Defiant Degens: How to Earn Yield with Automated Options Selling on Ribbon Finance

This is a weekly tutorial on the most compelling opportunities to consider yield farming, written by our friend DeFi Dad, an advisor to the Defiant and the Chief DeFi Officer of Zapper. The goal is to expose more Defiant readers to new DeFi applications and their associated liquidity mining programs. Background on Protocol: Ribbon Finance…

By: DeFi Dad • Loading...

DeFi

This is a weekly tutorial on the most compelling opportunities to consider yield farming, written by our friend DeFi Dad, an advisor to the Defiant and the Chief DeFi Officer of Zapper. The goal is to expose more Defiant readers to new DeFi applications and their associated liquidity mining programs.

Background on Protocol: Ribbon Finance is a new structured products protocol in DeFi for earning yield. Ribbon’s first product focuses on earning yield through automated options strategies. The protocol also allows developers to create arbitrary structured products by combining various DeFi derivatives.

In traditional finance, structured products are pre-packaged investments that include assets linked to interest and often one or more derivatives. Structured products are normally designed to achieve highly customized risk-return objectives. The closest thing to a structured product in DeFi has been Yearn Finance vaults. I would personally classify Yearn vaults as a parallel to structured products and so it’s exciting to see a new Yearn-like approach to automating options strategies through Ribbon. Pioneering options protocols like Hegic and Opyn will benefit from Ribbon which will likely provide easier exposure to more powerful options selling strategies.

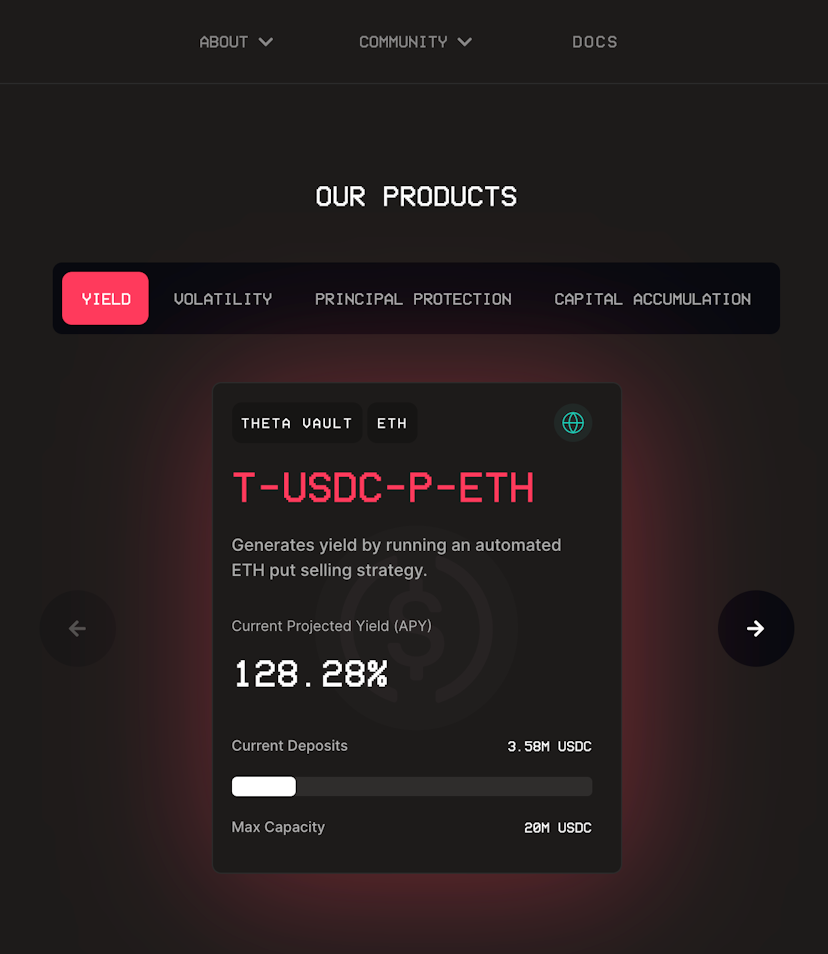

The first 3 products by Ribbon Finance are:

- An automated ETH put selling strategy (T-USDC-P-ETH)

- An automated WBTC covered call strategy (T-WBTC-C)

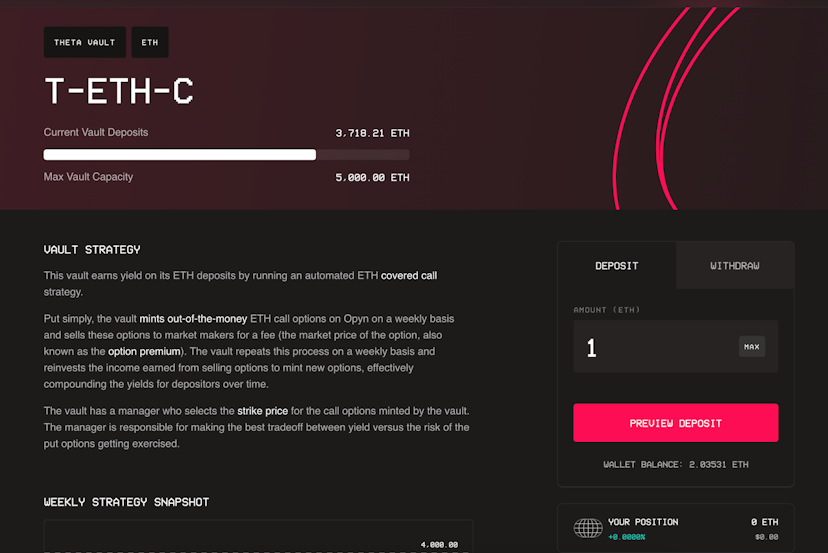

- An automated ETH covered call strategy (T-ETH-C)

As of writing this morning, Ribbon coincidentally just launched a governance token RBN, distributing 3% of the RBN supply to 1620 early adopters the last month since launching on April 12th. Anyone who meets the following criteria can go here on Ribbon to claim their RBN tokens, which are valueless as of today because they are non-transferrable, meaning you cannot sell or transfer them.

- Past & existing users of Ribbon products

- Active Ribbon Discord members

- Users of various options protocols on Ethereum including Hegic, Opyn, Charm, and Primitive

I would anticipate that one of the first governance votes with RBN will aim to allocate more RBN to subsidize more users to try Ribbon Finance products.

Opportunity: In light of the recent market volatility in the markets, Ribbon Finance is one way to sell options and hence short volatility by gaining exposure to automated options selling strategies with USDC, WBTC, or ETH. Since volatility is cyclical like price action, this is potentially a promising strategy (but not guaranteed) for someone who’s short volatility and already holding USDC, WBTC, or ETH.

- If you’re wanting to earn yield on USDC by selling ETH puts, one can consider T-USDC-P-ETH. Learn more about the vault strategy.

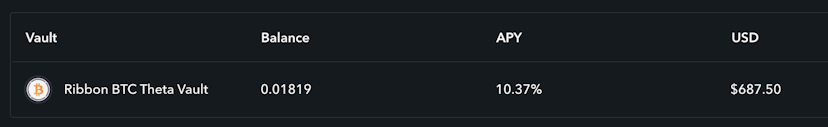

- If you’re wanting to earn yield on WBTC by selling WBTC calls, one can consider T-WBTC-C. Learn more about the vault strategy.

- If you’re wanting to earn yield on ETH by selling ETH calls, one can consider T-ETH-C. Learn more about the vault strategy.

I cannot advise which to buy because that would be giving financial advice. However, I can share that I personally would consider the 1st vault if I’m bullish on ETH and short volatility, but I would consider the 2nd and 3rd vault if I’m short term bearish on WBTC or ETH and short volatility.

Time to Complete: 5-10 mins if paying the recommended FAST gas price on gasnow.org

Gas + Protocol Fees: Based on the FAST gas price on gasnow.org currently between 40-80 Gwei with ETH at $2500, I would estimate paying the following gas fees.

- Depositing into the T-USDC-P-ETH vault = $20-$40

- Depositing into the T-WBTC-C vault = $20-$40

- Depositing into the T-ETH-C vault = $10-$20

Risks: As always, this is not financial advice and you should do your own research. Consider all these risks if you choose to participate in the liquidity mining program.

- Smart contract risk in Ribbon Finance and associated protocols like Aave, Compound, dYdX, and DDEX. Despite being audited, Ribbon is a new protocol and I’d approach any new DeFi with caution.

- Oracle failure

- Liquidity crisis

- Systemic risk in DeFi composability

- Estimated projections of APYs can changed based on weekly performance of vault strategies and if there are future allocations of RBN to subsidize users.

- Regardless of which vault I choose with Ribbon, I am not guaranteed making profits. I can lose part or all of my deposit over time if the automated strategy keeps losing to those buying the options.

Tutorial:

- First, thing I ask myself: Am I wanting exposure to automated options selling strategies? Do think this is a good strategy long term in DeFi or am I simply wanting to “short volatility” in the short term? If the answers are a resounding yes, then Ribbon Finance might be ideal for me.

- Second, I ask myself: Am I willing to risk depositing USDC or a volatile asset like WBTC or ETH? There are 3 vaults catering to those who hold USDC vs WBTC vs ETH.

- Third, I ask myself:

- If I’m willing to deposit USDC and short volatility but also bullish on ETH, do I want exposure to an automated strategy selling ETH put options weekly? If yes, I would opt for the T-USDC-P-ETH vault here.

- Alternatively, if I’m holding WBTC or ETH, am I wanting to short volatility while believing WBTC or ETH are likely to range for some time? If yes, then I would opt for either T-WBTC-C or T-ETH-C vaults.

- Let’s assume the following:

- I hold ETH long term but I believe the market is likely to range for now and I want to earn yield selling weekly puts to market makers on a weekly basis, one that reinvests the income earned from selling options to mint new options, effectively compounding the yields for depositors over time.

- So I’m choosing to deposit my ETH into a covered call strategy with T-ETH-C by Ribbon Finance.

- While in this vault, I’m effectively holding a long position in ETH while also selling call options on ETH.

- If ETH does rocket upwards in price, then I’m going to lose ETH on this vault if/when those sold call options expire in-profit for those who bought the ETH calls.

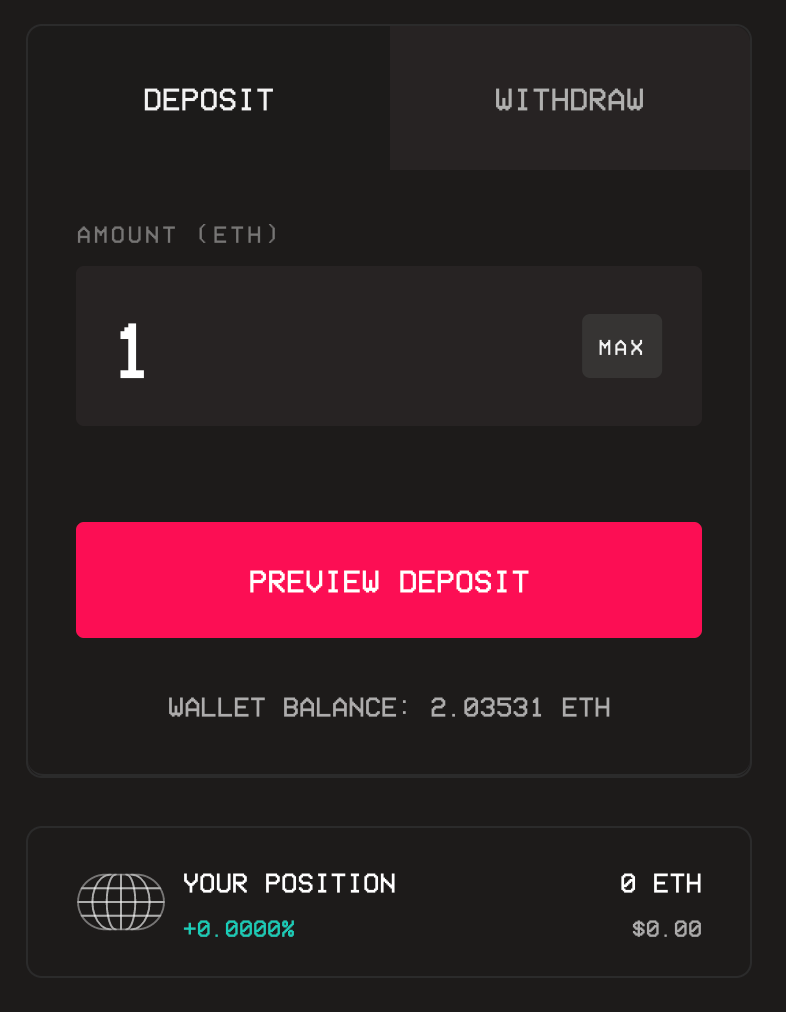

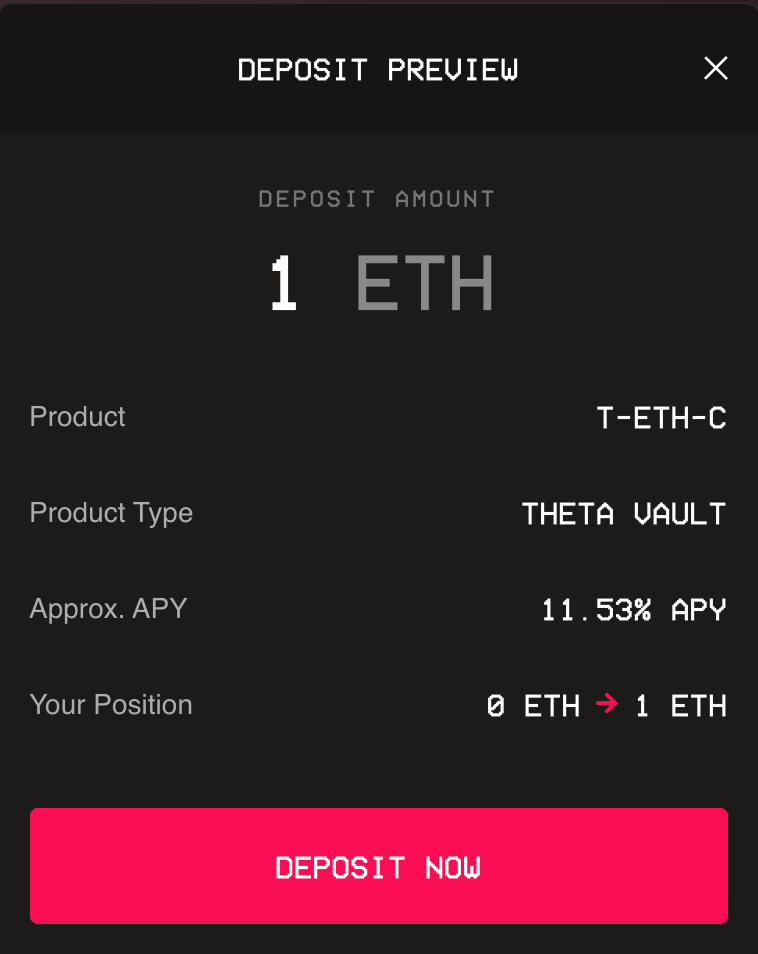

- To get started earning yield in the T-ETH-C vault, I go here. Read about the vault strategy and the risks. Be sure to check out the Current Projected Yield (APY) vs the Yield (Cumulative).

- If I’m game to enter this vault, specify how much ETH to deposit and click Preview Deposit.

- Then click Deposit Now and confirm on MetaMask.

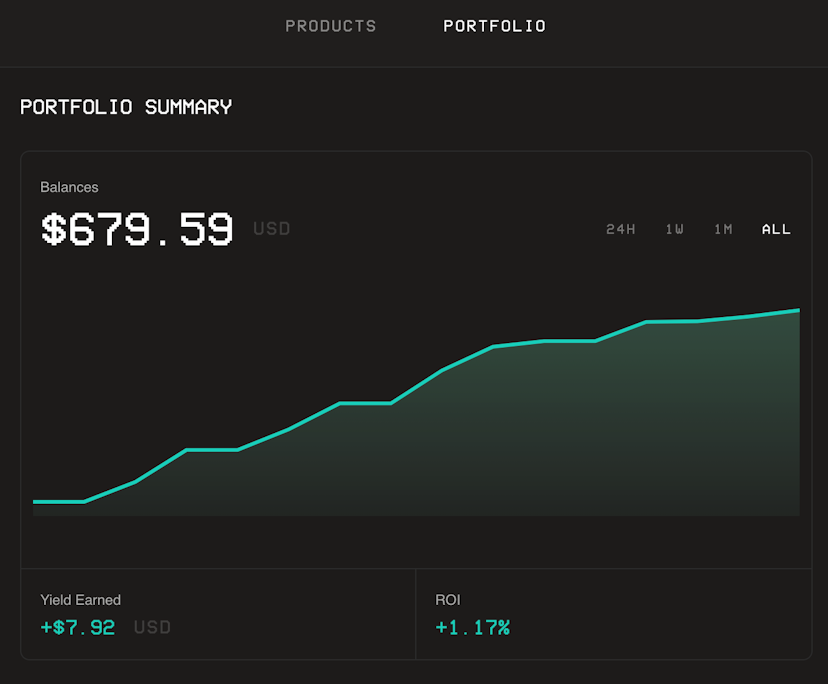

- Once confirmed, I can track my portfolio of yield or losses here on Ribbon Finance as well as my net balance in the Ribbon vault on my Zapper Dashboard.

About Author: DeFi Dad is a DeFi super-user, educator, and investor. You can subscribe to his YouTube channel at defidad.com and get started on your DeFi journey with Zapper Learn with DeFi basics and tutorials.

Disclosure: DeFi Dad earned RBN in the airdrop. This is not an endorsement or recommendation to buy RBN in the future. Please do your own research.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.