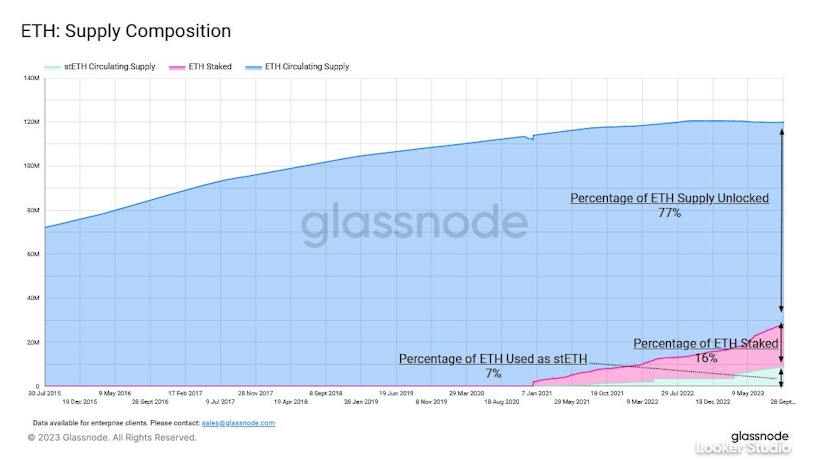

Lido’s stETH Token Accounts For 7% Of Circulating Ether

Dominant Liquid Staking Protocol Is Accruing 0.5% of ETH Staking Rewards

By: Samuel Haig • Loading...

DeFi

A new report from Glassnode is the latest example of web3 researchers sounding the alarm on the rising dominance of Lido over the supply of staked Ethereum.

According to Glassnode, Lido’s liquid staking derivative, stETH, is enjoying surging demand at the expense of ETH, which is stagnating in comparison. The report said 7% of Ether’s supply has been converted to stETH, with the trend showing no signs of slowing down. 16% of ETH’s supply is staked in total.

“The rise of liquid staking has reshaped the Ethereum supply composition and the dynamics of ETH emission, with a notable presence of Lido driving these dynamics,” Glassnode said. “stETH has taken over from ETH as the preferred asset on lending platforms. This shift is mainly propelled by the appeal of leveraged stETH positions.”

Glassnode said strategies providing leveraged exposure to staked Ether offer greater yields than are available providing stETH/ETH liquidity on decentralized exchanges.

Ethereum researchers have been sounding the alarm on Lido’s rising dominance over the past two years, with analysts warning Lido’s increasing control over the supply of staked Ether could threaten the decentralization of Ethereum’s consensus layer. The project already controls 32% of staked Ether.

But pundits are betting that Lido’s dominance will not wane any time soon. stETH appeals to web3 beginners as an easy vehicle for accessing staking exposure, while third-party DeFi protocols are utilizing the token as a “money lego” to enable advanced DeFi trading strategies.

With the Lido treasury receiving 1.6% of staking rewards, the numbers suggest the Lido treasury is currently amassing 0.5% of all new Ether entering supply as staking rewards.

Money Legos

An emerging crop of innovative DeFi protocols is tapping stETH and other liquid staking derivatives to offer leveraged exposure to ETH staking rewards.

Gearbox Protocol was an early pioneer, with stETH among its flagship leveraged yield farming products since its v2 launch last year. On Oct. 4, Contango began offering futures contracts underpinned by stETH recursive lending positions using the money market protocol, illustrating the increasing complexity and sophistication of stETH-based DeFi products.

“The goal of staking is not to promote DeFi, the goal of staking is to promote the security and the health of the Ethereum network,” Superphiz, the co-founder of the EthStaker community, commented last year. “You’ve got to keep those two goals separate.”

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.