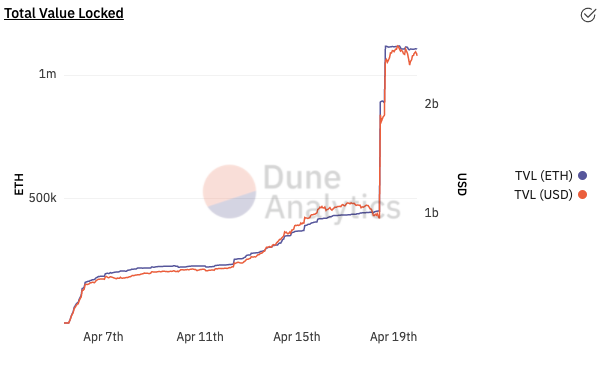

Liquity Network Attracts Over $2.4B in Assets in Two Weeks

Liquity Network, relatively unknown before its April 5 launch, now has $2.4B of ETH locked, placing it 11th among all Ethereum protocols, ahead of open finance mainstays Synthetix and Bancor. The protocol resembles MakerDAO in that users lock up ETH in order to mint Liquity’s stablecoin LUSD, but differs from the DAI-orginiator in that it…

By: Owen Fernau • Loading...

DeFi

Liquity Network, relatively unknown before its April 5 launch, now has $2.4B of ETH locked, placing it 11th among all Ethereum protocols, ahead of open finance mainstays Synthetix and Bancor.

The protocol resembles MakerDAO in that users lock up ETH in order to mint Liquity’s stablecoin LUSD, but differs from the DAI-orginiator in that it offers zero-interest loans and a lower collateralization ratio. Liquity already has $1.2B in LUSD. MakerDAO didn’t pass the $1B DAI mark until just over a year after multi-collateral-DAI launched on Nov. 18 2019, though in a much smaller DeFi ecosystem and amid a bear market in crypto.

How It Works

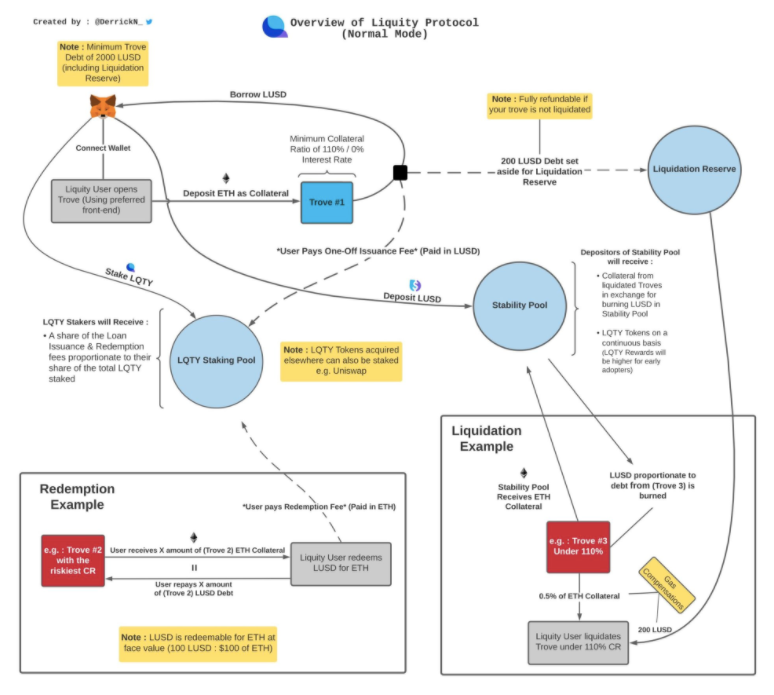

Liquity’s zero-interest loans don’t mean free: borrowers pay a one-time, but variable fee (between 0.5% and 5%, currently 0.52%) when originating a loan with a “Trove” which functions similarly to Maker’s Vaults. Users must also set aside 200 LUSD to pay the transaction fee if their Trove is liquidated.

To open a Trove a user deposits ETH and must maintain at least a 110% loan-to-value (LTV) ratio in order to avoid liquidation, compared with Maker’s 150% and Compound’s, at best, 133% collateral ratios.

Stability Pool

The user can then borrow up to ~90% LUSD against their collateral. The primary use case for LUSD has so far been the token’s use in the Stability Pool, where users have deposited $1.11B, or 91%, of the total minted LUSD.

The Stability Pool serves as “the first line of defense in maintaining system solvency,” according to the protocol docs. When a Trove is liquidated for falling below the 110% LTV level, the Stability Pool will burn the deposited LUSD equivalent to the outstanding debt of the liquidated Trove.

The upside for Stability Pool depositors is that they receive the pro rata amount of the liquidated ETH. According to the docs, “it is expected that Stability Providers will receive a greater dollar-value of collateral relative to the debt they pay off.”

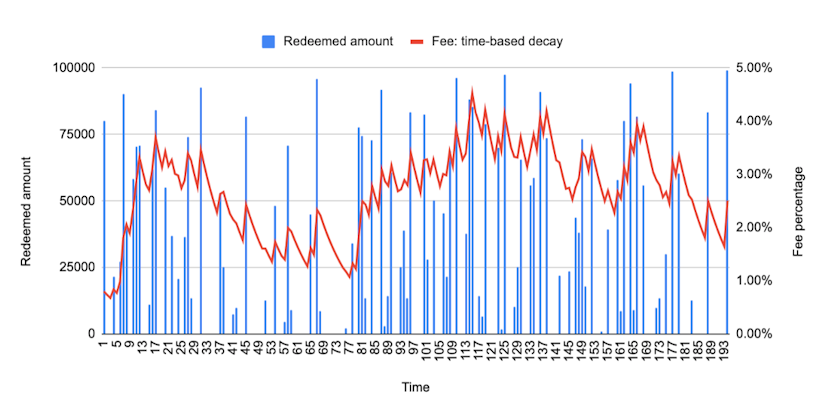

Redemption Fee

Liquity also has a redemption fee for when users wish to redeem LUSD. Note that redemptions are not the same as paying back debt which is free. LUSD redemptions allow any user to exchange 1 LUSD for the equivalent dollar amount of Ether, minus the redemption fee.

The Ether comes from the Trove with the lowest, and hence riskiest, LTV ratio, meaning that redeemers are paying off the debt of Liquity’s riskiest users in exchange for their collateral. Users who lose ETH collateral due to redemptions don’t incur a net loss as their LUSD debt is reduced proportionally. They do however, lose ETH exposure, incentivizing users to maintain high LTV ratios.

Redemption volume sets the redemption fee and borrowing fees. The more volume, the higher the fees. Redemption fees have no cap, but borrowing fees max out at 5%. The lower the redemption volume, the lower the fees, with a minimum of 0.5%.

Liquity also has a second token, LQTY, which accrues to Stability Providers, and frontend providers who maintain an interface to the protocol. When staked, LQTY captures borrowing and redemption fees in LUSD and ETH on a pro rata basis.

Liquity also launched a six-week liquidity rewards program for the LQTY:ETH Uniswap Pool starting from when the protocol launched on Apr. 5.

No Frontend

The Liquity team elected not to build a frontend to their app, instead choosing to incentivize developers to build web interfaces which allow users to interact with the protocol. Developers will receive a portion of the LQTY tokens earned by users who deposit into the Stability Pool through their app. It will be up to developers to set the rate at which they reward themselves, though if they choose to take a higher cut, they will need to make an interface that can compensate for lower user rewards.

Liquity may have knocked DeFiers’ Unisocks off, but the founder, Robert Lauko noted in the mainnet launch post that the project is the product of a year and a half of research and development.

In the short term, Liquity has joined Fei Protocol in ranks of recent stablecoin-issuing protocols which have quickly garnered over $1B in value locked in the weeks after launch, though with a smoother launch compared with Fei’s struggles . LUSD has thus far maintained a peg very near to 1USD. It sits at $0.99 at the time of writing.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.