Federal Reserve Survey Finds 12% of U.S. Adults Held Crypto Last Year

Nearly one in eight U.S. adults owned crypto during 2021, according to a survey from the Federal Reserve on May 23. In the central bank’s Economic Well-Being Of U.S. Households in 2021 report, the Fed found that 12% of the 11,000 U.S. adults surveyed held cryptocurrency last year. About 92% of the Americans held crypto…

By: Samuel Haig • Loading...

DeFi

Nearly one in eight U.S. adults owned crypto during 2021, according to a survey from the Federal Reserve on May 23.

In the central bank’s Economic Well-Being Of U.S. Households in 2021 report, the Fed found that 12% of the 11,000 U.S. adults surveyed held cryptocurrency last year.

About 92% of the Americans held crypto to speculate on its price. Last year, the combined market cap of crypto assets surged from $763B to $2.9T in November, before crashing to about $1.3T in 2022.

Just 2% of U.S. adults – or a sixth of those who held digital assets – used crypto to buy things. And only 1% used crypto to send money to friends and family.

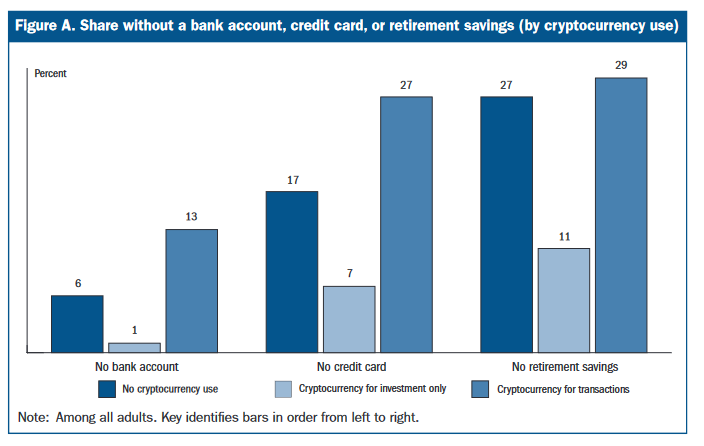

Of those who used crypto to pay for goods and services, 13% did not have a bank account – more than double the population’s average of 6%. About 27% didn’t have any retirement savings.

The Fed also found that poorer Americans are more likely to pay for things in crypto. Those who held it for investment purposes were disproportionately wealthy, with 46% having six-figure incomes, and a further 25% earning between $50,000 and $100,000.

Banking status of cryptocurrency users. Source: Federal Reserve.

The report marks the first time the Fed has surveyed Americans about crypto adoption.

Chainalysis noted a surge in cryptocurrency adoption last year. In its 2021 Global Crypto Adoption Index report, the blockchain intelligence firm estimated crypto digital asset usage increased 880% worldwide last year.

Chainalysis ranked the U.S. eighth overall for adoption. Vietnam topped the list, followed by India, Pakistan, Ukraine, Kenya, Nigeria, and Venezuela. Chainalysis said that the fall in U.S. peer-to-peer exchange volumes amid the “institutionalization of cryptocurrency trading” knocked the nation down the rankings.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.