DeFi Tokens Outperform Amid Crypto Bull Market

As Ethereum pushed past an all-time, DeFi too, broke away from the rets of the crypto market. Defi tokens make up four f the top 10 gainers over the last seven days, and 10 of the top 25. The top DeFi gainer has been lending protocol Aave, up 35% over the last week. Decentralized exchange…

By: Owen Fernau • Loading...

DeFi

As Ethereum pushed past an all-time, DeFi too, broke away from the rets of the crypto market.

Defi tokens make up four f the top 10 gainers over the last seven days, and 10 of the top 25.

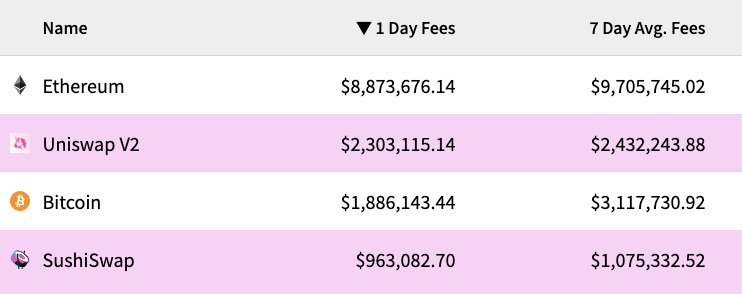

The top DeFi gainer has been lending protocol Aave, up 35% over the last week. Decentralized exchange Uniswap checks in second with a 33% gain along with the bragging rights that come with passing Bitcoin in terms of fees paid to the network according to Crypto Fees.

The DeFi Pulse Index, buoyed by the UNI and AAVE tokens, also hit an all-time high in dollar terms on Sunday.

Why Now?

Investors may be shifting from Bitcoin to DeFi, Qiao Wang, of accelerator DeFi Alliance, told The Defiant.

“It’s a combination of strong fundamentals and BTC consolidation,” he said.

DeFi protocols have measurable revenue which come from the fees users pay to engage with them. For example, Uniswap takes a .3% of every trade. This contrasts with many crypto companies from the initial coin offering (ICO) era which tried to integrate a token into their app without a clear fee-driven model to consistently drive revenue, or even with many fintech and Web2 unicorns, which have yet to turn a profit.

Alex Svanevik, founder of blockchain analytics platform, Nansen, expanded on the idea, telling The Defiant, “DeFi is the primary bet on the Ethereum ecosystem (besides ETH itself). This is becoming clear to larger investors who carefully entered crypto by investing in BTC.”

Svanevik added that the impending CME launch of ETH futures on Feb. 8th “helps drive the Ethereum narrative.”

Good News Keeps Coming

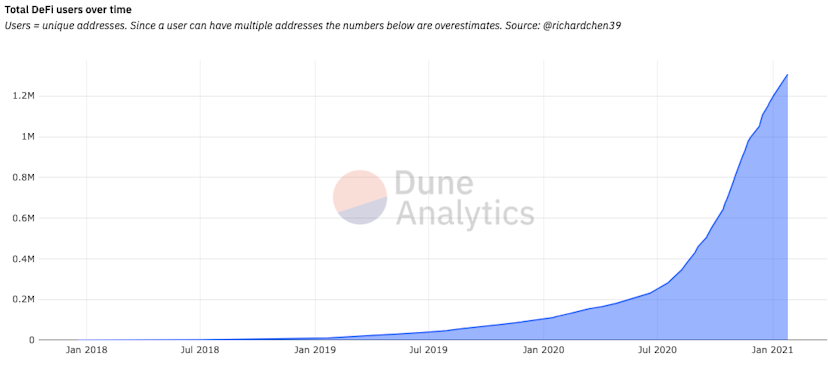

Other DeFi metrics are up too as both total value locked (TVL) in open finance protocols is at an all-time high of over $26B and the number of unique users in the space has breached 1 million.

Additionally, excluding both Ethereum, which underpins all noteworthy DeFi protocols, and Chainlink, which is a key piece of DeFi infrastructure, three DeFi tokens, UNI, SNX, and AAVE rank in the top 20 of cryptocurrencies in terms of market capitalization.

This degree of representation is a first and has some, like EthHub co-founder Anthony Sassano, predicting that the top 10 coins will consist exclusively of BTC, ETH, and DeFi tokens.

Carrying On Despite Pesky Fees

Transaction fees continue to hinder less-wealthy users’ bottom lines. As those are flat fees, open finance is most useful for those trading large amounts. For example, it currently costs $18 to make a deposit with lending protocol Compound according to a popular Dune Analytics dashboard.

Still, it’s difficult to find a bearish voice amidst DeFi’s continued success.

Plus, if increasing prices are any indication, the market is confident that scaling issues will be solved. Recent momentum in Layer 2 integrations by DeFi heavyweights like Synthetix and Aave-associated teams continue to fortify the belief that open finance is here to stay.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.