MakerDAO Attracts $700M In Deposits After Hiking DAI Savings Rate

Spark Protocol TVL Surges 750%

By: Samuel Haig • Loading...

DeFi

Total value locked in Spark, a lending protocol launched by MakerDAO developers, is up 750% in four days.

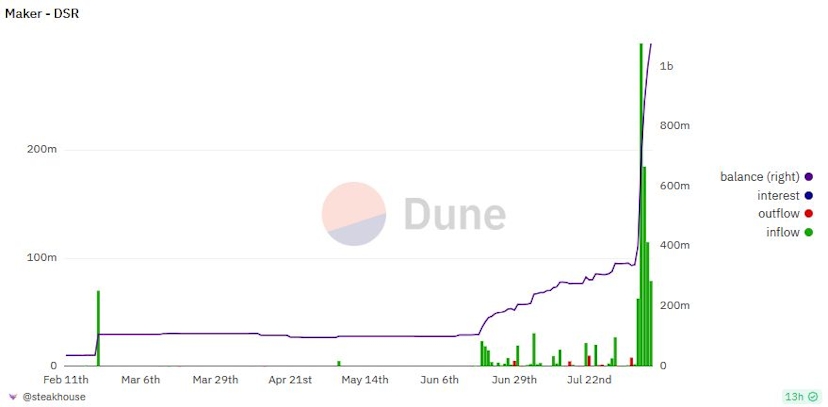

Deposits rocketed from $57.7M on August 6 to $440M after MakerDAO hiked the DAI Savings Rate (DSR) from 3.3% to 8%. The increase was intended to promote the adoption of the DAI stablecoin, Spark, and the DSR, with returns designed to lower as TVL increases.

DAI deposited in the DSR has tripled to more than $1B since the rate was increased. A wallet identified as belonging to Justin Sun, the founder of Tron, was spotted swapping more than 90,000 stETH for 77.8M DAI and depositing it into Maker.

Maker’s latest rate hike follows an increase from 1% to 3.3% in May, with the protocol competing to protect DAI’s stablecoin market share as new stablecoins from Curve and Aave entered the market.

Both Curve’s crvUSD and Aave’s GHO allow users to mint stablecoins against yield-generating protocol deposits, meaning users can continue to earn passive returns while accessing stablecoin liquidity against their assets.

As such, increasing the DSR allows DAI to compete with its upstart competitors, with the move coming as Maker’s revenue is at record highs thanks to its ten-figure exposure to U.S. Treasury bonds.

Spark Protocol is a fork of the Aave v3 lending protocol that launched with MakerDAO’s blessing in May. The DAI-focused money market also creates new use cases and yield opportunities for DAI holders, allowing depositors to access the DSR and also take loans against DAI collateral.

Volatility In Aave’s DAI Market

Interest rates for DAI on Aave v3, the top money market protocol, have oscillated violently in recent months.

Borrowing fees for DAI steadily trended between 2% and 4% from February until mid-June, when they rose as high as 10%. On July 13, rates rocketed to 31% and touched 26% two more times before the month ended.

The rate remained volatile during the first week of August and appears to be ramping up again.

The rise of Spark is likely contributing to the volatility of Aave’s DAI markets by offering stablecoin holders an alternative source of yield.

However, a two-year revenue-sharing agreement Spark offered as a peace offering to Aave after forking its code means Spark’s growth also benefits Aave, at least for now.

Advertisement

The Defiant Daily

“an industry must-read”

Get an edge in Crypto with our free daily newsletter

Know what matters in Crypto and Web3 with The Defiant Daily newsletter, Mon to Fri

90k+ Defiers informed every day. Unsubscribe anytime.