Ethereum Activity Heats Up Ahead of EIP-1559

On-Chain Markets Update by Lucas Outumuro, IntoTheBlock Following the market’s crash in May, on-chain activity on Ethereum slowed down as demand for dog-themed tokens and opportunities for yield diminished. Over the past few days, this trend has reversed as demand for NFT and gaming projects picks up. With the implementation of EIP-1559 less than a…

By: Lucas Outumuro • Loading...

DeFi

On-Chain Markets Update by Lucas Outumuro, IntoTheBlock

Following the market’s crash in May, on-chain activity on Ethereum slowed down as demand for dog-themed tokens and opportunities for yield diminished. Over the past few days, this trend has reversed as demand for NFT and gaming projects picks up. With the implementation of EIP-1559 less than a week away, it is worth looking at the recent growth in on-chain activity and how it is expected to affect Ether’s supply.

As crypto markets experience price drops of over 30%, transaction activity also tends to decrease as speculators leave the market. This was the case in September 2020 following DeFi summer and the recent crash was no exception.

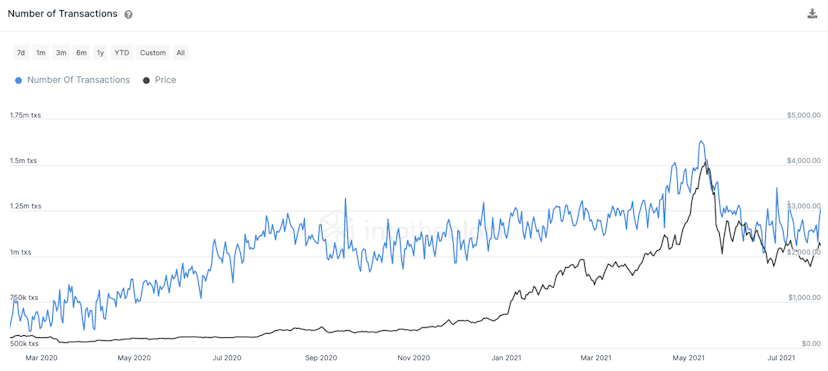

As of July 28 via IntoTheBlock’s Ethereum network indicators

Ethereum transactions decreased by nearly a third from their peak, but still managed to sustain above 1 million per day. This is particularly impressive considering that this figure excludes transactions in layer 2 solutions and side-chains such as Polygon.

Having bottomed at 1.02 million transactions per day, Ethereum activity appears to be picking up over the past few weeks. This time around it appears that it is not DeFi but instead NFTs and gaming leading demand for transactions on Ethereum.

While gaming activity around Axie Infinity has grown remarkably throughout the summer, particularly in the developing world, two new NFT projects are the culprits behind the recent increase in gas prices.

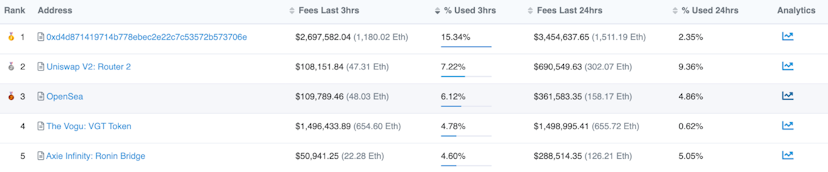

As of July 27 via Etherscan Gas Tracker

The first address in the image above belongs to Stoner Cats, an animated series featuring Ashton Kutcher, Mila Kunis and Vitalik Buterin amongst others. The series uses a novel approach where only the holders of NFTs get to access the content. High demand for the star-studded series led to gas prices of over 1,000 gwei and one point and $787,000 worth of ETH spent in failed transactions.

Along with this, The Vogu Collective, an NFT collection of 7,777 robot avatars selling as high as 26 ETH, also took a significant share of fees spent on the blockchain. At the time of writing, four out of the top five projects in terms of ETH spent in fees are related to NFTs. This recent surge in demand led the total amount spent in fees to surpass 5k ETH (~ $11.8 million) for the first time in over a month.

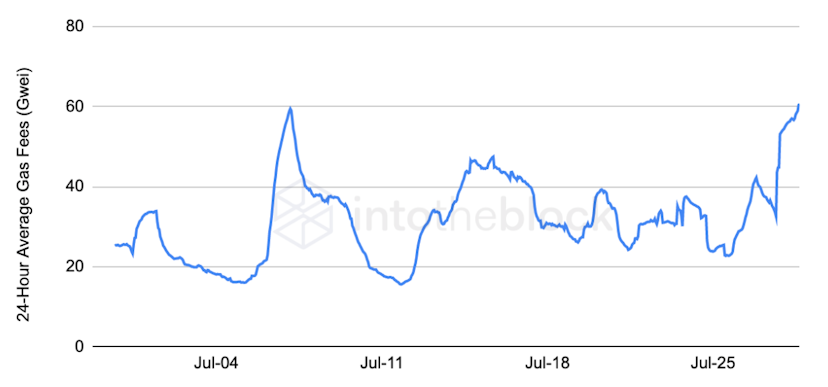

As of July 28 via IntoTheBlock’s Ethereum network indicators

As shown in the graph above, the total amount of ETH spent in fees has more than doubled over the past month and is around the same level it was 90 days ago. That being said, it is still 80% down from its previous high of 30k ETH on May 19, when traders were willing to pay substantial fees to avoid liquidations during the price crash.

For better or worse, the recent increase in demand has sent gas fees back above 60 gwei, more than tripling from its lows.

As of July 28 via IntoTheBlock’s DeFi network indicators

The increase in gas fees can be seen as a double-edged sword ahead of EIP-1559. On one hand they do price out users looking to make small transactions, but on the other hand it may be welcomed by holders as the amount of ETH being burned will increase depending on the fees being charged.

Based on the Ultrasound.Money simulator, following the implementation of EIP-1559 a week from now, 6,000 ETH per day would be burned at an average gas fee of 60 gwei. Even though this would not be enough for Ether’s supply to become deflationary, it would start to decrease its inflation rate and project a peak in its supply right before the merge.

As more use-cases continue to pop up on top of Ethereum — from play-to-earn to collectibles to options — it seems that on-chain activity is on track to continue growing regardless of price activity. With the implementation of EIP-1559, incentives would be aligned between holders and users as more ETH gets burned as demand to use Ethereum increases. Even though this may not result in Ether becoming deflationary straight away, it sets the path for one of the largest crypto-economic upgrades ever.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.