Gauntlet Flags Risk Posed By $176M CRV Position On Aave

Cites Declining Liquidity For Curve Token

By: Owen Fernau • Loading...

DeFi

A large leveraged position in CRV tokens across major DeFi lending protocols has caught the attention of the space over the last few days.

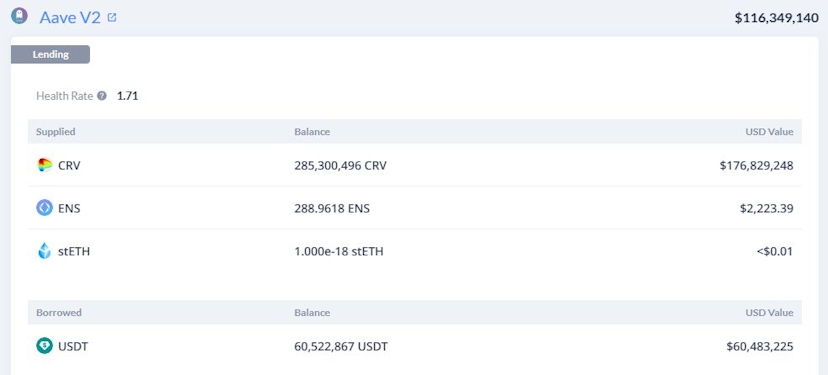

A wallet known to belong to Michael Egorov, co-founder of the decentralized exchange Curve Finance, has outstanding debt of $60M in stablecoins secured by CRV worth $176M as of June 16.

Egorov has collateralized his CRV on Aave, DeFi’s largest lending protocol, with nearly $8B in total value locked (TVL). While the position currently remains safe from liquidation, Gauntlet, a risk management firm, has recommended that Aave’s governance freeze the CRV market on Aave V2. This would mean that neither Egorov nor anyone else can add any more CRV to be used as collateral on the platform.

CRV is down nearly 30% in the past month amid the rout in altcoins, which may have prompted the renewed concern over a longstanding position.

The danger that Gauntlet is trying to mitigate is the potential for Aave to take on bad debt. This would likely happen if the price of CRV dropped to the point that the Aave protocol must liquidate the position, but isn’t able to do so due to its sheer size.

Too Big To Liquidate

To liquidate a position on Aave, a liquidator must repay the borrowed asset, USDT in this case. They then receive the collateral, CRV in this case, at a discount.

The problem – Egorov’s collateralized CRV in Aave V2 accounts for over 33% of the total circulating supply of the token. This means that if his entire position was to be liquidated, the liquidator wouldn’t be able to sell the CRV profitably due to inadequate on-chain liquidity.

Indeed, attempting to sell 100M CRV on mainnet, equivalent to around a third of Egorov’s position, would crater the price by 70%.

Gauntlet cited reduced liquidity in CRV as increasing the likelihood of disorderly liquidations. The firm declined to comment further on their recommendation when contacted by The Defiant.

Actively Managed Position

Andrew Thurman, the former head of communications at data provider Nansen, doesn’t think it’s likely that Egorov doesn’t plan to pay back his debt, as some people suggested on Gauntlet’s forum post.

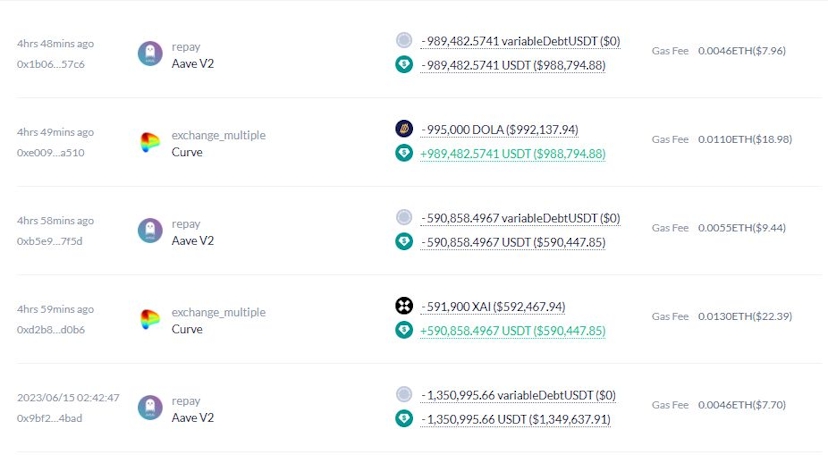

“Michael has actively managed that position in the past, including at times paying down portions of the debt,” Thurman told The Defiant over Telegram.

Egorov did not respond to an email from The Defiant requesting comment, but on-chain data show repayments of nearly $3M in the past day.

Aiham Jaabari, the co-founder of Silo Finance, another lending protocol, also thinks the concerns around Aave being left with bad debt are a bit overblown. He thinks that while Gauntlet’s post may have been intended to minimize the risk exposure of Aave V2, other traders have pounced on the narrative in order to push down the price of CRV.

Supporting this theory, funding rates to short CRV skyrocketed on Binance this week, according to the well-known Twitter account DeFiMoon. Funding rates go up when more traders are entering a trade using a derivative called a perpetual swap.

Jaabari told The Defiant he spoke with Egorov on June 14 to talk about Silo. “I’ve been telling him, ‘Hey, give us a shot.’”

Unlike Aave V2, where all assets are pooled together, Silo groups smaller groups of assets to be borrowed and lent against each other. Jaabari said Silo doesn’t yet have enough USDT liquidity for Egorov to migrate his whole Aave V2 position to Silo.

Egorov also has other borrowing positions collateralized by CRV, worth over $10M on lending protocols Frax Finance and Abracadabra, according to DeBank.

Gauntlet’s concerns around leaving Aave with bad debt may have been inspired by a ‘highly profitable trading strategy’ executed last year by Avraham Eisenberg, where the trader pushed down the price of CRV by borrowing the asset against a position of collateralized USDC.

Jaabari said that Eisenberg was trying to liquidate Egorov’s position by pushing the price of CRV down, but ultimately didn’t succeed. “After they saw what happened to Avi, no one is doing this,” Jaabari said.

The SEC charged Eisenberg with market manipulation in January.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.