Demex Revolutionizing Perpetual Trading: Opens Up Market Making For Anyone

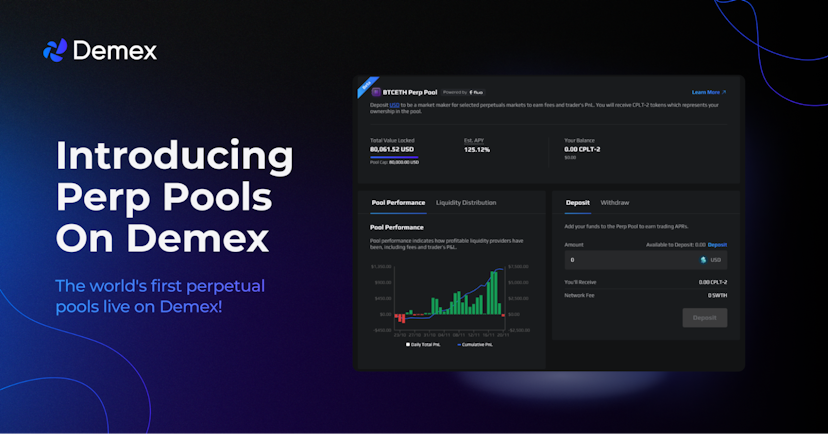

SponsoredDemex, a leading cross-chain perpetual trading DEX is introducing a groundbreaking innovation in the perpetual trading space today with Perp Pools.

By: Demex • Loading...

DeFiDemex unveils its innovative Perp Pools, simplifying market making for crypto traders in perpetual markets. The Perp Pools are easy-to-use, highly efficient, and automated to ensure passive gains.

Demex strives to redefine perpetual trading by exploring decentralized market-making possibilities, with ongoing efforts to enhance liquidity that align with evolving industry standards. It moves Demex towards a more decentralized future of permissionless and transparent market making that is accessible by anyone, regardless of size and skill.

Users providing liquidity to perp pools will earn from market-making fees, funding fees, traders' P&L, as well as potential liquidity incentives.

How does perpetual pools work?

All it requires is to deposit USDC, even easier than depositing liquidity into spot markets. The pool then uses the liquidity and performs the market-making automatically in the background.

Specifically, it takes the liquidity and provides quotes near the index price on the order books of assigned perp markets (i.e. BTC-PERP, ETH-PERP, etc). This fills up the order books on both the buy and sell sides of each market assigned.

Ultimately, this results in Demex’s perpetual markets that is highly liquid around the index price, and traders can enter and exit large positions without incurring huge spread or slippage.

What makes Demex’s perpetual pools unique?

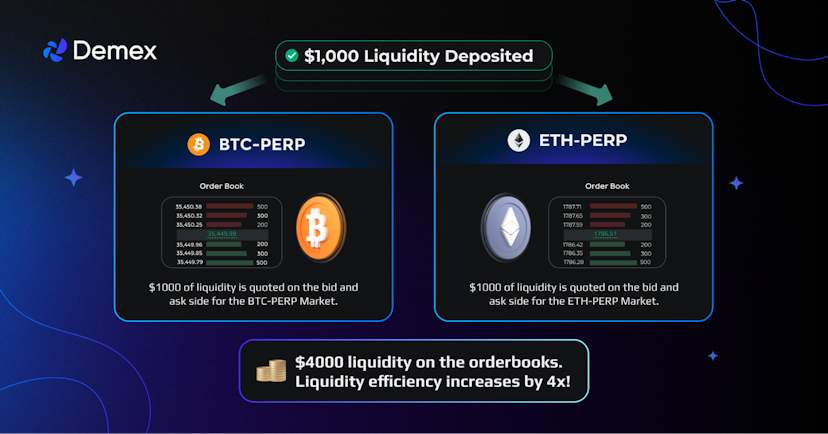

Liquidity efficiency multiplier:

Demex perpetual pools have higher liquidity efficiency. It allows a single dollar of liquidity to be simultaneously provided to the order books of multiple perpetual markets. This means that the liquidity can be exposed to multiple markets simultaneously and utilized more often, allowing liquidity providers to earn fees more regularly, resulting in a higher APR.

For example, $1,000 of liquidity deposited in the $BTC and $ETH Perp Pool will provide $1,000 in bids and $1,000 in asks for each perp market, providing a combined liquidity of $4,000. This liquidity efficiency increases based on the number of perp markets assigned to a perp pool.

Dynamic funding rate:

To protect liquidity providers, perp pools have a dynamic funding rate mechanism. The funding rate gradually increases when the liquidity utilization rate is high, allowing liquidity providers to earn more when there is a preference for the majority of traders go long or short.

Additionally, the high funding rate also encourages funding rate arbitrageurs to take the less popular trade, reducing the perp pool’s exposure back towards 0, allowing it to be delta-neutral even during directional markets.

How do I deposit into a perpetual pool?

All it requires is to deposit USDC, even easier than depositing liquidity into spot markets. The pool handles the market-making automatically in the background without users needing to lift a finger.

1. Go to Demex

Visit Dem.exchange and connect your wallet or use social login to begin interacting with Demex.

2. Deposit Stablecoins into Perp Pools

Deposit USDC into Demex from multiple chains, and then deposit into perp pools to start earning fees.

3. Sit Back and Earn

After depositing your liquidity, relax and start earning rewards passively from traders. You’ll earn from traders' profit and loss (PnL), funding fees, and market-making fees.

Demex Token Airdrop to Traders and Liquidity Providers

For traders seeking a powerful cross-chain perp DEX, Demex is the ultimate platform. With a plethora of markets, and advanced trading tools such as Chart Trading and TP / SL (Take Profit / Stop Loss), and many more, Demex offers best-in-class trading experience.

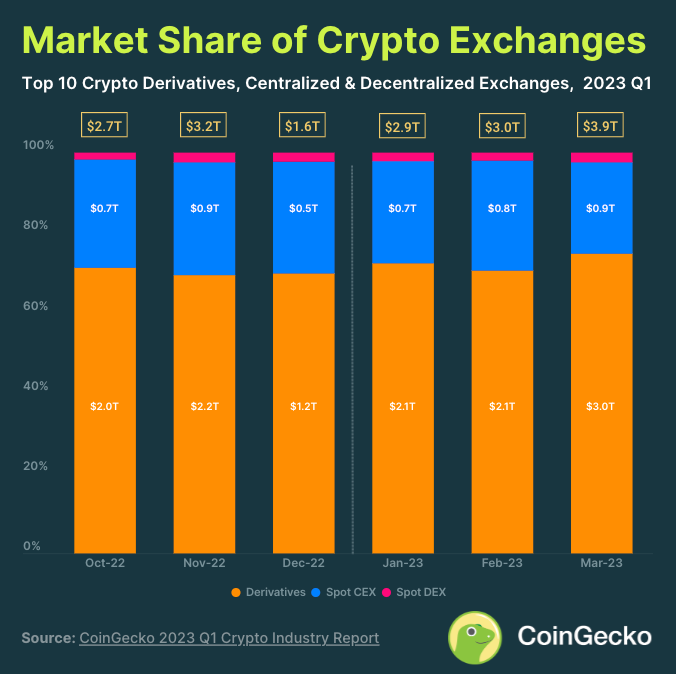

For liquidity providers looking for a passive stream of real yield, perp Pools offer a significantly broader scope for higher returns when compared to spot pools. This is mainly because people trade larger amounts and more frequently in perpetual markets due to leverage.

Perpetual trading volume have also outpaced spot volumes, and there remains a trillion-dollar growth in interest for derivatives trading over spot trading, which Demex is well positioned to capture.

Additionally, the Demex token is set to launch in Q1 of 2024. Traders and liquidity providers of Demex will be eligible for its upcoming airdrop.

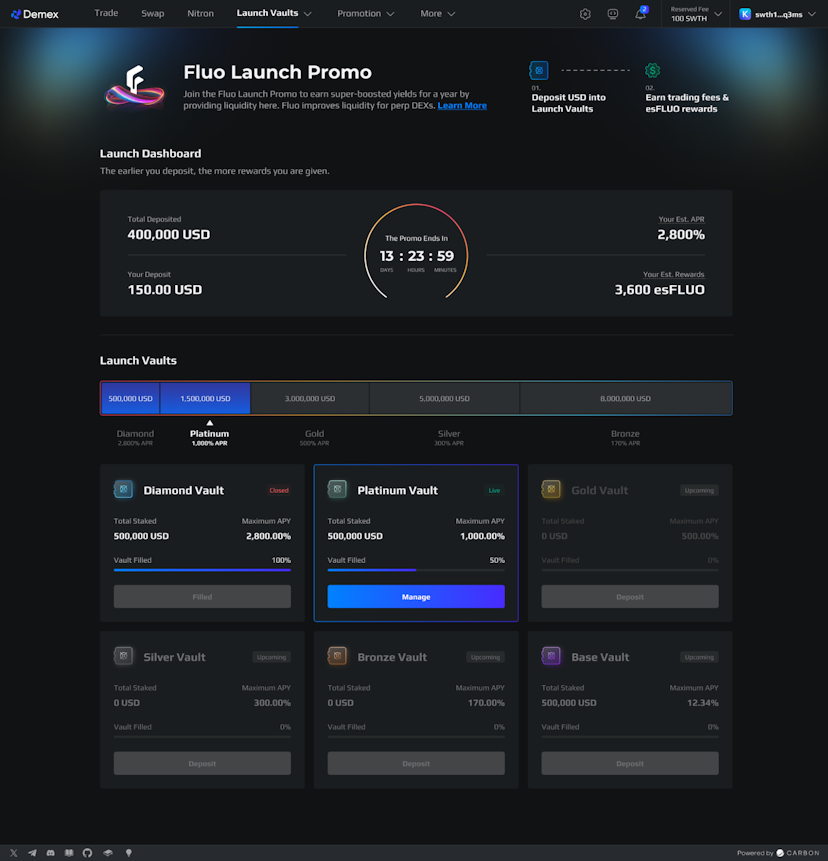

Partnership with Fluo Finance

Demex has also partnered with Fluo Finance, an omni-chain liquidity management protocol specializing in decentralized market-making vaults for derivatives DEXs.

This partnership positions Demex as a leading popular perp DEXs in terms of order book liquidity. Demex’s perp pools will also be incentivized with extra FLUO emission rewards in the future, allowing liquidity providers to earn more rewards, especially if they are early!

About Demex

Demex is a powerful derivatives DEX, for traders looking to trade perpetuals, with the most advanced feature to make the trade of lifetime. Demex also has money markets, liquidity pools, auto-compounding vaults, and more. As a powerful cross-chain DEX supporting assets from Ethereum, Arbitrum, Axelar, Cosmos Hub, and 15+ other chains, Demex is a pioneer in the DeFi space.

Join Demex, embrace the potential to maximize yields, enhance your trading experience, and shape the future of derivatives trading in the DeFi space.

Demex | Demex App | Demex Guide | Demex Blog | Twitter | Discord | Telegram Announcements

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.