Grayscale ETF Outflows Slow As BTC Price Rises

Grayscale outflows recede 60% as BTC recovers 12% from local low.

By: Samuel Haig • Loading...

Markets

Outflows from the Grayscale Bitcoin Trust ETF are beginning to slow amid a double-digit recovery in the price of BTC since last week.

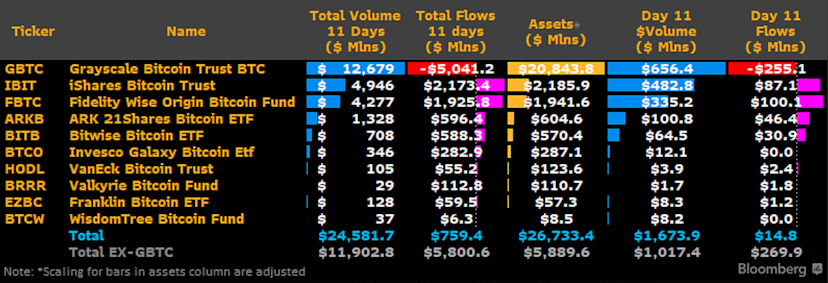

Data compiled by James Seyffart, an analyst at Bloomberg, shows a steady decline in the volume of outflows exiting Grayscale's Bitcoin Trust ETF. On Jan. 29, $255M left the exchange-traded fund after its 11th day of trading.

Outflows from the fund have consistently fallen since tagging $640.5M last week on its seventh day of trade.

Seyffart’s data also indicates spot Bitcoin ETFs absorbed $759.4M over 11 days of trading, despite more than $5B exiting Grayscale’s Bitcoin ETF. For comparison, nearly $2.2B has flowed into BlackRock’s iShares Bitcoin Trust, followed by $1.9B entering the Fidelity Wise Origin Bitcoin Fund, and the Ark 21Shares Bitcoin ETF taking in $596M.

Investors offload Grayscale Bitcoin Fund shares

The heavy outflows from Grayscale’s ETF were likely propelled by investors that scooped up from the Grayscale Bitcoin Fund while shares were trading at a heavy discount prior to its conversion to an exchange-traded fund exiting their positions.

Investors may also be exiting the fund in favor of other ETFs as Grayscale’s parent company, Digital Currency Group, grapples with the fallout from the insolvency of its portfolio lending company, Genesis Global.

Despite the fund’s heavy outflows, Grayscale still holds $21.5B worth of Bitcoin, ranking it among the largest BTC hodlers behind Satoshi Nakamoto and the Binance centralized exchange.

The recent decline in outflows may result from investors seeking to ride Bitcoin’s recent recovery, with BTC rebounding 12.4% since tagging a low of $38,680 on Jan. 23.

Data from CoinShares indicates more than $2.2B exited Grayscale’s ETF last week, outpacing the $1.8B that flowed into other spot Bitcoin ETFs. Combined with other institutional crypto products, CoinShares said $500M exited the sector last week.

Seyffart also noted a decline in ETF trade volume over recent days, with the 10 Bitcoin ETFs hosting $1.6B worth of volume on Jan. 29 — equating to just 6.8% worth of the 11-day total.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.