Internet Bonds: Bridging the Gap Between Proof of Stake and Traditional Finance

Viewing eth2 through the lens of traditional financial tools will help the industry mature and grow. Historically, it was difficult to participate financially in the development of the interworking protocols that formed the basis of the internet. Web3.0, however, flips this on its head. Decentralization, a core tenant of most proof of stake (PoS) blockchains,…

By: Mara Schmiedt • Loading...

Research & Opinion

Viewing eth2 through the lens of traditional financial tools will help the industry mature and grow.

Historically, it was difficult to participate financially in the development of the interworking protocols that formed the basis of the internet. Web3.0, however, flips this on its head. Decentralization, a core tenant of most proof of stake (PoS) blockchains, requires wider participation of both capital contributors and labor. Participation in these PoS protocols involves collateralizing value for the right to work and providing security to the network in return for recurring rewards. This process is widely known as ‘staking’.

Despite its technological advancements over the past few years, the blockchain industry still lacks a unified collective understanding of, and terminology for, the new asset class represented by proof of stake-based tokens. This lack of definition is a hurdle for the maturation of the blockchain industry and adoption by new entrants.

In order to persuade new institutional entrants to get involved, we must leverage existing knowledge and language from traditional finance and equip interested parties with the tools and valuation methodologies to assess the risks and returns associated with proof of stake chains.

Internet Bonds, a new type of reward-based digital work agreement, and the introduction of a risk-free rate in the decentralized Web3.0 economy are the critical steps to instigate this broader participation and push the blockchain industry to the next level of the adoption curve.

Internet Bonds – Introducing a New Asset Class

On December 1st, the decentralized internet reached a critical milestone with the official launch of Ethereum 2.0.

At the time of writing, over $7.9B (3.7M ETH) has been deposited in the eth2 deposit contract to bootstrap the security of the new Ethereum chain, offering financial exposure to what could become the new base layer of the internet (Web3.0). This signals strong demand for a new type of asset class, which yet remains to be defined.

Internet Bonds offer a conceptual framework for understanding and valuing these new types of digital work agreements between the lenders of capital and resources and the protocol(s) operating on the base layer of the new internet economy.

Akin to traditional bond structures, Internet Bonds represent an agreement between the bond issuer (the protocol) and the bondholder (the validator).

However, unlike traditional bond structures, internet bondholders in Web3.0 are lenders of capital, labor, resources, and owners of the network at the same time.

Internet Bonds on eth2 require a deposit of 32 ETH as collateral, creating a contract that promises rewards based on participation in the network; these perpetual cash flows are contingent on the ability of depositors to maintain a validator that remains active and behaves honestly in the network.

An Internet Bond is a new type of reward-based digital work agreement that can be best described as a hybrid-perpetual bond with debt and equity-like characteristics.

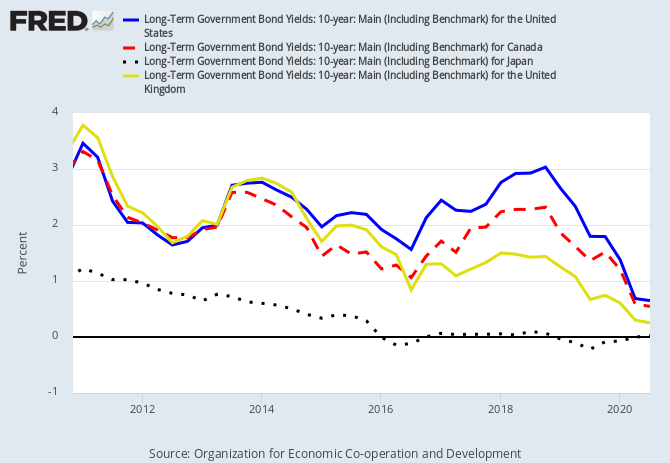

In its mature state, the annual reward rate is anticipated at ~ 3% to 5%, presenting an interesting opportunity at a time where interest rates and government bonds are approaching near-zero or even negative rates.

Internet Bonds provide the Basis for the Introduction of Web3.0’s Risk-Free Rate

In this mature state, Ethereum’s underlying reward rate represents the risk-free rate of participation in the Web3.0 economy. Analogous to the risk-free rate in the traditional economy, the introduction of internet bonds and an associated risk-free rate in Web3.0 provides a benchmark by which to evaluate participatory risks and returns. Moreover, it provides the critical input to, and enables the cross-application of, existing foundational models in traditional finance.

This understanding will allow participants in the Web3.0 economy to better evaluate the fair value of assets when the risks and time value of money are compared to expected returns.

It is important to note that the risk-free rate is a theoretical measure in today’s world, as no investment is absolutely risk-free. For the purposes of further analysis, it is assumed that a validator on Ethereum that correctly follows the protocol under normal operations will never incur a slashable event.

Tokenized Internet Bonds

In the first phases of eth2, the initial ETH deposited, and all rewards accrued, are non-transferable until the existing eth1 chain is migrated to the new eth2 chain. Since the timeline for this migration is unknown (but is expected to take 12—24 months), market participants are solving for this illiquidity concern by offering new crypto-primitives.

The tokenization of Internet Bonds involves the issuance of an ERC-20 representation of collateralized, staked ETH on the eth1 chain, allowing for its use while still locked to eth2. This transferability allows for the ETH to be used in DeFi, and, as a result, enhances capital efficiency. In this context, the relationship between DeFi and Staking should be seen as synergetic subsets of a maturing economy rather than a point of conflict or cannibalization.

Diverging prices between the underlying assets and their tokenized representations offer an important indicator for the market’s sentiment on the likelihood of Ethereum successfully migrating to eth2. As suggested by Michael Casey, this indicator is not much different from the CME Group’s “Federal Funds Futures,” which functioned as a gauge of market expectations for the Federal Reserve’s monetary policy decisions.

Moreover, since the operational risks between different providers is non-fungible, at a more granular level, diverging prices between different assets will serve to be a useful signal of the collective perception of operational risk associated with a given issuer.

eth2 presents a fundamentally new, borderless, and permissionless way for individuals and institutions to get financial exposure to the new base layer of the internet. Before we can experience this future we must provide the appropriate shared framework for understanding its opportunities.

Mara is a Business Development Manager at Bison Trails, a leading blockchain infrastructure as a service company. In her role, she is responsible for establishing and managing customer relationships, strategic partnerships and corporate growth initiatives.

Mara brings both broad experience and passion for bringing blockchain-based protocols, products and services to market. Prior to joining Bison Trails, Mara held positions as a Strategy Manager at ConsenSys and Management Consultant at PwC. She serves as an advisor to early-stage blockchain startups and holds a BSc from the London School of Economics.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.