tech rebranded from Recursiverse in December, and previously launched the BRC-420 token standard and Bitmap metaverse game.

Merlin’s Seal comes as an increasing number of projects are seeking to unlock Layer 2 scalability and build out a robust DeFi ecosystem on top of Bitcoin.

Lightning Network launched in March 2018, with the payments-focused network currently ranking as the largest Bitcoin Layer 2 with a $270M TVL.

Stacks comes in second with $226M, with its TVL surging 1,611% from $13.2M on Oct. 1. The network’s growth has been propelled by the Alex decentralized exchange — which is up 10 times since the start of October with a $82M TVL, and StackingDAO — an STX staking protocol which boasts a $76.7M TVL since launching in December.

Rootstock is also a leading Bitcoin Layer 2 with a $170.5M TVL. Its largest protocol, Sovryn, a BTC-focused money market and margin trading protocol, boasts a $72.5M TVL after rallying 162% over the past month.

A trove of upstart protocols have also recently moved to launch Ethereum smart contract compatibility on Bitcoin.

Merlin’s Seal

Merlin’s Seal participants can earn M-points to secure an allocation of MERL by providing liquidity to Merlin Swap, the Layer 2’s native decentralized exchange, or by “staking” BTC, ETH, USDT, USDC, BRC-20 tokens, and BRC-420 tokens on the network.

MERL will become claimable in March, with 20% of the governance token’s supply going to Merlin’s Seal participants.

However, deposited assets remain locked until April, and are represented by M-Tokens, such as MBTC, MUSDC, and MUSDT. M-Tokens cannot be transferred from Merlin Chain but can be traded for other assets, with M-Token holders able to redeem the tokens for the underlying assets come April.

Bridged assets are custodied using Cobo’s Multi-Party Computation (MPC) wallet, which requires signatures from both Merlin and Cobo in order to release users' assets. Bitmap Tech said the MPC wallet solution ensures the “non-custodial handling of funds” bridged voer to Merlin Chain.

Users can also sign up to operate decentralized staking nodes. Merlin said the staking mechanism is designed so that “private keys never exist or reside on any single device” to protect user assets from “attacks and human errors.”

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.