Large CRV-backed Loans Threaten to Destabilize DeFi

Curve Founder Is Deleveraging By Selling CRV To Prominent Crypto Investors

By: Owen Fernau • Loading...

DeFi

Michael Egorov, the co-founder of Curve Finance, a major decentralized exchange, has been shuffling millions of dollars around DeFi in an apparent effort to avoid nine-figure liquidations.

Egorov has over $90M in outstanding loans across lending platforms, primarily backed by CRV tokens worth over a quarter of a billion dollars.

CRV is trading at roughly $0.60 at the time of writing — if the price drops 38% to roughly $0.37, Egorov’s position of around $160M in CRV on lending platform Aave, stands to be liquidated, according to a dashboard from Parsec Finance.

Another $26M of collateralized CRV on the Fraxlend lending platform would be liquidated at approximately $0.31, and a $23M position on Abracadabra at $0.33.

Curve Exploit Threatens Borrowing Positions

While Egorov’s major borrowing positions are well-known, a $70M exploit of the Curve exchange on Sunday sent shockwaves through DeFi as the price of CRV tumbled — the token is down roughly 19% since the exploit.

At $26.6M, CRV also has relatively low on-chain liquidity, meaning that purchases and sales of the token have an outsized impact on price. This, combined with CRV’s already battered price, has increased the risk of Egorov getting liquidated.

In response, investors who had lent stablecoins against CRV have pulled their dollar-pegged assets from lending platforms, to the extent possible. This increased utilization of the CRV borrowing pools caused the interest rates on Egorov’s positions to soar, further increasing the probability of liquidation.

Fraxlend’s Increasing Interest Rate

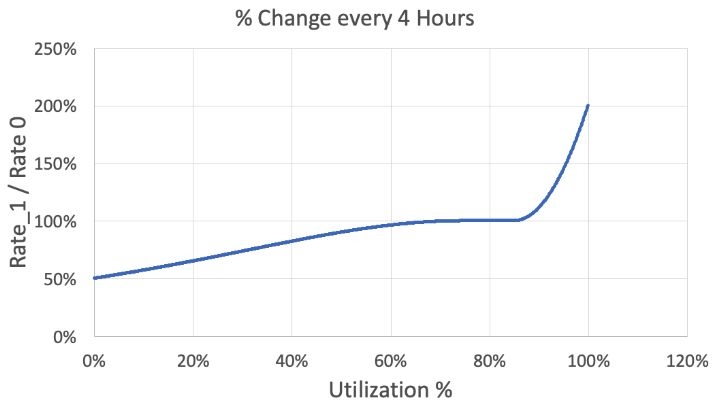

On Fraxlend, for example, utilization of FRAX lent against CRV hit nearly 100%.

This is particularly important because Fraxlend increases the interest rate proportionally to how much of the borrowed asset, in this case, the FRAX stablecoin, is being used relative to the available supply.

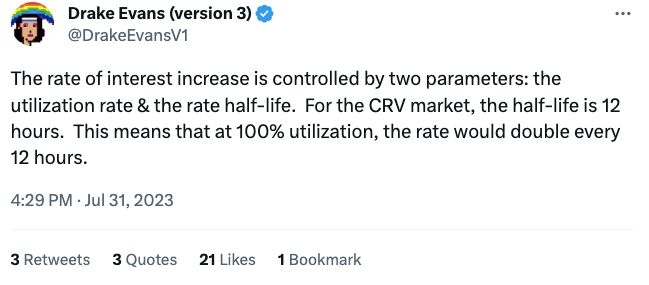

Drake Evans, who works on Fraxlend, said that at 100% utilization, the market for CRV and FRAX would double every 12 hours. Evans clarified that utilization never hits 100%, and “small steps down,” lower the rate of interest rate increases significantly. He gave the example that at 99% utilization, the interest rate charged to FRAX borrowers would increase by 1.87 times every half day.

Selling CRV to Pay Back Loans

The co-founder has taken action to fortify his financial position, selling 39.25M CRV, worth $15M, to wealthy figures in crypto, according to the on-chain tracker, Lookonchain. On-chain data shows that Egorov sold CRV at $0.40, roughly a 40% discount from the current market price.

Egorov is using the funds to pay back loans, specifically on Fraxlend.

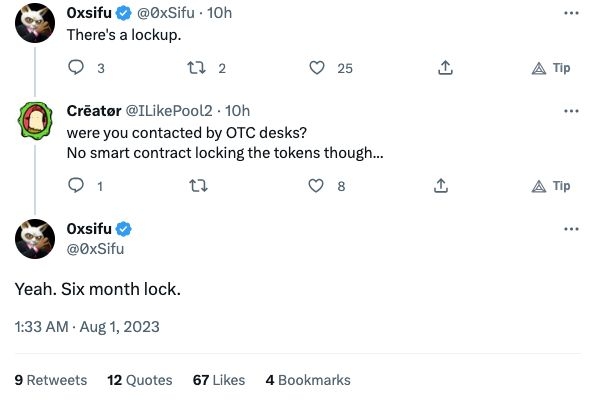

Justin Sun, the controversial founder of the Tron blockchain, was one buyer of CRV, as was 0xSifu, an investor and DeFi founder.

0xSifu said that the deal includes a six-month lockup, likely to prevent him and other buyers from immediately selling CRV for an instant profit.

crvUSD-fFRAX Pool

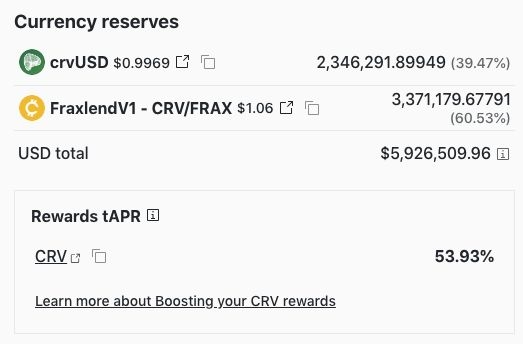

Egorov also deployed a new pool on Curve which pairs the exchange’s new crvUSD stablecoin, with a token which represents FRAX lent against CRV on Fraxlend.

The idea is that people who would otherwise be withdrawing FRAX lent against CRV for fear of incurring bad debt will leave it there in order to use the receipt token, fFRAX, in the new Curve pool.

The incentive to do this is the 100,000 CRV tokens which the Curve co-founder has put up as rewards for those who deposit in the crvUSD-fFRAX pool. The incentives appear to be working — there’s nearly $6M in the pool already, including 3.3M of tokens representing FRAX lent against CRV positions on FRAX lend. Depositors in the new pool are earning around 54% APR at the time of writing.

Thanks to the new pool, the utilization rate of FRAX lent against CRV on Fraxlend has dropped to 36.5%.

This has brought the borrowing rate on Fraxlend down to 75%, still high, but undoubtedly a welcome respite for Egorov.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.