Ethereum Short Positions at Highest Level Since 2019

Traders are betting ether’s plunge isn’t over yet. Ether short positions on Bitfinex, a top five spot exchange in terms of volume according to CoinMarketCap, are at the highest level since March 2019. The spike in short volume comes on the heels of a 14-day streak during which ethereum’s price nearly doubled, breaking through $1,000…

By: Owen Fernau • Loading...

MarketsTraders are betting ether’s plunge isn’t over yet.

Ether short positions on Bitfinex, a top five spot exchange in terms of volume according to CoinMarketCap, are at the highest level since March 2019.

The spike in short volume comes on the heels of a 14-day streak during which ethereum’s price nearly doubled, breaking through $1,000 and climbing to just 8% away from its all-time high, only to plunge 23% in the last two days. Short sellers are piling on this correction.

ETH is still up nearly 600% in the past year.

No Need to Panic

There may not be a need for ether holders to panic. The last time Bitfinex’s ETH shorts were at comparable or higher levels was in Q4 of 2018 through Q1 of 2019. ETH price gained 3% in the following three months.

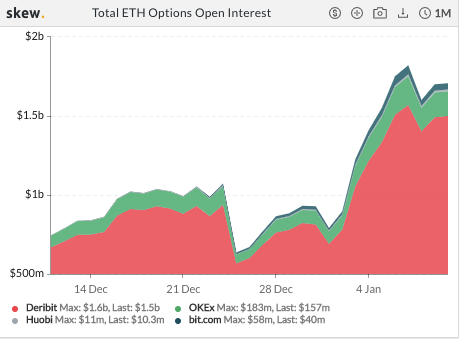

Additionally the increase in short selling has come at a time when total ETH options’ open interest has approximately doubled in the last month according to Skew.

The climb in Bitfinex’s ETH shorts could be partially due to a more mature options market as a whole.

Regardless of the reason, traders are certainly buying shorts, as, at least in the short term, the bullish calls for a $10K ethereum have gone silent.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.