Markets Round-Up: Top 100 DeFi Tokens Climb to Record Market Cap

While many crypto analysts spent the week focused on Bitcoin’s pull-back to below $60,000, top DeFi assets quietly saw significant gains to drive the sector’s combined market cap in uncharted territory.

By: Samuel Haig • Loading...

DeFi

While many crypto analysts spent the week focused on Bitcoin’s pull-back to below $60,000, top DeFi assets quietly saw significant gains to drive the sector’s combined market cap in uncharted territory.

Market Cap

According to CoinGecko, the combined capitalization of DeFi tokens pushed above its May all-time high of $150B on Oct. 26 before topping out at $152.6B the following day. CoinGecko estimates DeFi assets to represent 5.6% of the combined crypto market cap, up 0.2% for the week.

Image source: CoinGecko

Terra (LUNA) ranks as DeFi’s largest market, representing 11.4% of the sector’s top 100 with a capitalization of $17.4B, despite its dominance receding by 0.9% since Oct. 22.

Chainlink (LINK) ranks second with $14.4B after gaining 10.6% for the week. Chainlink now represents 9.6%of the top 100 DeFi tokens’ capitalization — a 0.5% increase in seven days. After being overtaken by Chainlink, the dominance of third-ranked Uniswap fell by 0.2% to currently represent 8.9% of the market. Uniswap’s market cap is $13.3B.

However, when looking at 24-hour trade volume, Chainlink is firmly in front with $1.6B, followed by Curve (CRV) with nearly $1.1B, and Terra with $840M.

Top Gainers

Roughly half of DeFi’s top 100 assets by capitalization posted gains for the week, including 11 assets that rallied by more than 20%, and four that surged 50% or more.

- Frax Share (FXS) + 122%

- Curve (CRV) + 70.9%

- GMX (GMX) + 62.9%

- Anyswap (ANY) + 53%

- THORChain (RUNE) + 45.1%

Biggest Losers

While approximately half of DeFi’s leading assets suffered drawdowns over the past seven days, only eight tokens posted double-digit losses

- BOUNCE (Auction) – 32.3%

- Idex (IDEX) – 19.5%

- Venus (XVX) – 16.2%

- dYdX (DYDX) – 13.3%

- STP Network (STPT) – 12.6%

Total Value Locked

While CoinGecko estimates the DeFi market cap to have posted new highs this past week, data from DeFi Llama shows the sector’s total value locked (TVL) to have ballooned past its May 11 ATH of $164.2B by 51% since breaking into uncharted territory towards the end of August.

More than $247.6B worth of assets are currently locked up in decentralized finance protocols.

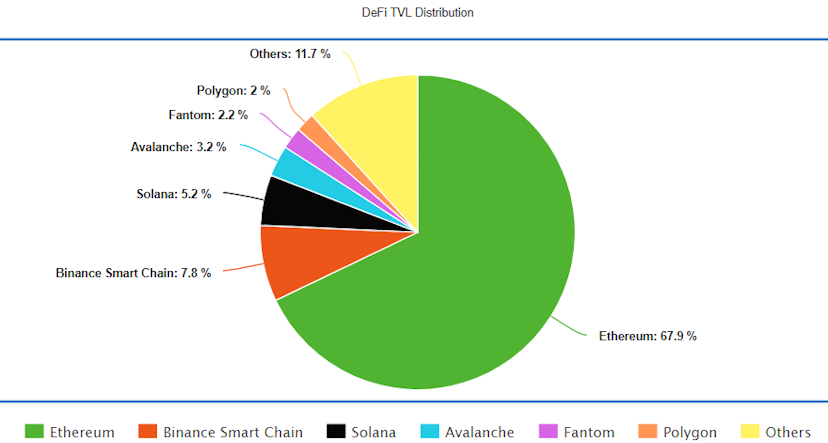

According to DeFi Llama, Ethereum’s dominance has grown by more than 1% to represent 67.9% of the sector’s capital with a record TVL of $168B, followed by Binance Smart Chain (BSC) with $19.4B or 7.8% of the sector’s total, and Solana near record highs with $12.9B or 5.2%.

Of the DeFi’s leading networks, Fantom saw the largest percentage gain for the week with its TVL growing by 30% from $4.3B to $5.6B to host 2.2% of DeFi liquidity. Avalanche’s TVL also increased by more than 10% to tag a record high of $8.5B or 3.2%, while $300M flowed into Polygon for the network to finish the week with $5B or 2%.

Aave (AAVE) has held its position as the largest DeFi protocol by TVL across chains after reclaiming the top spot last week, representing a TVL of $19.5B after gaining 4.4% for the week.

Curve (CRV) is a close second with $19B after posting a seven-day TVL gain of 6.6%, while MakerDAO (MKR) also gained more than 6% to rank third with $17.4B, followed by Wrapped Bitcoin (BTC) with a TVL of $14B after increasing by 1% this week.

Layer 2 Growth

Ethereum’s layer-two ecosystem continued to see TVL growth, with data aggregator L2beat estimating the value of capital locked on second layer networks increased by 5% to close the week at nearly $4.3B.

DeFi Llama places the value of DeFi on leading rollup network Arbitrum at a new all-time high of $2.4B, while data from L2beat suggests dYdX’s derivatives exchange ranks second behind with a record high above $1B. Optimism ranks third with a DeFi TVL of $283M.

Fees

Uniswap was the top protocol by fee generation for the week, driving $5.8M in daily swap fees on average for the past seven days — a 36.5% increase over the previous week.

Aave ranked second with $2.5 M after sitting outside of the top five last week, followed by SushiSwap with $1.7M, Compound with $944K, and Quickswap with $310K. By contrast, Bitcoin’s average daily fee generation was $775K for the week.

Burn

According to Ultrasound Money, Uniswap v2 was the single-largest source of Ether being burned last week with 10,796 ETH destroyed (approximately $47.3M).

Behind Ether transfers, leading NFT marketplace OpenSea was third with 5,018 Ether burned ($22M), while Uniswap v3 came fifth behind Tether with 2,602 ETH burned ($11.4M). 1inch v3 and SushiSwap ranked ninth and tenth overall with 1,515 ETH ($6.6M) and 920 ETH ($4M) burned respectively.

Index Tokens

While DPI has posted a sluggish recovery since the recent gut-wrenching bear market, index tokens on centralized exchanges have posted triple-digit gains since their local lows in July.

The DeFiPulse Index (DPI) posted a modest gain of 2.7% to last trade hands for $349. The token has now gained 62.3% since its July low of $215, DPI is still down by 44.5% from its May ATH of $628.5.

The perpetual markets for FTX’s DEFI index contracted just 0.5% this week, after rallying by 13% last week. Open Interest for the contract also increased from $12.6M to $13.2M.

Although the recent bear trend saw FTX’s DEFI contract shed 66% of its value, the contract is currently trading within 19% of its May ATH after rebounding 135% from its recent low of $5,640.

Binance’s DeFi Composite Index Token is trading for $2,740 at the time of writing after gaining 3.4% in seven days. Despite the perpetual contract bouncing 150% from its local low after crashing $72 amid the mid-2021 crypto bloodbath, the market is still down 29% from its May record high.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.