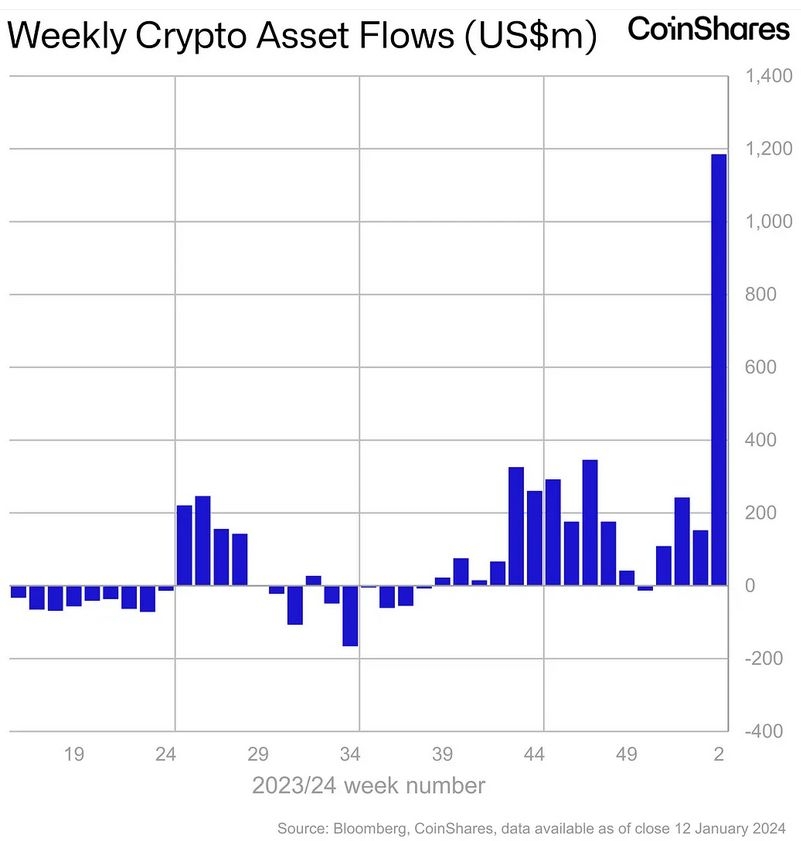

Institutional Crypto Trading Tops $17B During ETF Launch Week, Highest On Record

Weekly trading volume averaged just $2B in 2023.

By: Pedro Solimano • Loading...

Markets

Institutions went on a feeding frenzy last week, with CoinShares reporting that large entities traded a whopping $17.5B in digital assets.

According to the latest Digital Asset Fund Flows report, trading volumes for ETP products last week were the highest on record. However, although inflows topped $1.18B, futures-based Bitcoin ETFs continue to hold the top spot, with $1.5B purchased back in October 2021.

Trading volumes reached an unusual 90% of all activity on trusted exchanges on Friday, wrote James Butterfill, head of research for CoinShares. The figure typically fluctuates between 2-10%.

With the launch of spot Bitcoin ETFs in the United States, the world’s most valuable cryptocurrency took center stage in terms of activity from large investment firms. Weekly flows soared to $1.14B, and in terms of AUM, BTC dominates 70% of all digital assets.

After approaching $50,000 last week, Bitcoin has since taken a tumble. It’s down nearly 8% in the past seven days, changing hands for $42,814, as per Coingecko.

Grayscale Outflows

Among entities reported by CoinShares, Grayscale witnessed $597M worth of outflows, followed from afar by ETC Issuance GmbH and Purpose Inv. ETF with $44M and $21M, respectively.

Altcoins also enjoyed the Bitcoin ETF hype and ended the week in the green. Ethereum saw $25M in purchases by institutional investors, as did XRP and Solana, with $2.2M and $0.5M respectively.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.