Looking Back at Uniswap’s Growth as it's Deployed on L2

On-Chain Markets Update by Lucas Outumuro, IntoTheBlock The anticipated launch of Uniswap on layer 2 has finally arrived, at least to some extent. Uniswap’s alpha on Optimism has been released, supporting only six crypto-assets so far, but at a fraction of the cost incurred on Ethereum’s mainnet. As Uniswap’s V3 is on track to fully…

By: Lucas Outumuro • Loading...

Research & OpinionOn-Chain Markets Update by Lucas Outumuro, IntoTheBlock

The anticipated launch of Uniswap on layer 2 has finally arrived, at least to some extent. Uniswap’s alpha on Optimism has been released, supporting only six crypto-assets so far, but at a fraction of the cost incurred on Ethereum’s mainnet.

As Uniswap’s V3 is on track to fully deploy onto layer 2 both on Optimism and Arbitrum, it is worth recapitulating over the impressive growth it has already achieved. This piece aims to cover a holistic view of Uniswap’s three versions, cast comparisons versus traditional counterparts and finally analyze the implications of its upcoming full release on layer 2.

Unifying Key Metrics

Uniswap liquidity providers (or LPs) have amassed over $920M in trading fees since the protocol’s inception. This amount has been calculated by aggregating the total fees accrued between Uniswap’s three versions, based on IntoTheBlock and Uniswap info.

Approximating $1B in lifetime fees, Uniswap is the highest generating DeFi protocol — even though there may still be controversy surrounding those fees going to supply-siders as opposed to token holders. Value accrual discussions aside, the magnitude of Uniswap LP revenues demonstrates the growth of DeFi into a legitimate threat for centralized services.

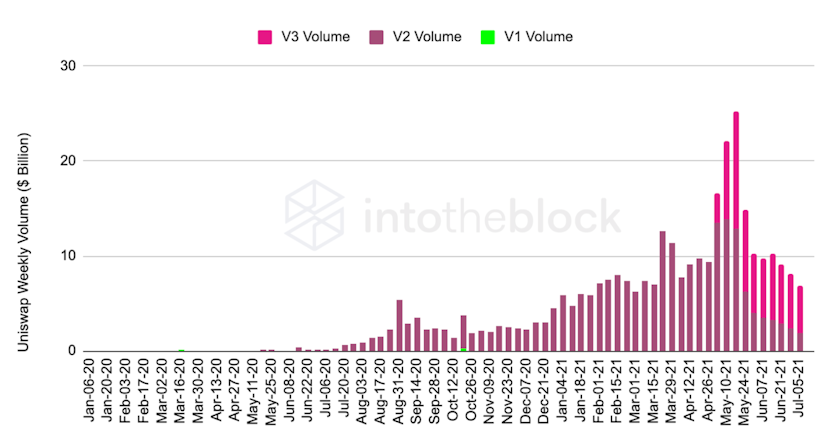

This growth is apparent in Uniswap’s trading fees across its three versions.

Based on IntoTheBlock’s Uniswap protocol indicators and Uniswap.info

Even after a 70% drop from its highs on the week of May 19, Uniswap volumes have grown 40x year over year and 900x in comparison to January 2020.

Uniswap V2 eclipsed V1’s volumes and similarly, Uniswap V3 quickly surpassed V2. At the time of writing, Uniswap V3 already makes up for nearly three quarters of the total volume traded across all versions.

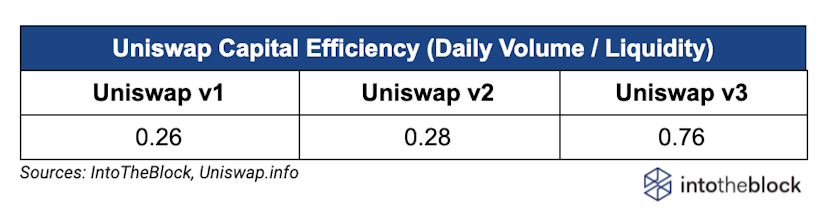

Two main upgrades are likely to be behind the quick rise of Uniswap V3: its improved capital efficiency and its low 0.05% fee pools. Both of these result in a better experience for traders, providing a more competitive offering relative to centralized exchanges.

In terms of capital efficiency, Uniswap V3 can certainly do more with less. The ratio of volume traded on a given day over the protocol’s TVL is nearly three times greater than it was on V2. This is facilitated by V3’s concentrated liquidity, which enables low slippage trading, requiring less liquidity.

’

Moreover, 0.05% fee pools have also proven to be a success. Although initially framed for stablecoin pairs, currently the pair with the highest trading volume out of all Uniswap versions is the USDC/ETH 0.05% fee pool. As of July 14, this pool is trading around the same volume as the next four highest trading pools combined.

The high adoption of low fee pools has brought down average fees per pool to 0.23%, closing the gap relative to centralized exchanges. Considering how the launch on layer 2 makes gas fees nearly negligible, it is likely that Uniswap V3 on layer 2 will heat up the competition with giants like Coinbase and Binance.

Versus Centralized Exchanges

Decentralized exchanges share out of crypto trading volumes has increased to 10% from just 0.32% two years ago, based on The Block’s dashboard. This has led Uniswap’s valuation to rise as high as $22B.

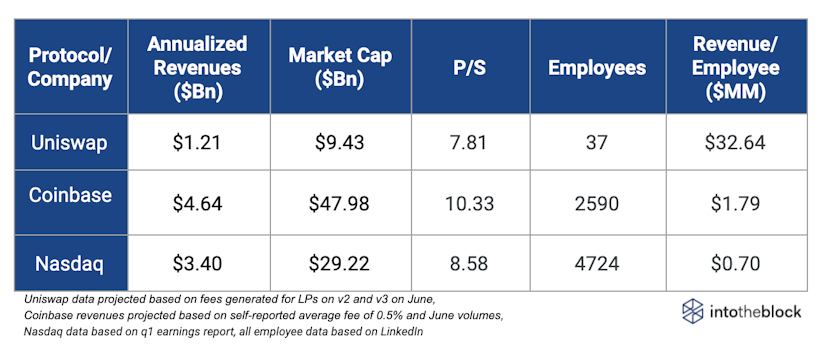

Not only is Uniswap capital efficient in terms of volume per liquidity, it is remarkably efficient in terms of dollar value generated per employee, making $32.6M (!) per employee. In this category, it significantly outperforms centralized exchanges such as Coinbase and traditional financial organizations like Nasdaq.

Despite this, Uniswap appears to be priced at a discount relative to its revenues when compared to Coinbase and Nasdaq.

It is worth noting that these comparisons are not apples to apples, especially considering that Uniswap’s revenues accrue to LPs while Coinbase’s and Nasdaq’s go to the company (not shareholders as they do not offer dividends). Furthermore, it is possible that LinkedIn employee numbers have not been updated for any of these three. (No official response was received after reaching out on Uniswap’s Discord about the current number of team members.)

Despite the caveats with the data, the trend is evident. Uniswap is comparable to centralized counterparts in terms of fees generated, and it does so with a considerably smaller team. Moreover, despite Uniswap’s 40x year over year growth in volumes, it remains at a conservative 7.81 price-to-sales ratio.

Going forward, as Uniswap fully deploys V3 onto layer 2, competition with centralized exchanges is likely to reach new heights. With gas fees decreased, Uniswap’s low 0.05% fees will put pressure on centralized exchanges, as has already been happening with the success of the USDC/ETH pool on V3 mainnet. Ultimately, this step stands to take Uniswap beyond the $1B in fees generated and beyond.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.