DeFi Traders Increase Leverage As Markets Rally

Stablecoin borrowing rates have climbed to double digits on major lending protocols, with outstanding loans growing 20% to $8 billion in 2024.

By: yyctrader • Loading...

Markets

As Bitcoin approaches all-time highs and altcoins heat up, stablecoin liquidity is fetching a premium across DeFi.

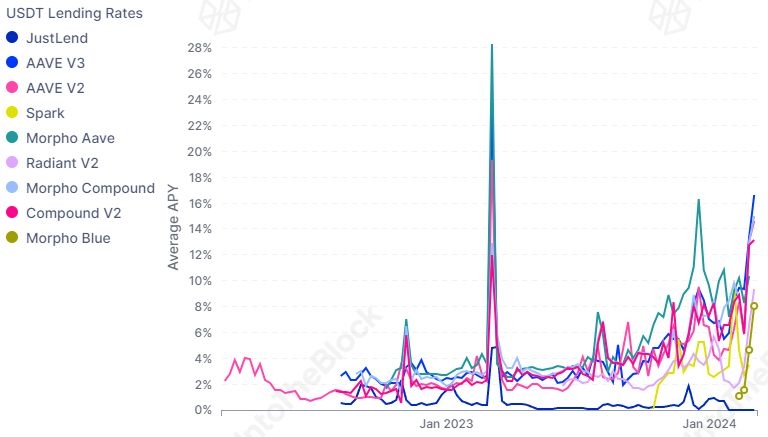

The cost of borrowing leading stablecoins USDT and USDC against crypto collateral has spiked into double digits on major DeFi lending protocols.

USDT and USDC rates spiked to 16% and 17.7%, respectively, on AAVE V3, while DAI lending rates on Compound V2 soared to 15.8%, according to data from IntoTheBlock. Stablecoin lending rates in DeFi protocols were trending under 5% for most of the bear market.

On Aave, the largest money market with over $16 billion in total value locked (TVL), borrowing rates were higher only in March 2023, when the collapse of Silicon Valley Bank precipitated a short-lived liquidity crunch.

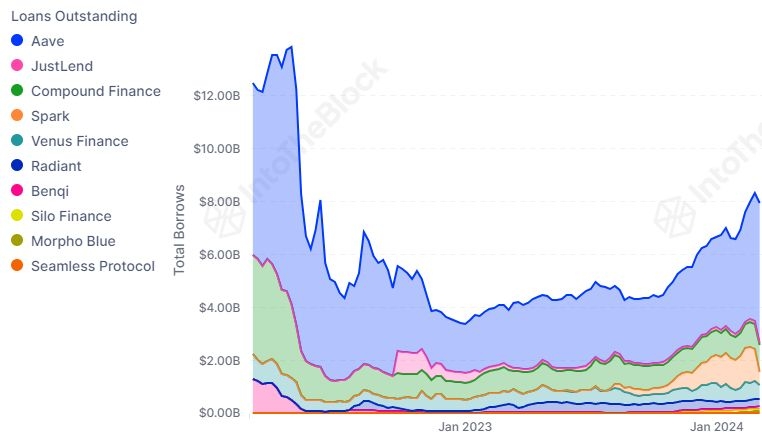

Outstanding loans have surged by 20% since the start of the year to $8 billion, according to data from IntoTheBlock.

In a bull market, having liquidity on hand is paramount since lucrative trading opportunities can present themselves at a moment’s notice. At the same time, traders might not wish to sell their core positions in Bitcoin or Ether, for example, since they would likely incur sizable tax liabilities given the recent runup in prices.

One solution is to borrow stablecoins against existing assets and use that liquidity to participate in other opportunities, which could explain the rise in borrowing costs.

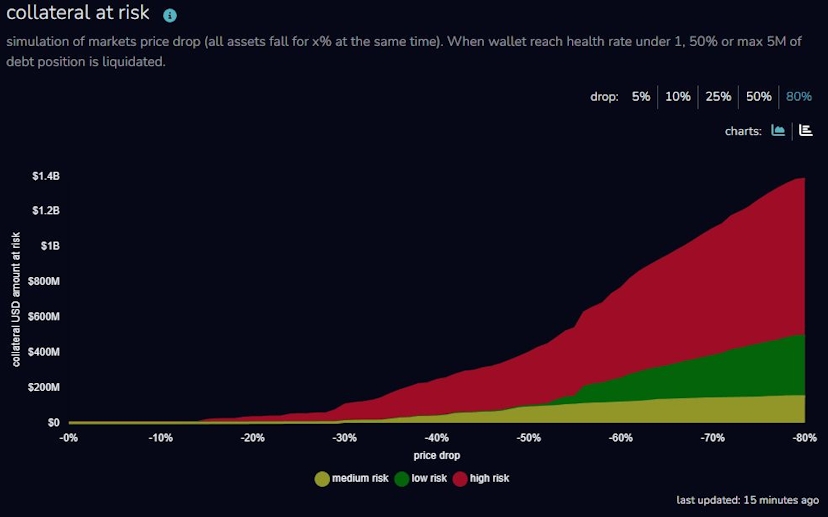

It’s worth noting that DeFi traders appear to be far more conservative than the leveraged degens trading on centralized exchanges (CEXs). While yesterday’s bout of volatility resulted in over $1 billion of CEX liquidations after funding rates spiked to multiyear highs well into triple-digits, DeFi was barely affected since collateral ratios are higher.

Indeed, data from BlockAnalitica shows that most collateralized debt positions on Aave remain well-capitalized, with major liquidations expected only if asset prices drop 30% or more.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.