Ether Locked in DeFi at All-Time High After Market Crash

An all-time high of 11.2M Ether is locked in DeFi protocols, despite a weekend sell-off. Liquidations spiked, while tokens continue sliding. Locked Ether’s resilience may show that DeFi participants do not consider the recent drop in price to signal a long-term trend and thus are not unlocking their ETH in order to sell. Borrowers may also…

By: Owen Fernau • Loading...

DeFi

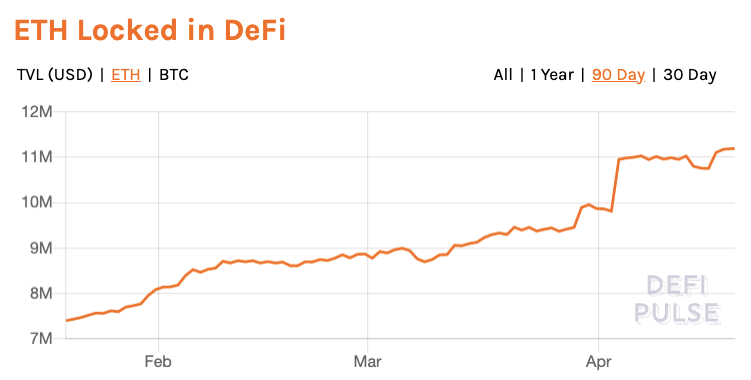

An all-time high of 11.2M Ether is locked in DeFi protocols, despite a weekend sell-off. Liquidations spiked, while tokens continue sliding.

Locked Ether’s resilience may show that DeFi participants do not consider the recent drop in price to signal a long-term trend and thus are not unlocking their ETH in order to sell. Borrowers may also be topping up their collateral positions to prevent liquidations in case ETH continues to slide.

DeFi tokens are taking longer to rebound. The DeFi Pulse Index of 14 sector tokens is underperforming the larger crypto market, down 1% today, while ETH and BTC are little changed.

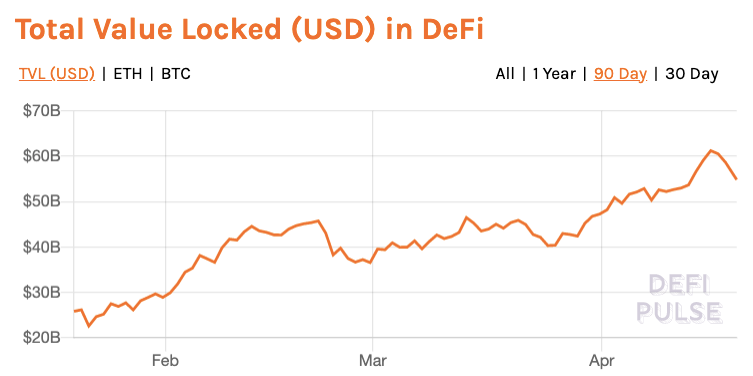

Total value locked in dollar terms is down to $54.8B from Thursday’s all-time high of $61.2B due to the underlying assets’ depreciation, according to DeFi Pulse. Bitcoin constitutes ~14% of TVL according to DeFi Pulse and its 10% drop since Friday contributed to lowering dollar-denominated TVL. ETH is 41% of TVL and it’s down 10% since Friday.

The DPI Index is down 14% since Friday. Major lending platforms, Compound and Aave are both down 6.5% and 6.7% respectively in the past 24-hours and while Uniswap is holding steady which sub-0% change in the last day, Sushiswap’s SUSHI is down 12%.

Of DPI’s constituent assets, MakerDAO’s MKR has bounced back the quickest. The asset is up 7% over the last 24 hours at the time of writing and is down only 1% since Friday. Overall, there’s no clear pattern as to which type of DPI’s assets have shown the most resilience.

Of the top 100 DeFi tokens in CoinGecko, four of the top 10 in terms of 24-hour gains are Ethereum-based projects. Mirror Protocol’s MIR and LUNA, both from the Terra ecosystem are among the top 10 last 24-hour DeFi gainers, with MIR, up 16%, leading all DeFi tokens.

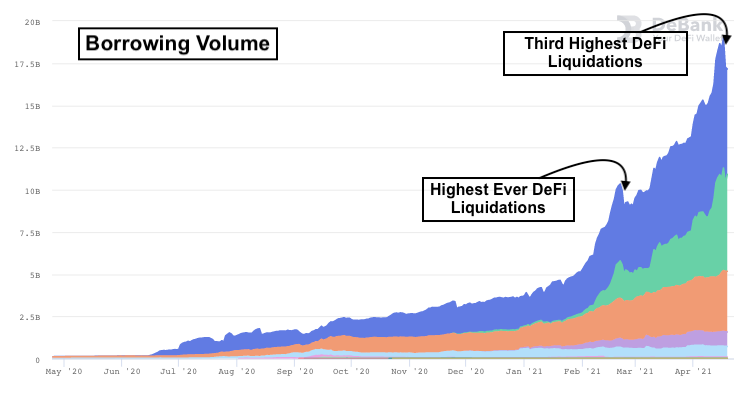

Liquidations Spike

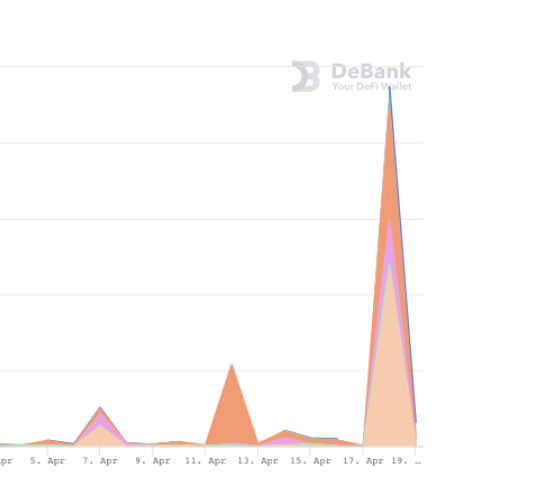

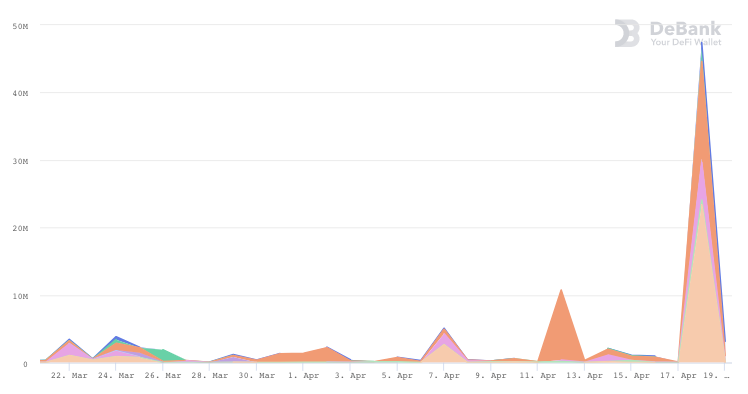

There were $47M worth of liquidations in DeFi protocols on Saturday. This was the third-highest mark ever according to DeBank, and almost five times higher than any other time this month.

49% of the liquidations happened on Aave’s V2, 30% on BSC’s Venus money market protocol, and 12% on Compound. In contrast with Mar. 2020’s Black Thursday, the fifth-highest DeFi liquidation event to date, which saw MakerDAO comprising over 90% of liquidations, the lending protocol contributed less than 1% of the liquidations in last Saturday’s crash.

Borrowing in DeFi had hit an all-time high of $19B on Friday, meaning the liquidations constituted only 0.26% of the total amount borrowed at the time. In contrast, the liquidation-to-borrow ratio on Feb. 22, the all-time high for liquidations, was 1.3%, 80% more than Saturday’s ratio. As borrowing has increased 47% since then, the weekend’s liquidations are not as significant as they seem once put in relative terms to borrowing.

DeFi liquidations were only 0.5% relative to centralized platform’s liquidations. Liquidations in CeFi hit $9.26B on Saturday according to ByBt. While total borrow volume isn’t as readily available for DeFi as it is for CeFi, that was 0.4% of the entire cryptocurrency market’s $2.25T market capitalization at the time.

Cryptocurrency market capitalization is down 7.4% relative to Friday’s all-time high of $2.34T.

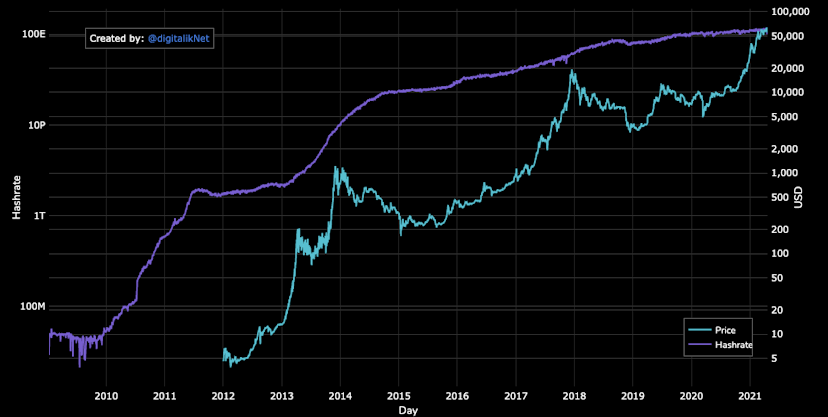

A Power Outage and a Rumor

As crypto participants cast around for a reason for the weekend’s drop some have landed on a power outage in the Xinjiang region of China, where a large amount of Bitcoin mining is done. As miners went offline BTC’s hashrate hit its lowest rate since Dec. 17 2020 according to BitInfoCharts. The drop was the largest one-day change in Bitcoin’s history. A lowered hashrate means lower security for Bitcoin. However, charting both hashrate and price shows no clear correlation between the two, making it difficult to say with certainty that the lowered rate led to the weekend’s sell-off.

Other potential causes for the sell-off are a rumor, ignited by a viral tweet, that the U.S. Treasury was going to “charge several financial institutions for money laundering using cryptocurrencies.” The rumor turned out to be false, but may have contributed.

Adam Cochran of Cinneamhain Ventures believes the issue was multi-faceted, but was caused at least in part, by a Binance systems failure.

Crypto may have also been due for a drawdown as the market bordered on euphoric last week.

Those new to the space, for whom 20% sell-offs may not yet be normal, may be dipping their toes more gingerly into one of the world’s most hyped markets.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.