Lido Revenue Sharing Proposal Draws Fire Amid Rising Staking Dominance

Liquid Staking Leader Controls Nearly 32% Of Staked ETH

By: Samuel Haig • Loading...

DeFi

Lido, the top liquid staking provider, is ruffling feathers in the Ethereum community by seeking to expand its dominance despite already commanding nearly one-third of the staked Ether supply.

Lido tokenholders are considering a proposal to introduce a tiered profit-sharing program to incentivize partnerships with other web3 communities. The program would replace Lido’s previous rewards-sharing system, which the proposal’s author, Frontalpha, says is “too easily abused for short-term gain” since the protocol activated staked Ether withdrawals.

“This proposal is for a tiered rewards-share program that offers a percentage of the DAO’s 5% share of staking rewards to participants who stake ETH using Lido,” wrote Frontalpha. The proposal outlines fixed-terms and capped limited rewards, gradual payouts, and mechanisms to identify abuse of the rewards program.

Lido’s revenue-sharing proposal has drawn strong criticism from decentralization advocates who fear that further increasing Lido’s dominance over the staking sector could pose a threat to the health and security of the Ethereum network.

“Lido continues to try to mercilessly expand their control of Ethereum stake - doing the opposite of what Vitalik Buterin asked for and cutting their fees to expand control,” tweeted Jasper_ETH, a community member of Rocket Pool, a competing liquid staking protocol. “They’re already at 33%, why cut the 10% fee to gain more power?”

Last month, Vitalik Buterin, Ethereum’s chief scientist and co-founder, recommended that no single staking pool control more than 15% of the network’s validators. Buterin added that pools should increase their fees to incentivize validators to stake elsewhere if they are above the 15% threshold.

Liquid Staking

Lido is a staking collective spanning an ecosystem of independent validators. Users staking Ether and other Proof of Stake tokens with Lido receive 90% of the staking rewards generated from their ETH, with node operators and the Lido DAO Treasury taking 5% each. Lido issues the liquid staking token (LST), stETH, allowing users to enter and exit staking positions without operating nodes themselves.

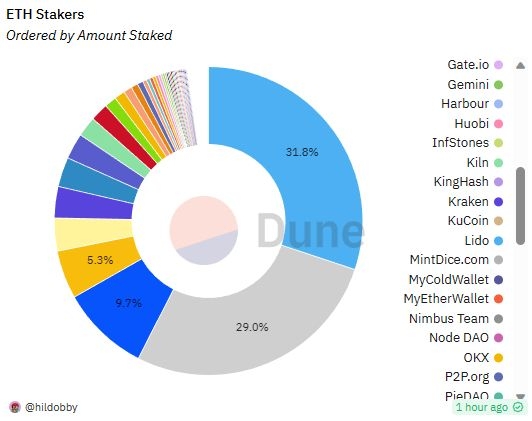

According to Dune Analytics, Ethereum’s staking ecosystem comprises 23M Ether and 724,077 validators. Lido commands nearly 7.4M ETH – 32% of the staked supply – and comprises 230,000 validators, 31.8% of the network’s total.

Lido is followed by Coinbase with a 9.7% market share, Binance with 5.3%, Figment with 3.5%, and Kraken with 3.4%. Rocket Pool is next with 3.2%.

Following the discussion, Seraphim, a Lido contributor, proposed a strategic alliance between Lido and Mantle. The deal would see 40,000 ETH allocated to stETH from BitDAO’s treasury to bootstrap liquidity across Mantle. BitDAO and Mantle agreed to merge last month.

Lido and Mantle would share revenues generated from the stETH over 12 months as part of the agreement. Seraphim noted the deal would be contingent on Lido governance passing the June 16 proposal.

LSTfi Fuels Lido Dominance

The popularity of stETH within the DeFi ecosystem is further solidifying Lido’s dominance as the LSTfi sector emerges. stETH’s market-leading position makes it the go-to integration for DeFi developers seeking to attract liquid staking liquidity, and also lends credibility from a user perspective.

The growing number of users bridging stETH onto other chains signals the increasing adoption of stETH across DeFi, with the value of bridged stETH increasing from $100M at the start of March to $253M today.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.