EigenLayer Pulls In $160M Of Deposits Within Two Hours

Ethereum Restaking Protocol Launches ‘Eigen Worlds’ NFT Collection

By: Jeremy Nation • Loading...

DeFi

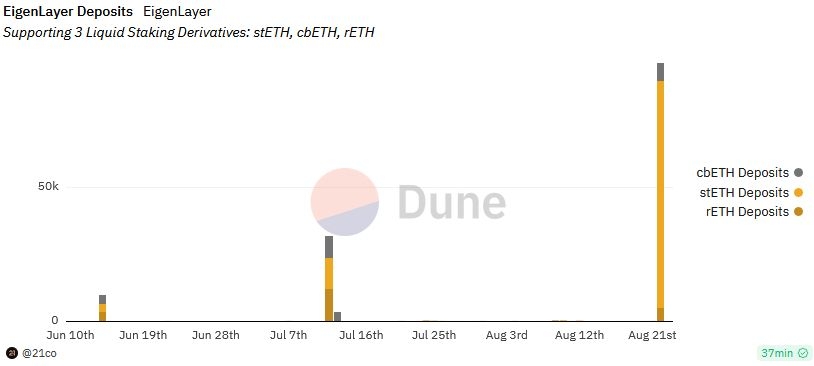

Restaking protocol EigenLayer raised the deposit caps on its liquid staking token (LST) restaking pools on Aug.22, saying that the pools for stETH, rETH and cbETH would close once any one of them hit 100,000 tokens deposited.

EigenLayer stopped accepting new deposits just under two hours later after stETH became the first LST to hit the cap. Users deposited 85,000 stETH, over 6,600 cbETH and nearly 5,000 rETH.

The protocol currently holds close to $240M in total value locked and today launched an NFT collection called Eigen Worlds, which enables “community members to mint their own names and visual emblems in the EigenLayer ecosystem.”

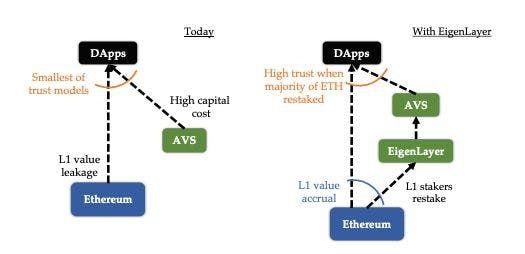

EigenLayer is designed to allow other projects, like bridges or oracle networks, to rely on restaked ETH for security, rather than needing to bootstrap their own validator sets and native token economies. These projects would pay EigenLayer for its services, resulting in additional yield for restakers.

Stader Introduces Liquid Restaked Token

Stader Labs is building a solution For DeFi users who want to use EigenLayer but want to retain access to their liquidity.

No stranger to LST markets, Stader already secures staked assets amounting to $122.35M in TVL across the Ethereum, Hedera, BSC, Fantom, Near, and Terra 2 networks.

The Stader team grappled with how to reconcile a potential conflict between LST restaking services from EigenLayer and the greater DeFi marketplace, co-founder Amit Gajjala revealed on Friday during The Defiant’s weekly livestream broadcast.

Stader's latest project introduces a new crypto primitive in the form of a liquid restaked token (LRT). rsETH is a token that represents LSTs that have been restaked through EigenLayer.

“When somebody stakes their LSTs or ETH with Stader, we restake them on a set of validators running on EigenLayer,” said Gajjala.

“We want to build an ecosystem surrounding EigenETH like liquidity pools, additional reward opportunities, collateralized positions,” said Gajjala.

Overall, Gajjala is bullish on EigenLayer. “The sky’s the limit for restaking rewards. They could be 10%, 15% or 20% depending on the number of services that are utilizing restaked LSTs or restaked Ethereum,” he said.

Work In Progress

The team is currently running the contract on a testnet, with a mainnet deployment imminent, according to Gajjala.

However, some aspects of Stader’s new staking model still hinge on unreleased portions of the EigenLayer, according to Stader protocol Co-Founder, Dheeraj Borra.

“We're still working on a solution. Part of what makes this space very complex with risk-taking is that EigenLayer is a three-sided marketplace and they've only enabled the first side of the marketplace,” Borra told The Defiant.

Yields on EigenLayer are currently not activated, although users may commit supported liquid staking tokens (stETH, rETH, cbETH) to the protocol.

The remaining two sides of EigenLayer’s marketplace are node operators and apps that use the validation services. Borra expects both to launch within months.

Risk Management

To avoid creating a house of cards that could potentially pose a threat to Ethereum, Gajjala says it’s necessary to build with “fundamentally really strong risk management practices.”

In that vein, a risk committee and the DAO have the task of performing a deep assessment of services, only onboarding and whitelisting those that meet stringent criteria.

“There’s going to be slashing risks, there’s going to be some other potential risks. There are so many unknown unknowns in this equation, till restaking and some of the services on top of restaking go live it’s very hard for us to imagine that at this stage,” said Gajjala.

“But having said that, if we ensure that the risk management is properly in place, it’s a fundamentally new primitive that’s going to be built on top of DeFi and ETH staking,” he added.

Advertisement

The Defiant Daily

“an industry must-read”

Get an edge in Crypto with our free daily newsletter

Know what matters in Crypto and Web3 with The Defiant Daily newsletter, Mon to Fri

90k+ Defiers informed every day. Unsubscribe anytime.