Ether Short Liquidations Spike To All-Time High

Margin calls for ETH shorts are surging.

By: Samuel Haig • Loading...

Markets

The crypto markets are punishing over-eager leverage traders.

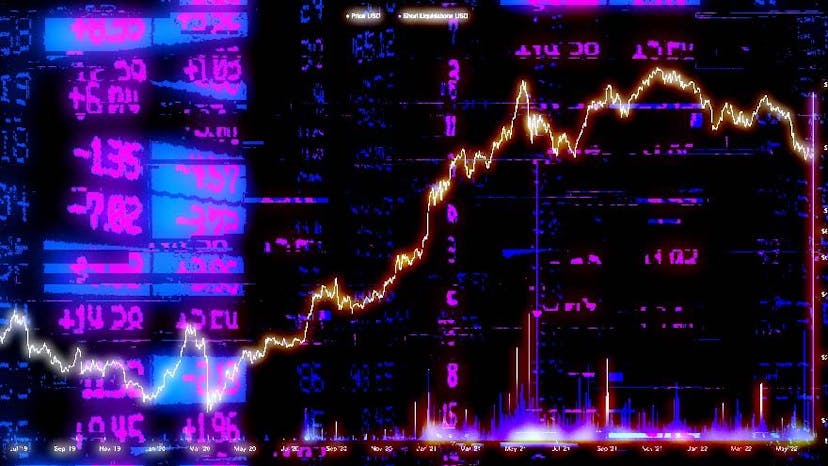

Margin calls for ETH shorts surged to unprecedented volume on June 6, with $686M worth of positions liquidated in a single day, according to CryptoQuant.

The liquidations came amid relatively modest upward price action, with ETH trading within a roughly 6.5% price range from $1,805 to $1,920. The price of Ether also rebounded by 10% over three days, bouncing from a local low of $1,745 on June 4.

ETH short liquidations and price. Source: CryptoQuant

The move coincided with the volume of BTC longs on Bitfinex continuing to push into new record highs. But $608M worth of longs have been liquidated over the past 24-hours amid today’s sudden 7% retracement.

Crypto commentator Lark Davis tweeted that the current market conditions have coincided with the largest BTC sell-off of BTC since early 2021.

Despite a high volume of short liquidations appearing to be a bullish indicator, past spikes in short margin calls have not always preceded significant moves to the upside.

Short Margin Calls

Yesterday’s margin calls significantly beat the previous record for Ether short liquidations of $527M on May 30, 2021.

While price action trended within a 13.4% range on May 30, 2021 and precipitated a 14% rally on May 31, 2021, ETH then entered a protracted downtrend from June 4, 2021 until tagging $1,700 on June 22, 2021. The lower $1,700 range was again revisited on July 20, after which ETH resumed rallying towards new all-time highs.

ETH/USD on Binance. Source: TradingView

The gains ETH posted yesterday have already been erased, with Ether crashing from $1,860 to $1,724 over two hours on June 7.

The DeFi markets also continue to suffer, with only eight assets among the top 100 by market cap posting gains for the past seven days excluding stablecoins according to CoinGecko.

The sector’s combined capitalization is $48.3B, its lowest level since February 2021. DeFi assets currently represent just 3.8% of the global crypto market cap, down from roughly 6% at the start of 2022.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.