Lido Dominance Recedes Despite Blast TVL Climbing To New Highs

Lido's staked Ether dominance has trended down since early December.

By: Samuel Haig • Loading...

DeFi

Lido’s staking dominance has fallen in recent weeks despite continued inflows to the controversial Layer 2 network, Blast.

According to Dune Analytics, Lido currently controls 31.8% of the staked Ether supply, down from more than 32.3% three weeks ago. Daily tweets from the LidoDominance X account show Lido’s dominance steadily falling since tagging a local high on Dec. 5.

Lido’s diminishing command over the supply of staked Ether follows renewed scrutiny from Ethereum decentralization devotees who feared that the rising value of assets locked in Blast, a forthcoming Layer 2 network, could push Lido’s dominance above one-third.

Blast burst onto the scene in late November, announcing it would reward early depositors with native yields in the form of staking rewards via Lido or stablecoin interests via MakerDAO, in addition to Blast “points.” The airdrop campaign attracted a surge in deposits despite the assets being locked until Blast’s mainnet deployment, which is currently slated to take place in February.

Blast’s early success came to the chagrin of many Ethereum’s, with analysts blaming Blast for Lido’s dominance crossing back above the 32% threshold for the first time since Oct. 12. Ethereum researchers have frequently warned that a single entity controlling more than a third of staked Ether could threaten to undermine the network’s decentralization.

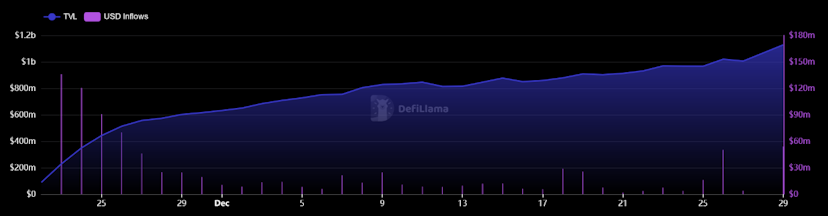

However, Lido’s dominance has since retraced despite Blast’s total value locked (TVL) rallying to new heights this week. A $54M inflow pushed Blast’s TVL to $1.12B on Dec. 29 after a $50M inflow pushed the protocol’s TVL above $1B for the first time on Dec. 26, according to DeFi Llama. Blast tweeted that nearly 86,000 users have deposited assets onto the network.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.