Lido Set To Complete Final Token Unlock

Leading Liquid Staking Protocol Had Sold 10M LDO To Dragonfly Last Year To Weather Bear Market

By: Owen Fernau • Loading...

DeFi

Tokenholders generally dread an increase in the circulating supply of an asset since it usually leads to added selling pressure.

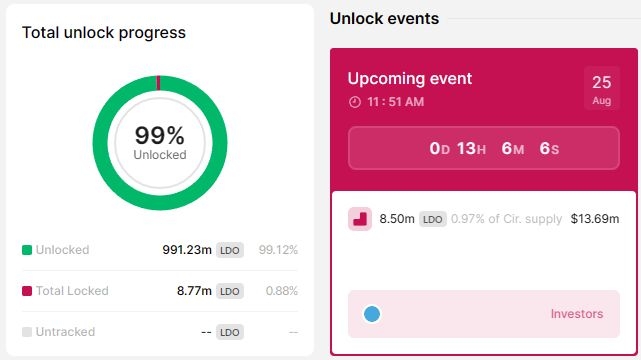

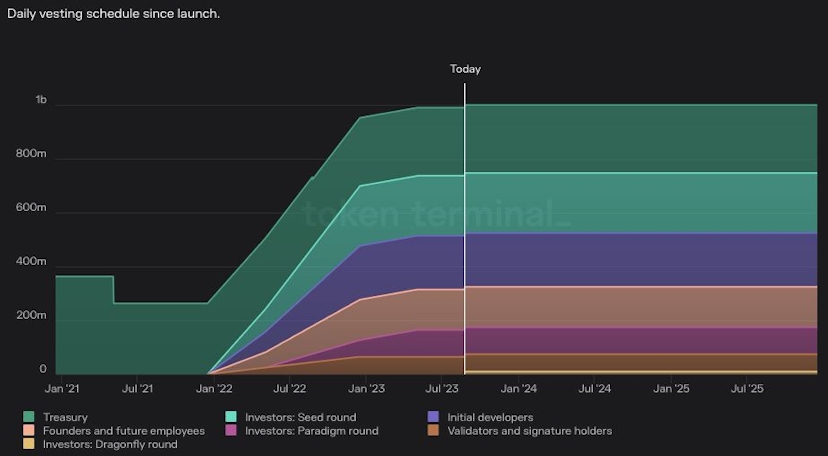

However, tomorrow’s unlock of LDO, the governance token of Lido Finance, is its final one, meaning that nearly all 1B LDO tokens will be on the open market, except for a tiny fraction that will vest to early investors until April 2024.

Lido has $13.8B in total value locked (TVL), making it the largest DeFi protocol. The protocol dominates the liquid staking space with its stETH token commanding a 75% market share.

Fiskantes, a partner at Zee Prime Capital, thinks the unlock is positive for LDO holders. “In general, it clears the supply from people who want to get rid of the position,” he told The Defiant.

The tokens being unlocked stem from a deal that venture firm Dragonfly struck with Lido’s decentralized autonomous organization (DAO) last August.

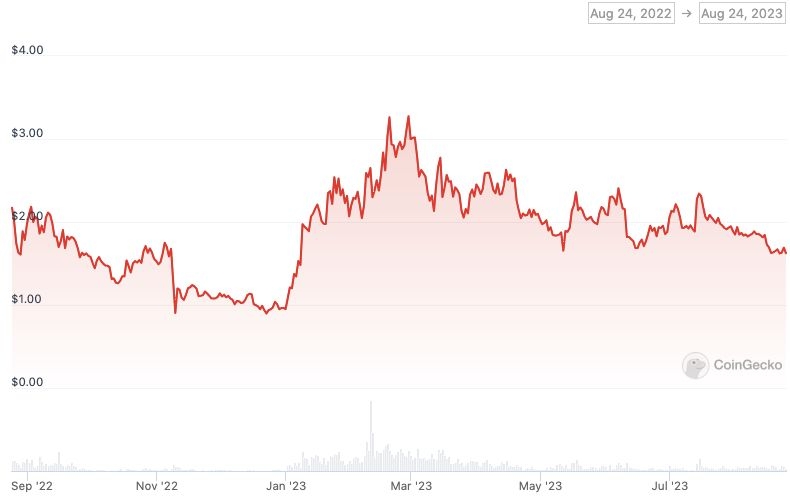

Token unlocks often make traders reconsider buying in, as additions to supply tend to depress prices, usually from early investors cashing out. Once a token’s supply is fully unlocked, that selling pressure should theoretically reduce since any party that wishes to sell can do so.

The situation with LDO is somewhat unique in that the DAO sold tokens in order to bolster its treasury in case of an extended bear market. Typically, unlocks are agreed upon by investors at early stages of the project, rather than direct sales from the DAO at later stages.

LSTfi

Lido has been the central player in the burgeoning “LSTfi” sector, which involves financial products built atop the tokens representing staked ETH on platforms like Lido.

LDO has a market capitalization of $1.42B at the time of writing, down roughly 50% from its 2023 peak.

To Fiskantes, the unlock in itself isn’t necessarily bullish. “[It] depends on token ownership distribution post-unlock,” he said. Major holders may not sell right away, but that doesn’t mean they don’t plan to sell.

“There is still [a] possibility that the big holders will dump anytime since there is no more lockup,” he said, adding that if a trader cares about short-term price action, they should monitor major holders’ wallets.

Fiskantes concluded by saying that an investor’s considerations should be different if taking a longer-term view. “You should derive your opinion based on projects’ traction, market share, value capture, and [the] team’s ability to innovate,” he said.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.