DeFi Outperforms Post Crash as On-Chain Indicators Remain Strong

On-Chain Markets Update by Lucas Outumuro, IntoTheBlock Following the biggest crash since Black Thursday, DeFi protocols have managed to withstand major headwinds and liquidations. While DeFi tokens dropped significantly along with the rest of the market, they sustained above their lows relative to Ether and still managed to grow in key on-chain metrics. The DeFi…

By: Lucas Outumuro • Loading...

DeFiOn-Chain Markets Update by Lucas Outumuro, IntoTheBlock

Following the biggest crash since Black Thursday, DeFi protocols have managed to withstand major headwinds and liquidations. While DeFi tokens dropped significantly along with the rest of the market, they sustained above their lows relative to Ether and still managed to grow in key on-chain metrics.

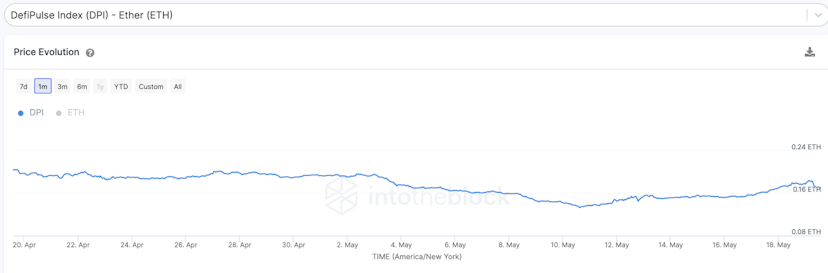

The DeFi Pulse Index (DPI) dropped 50% versus ETH from March to early May. Since then, we have seen a reversal over the past few weeks with DPI rebounding over 30% with on-chain activity turning bullish for DeFi.

As of May 19, 2021 through IntoTheBlock’s Uniswap protocol insights

The recent price increase in DPI comes at a critical price area around 0.13 ETH. Zooming out, we observe that this price was previous support for the index, potentially making this a double bottom for DPI in Ether terms.

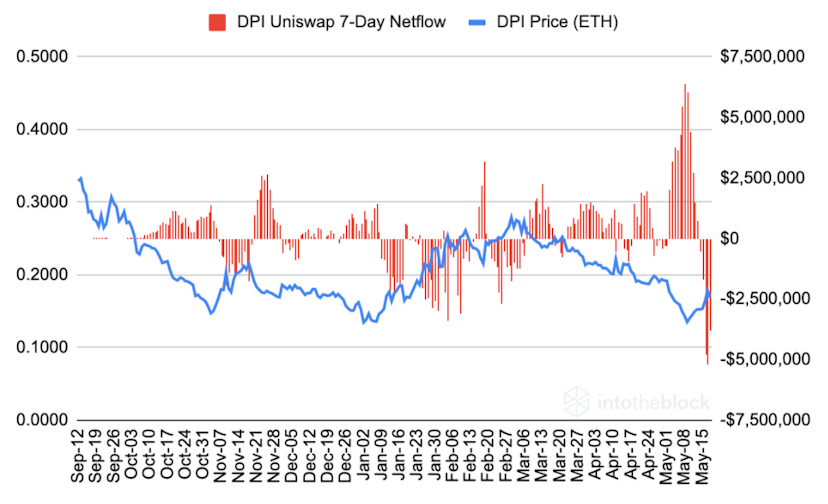

On-chain, we also see a strong reversal in the netflows of DPI on Uniswap V2. Netflows in this case refers to the inflows entering Uniswap minus the outflows for a particular token. Since traders remove liquidity from a trading pair, negative netflows for an asset point to high demand for it relative to the other asset.

In DPI’s case, netflows went from record highs to record lows within a week.

As of May 19, 2021 using data from IntoTheBlock’s Uniswap protocol insights

This turnaround comes as DPI capitulated—accelerating inflows as traders sold near the bottom—followed by aggressive buying activity after recovering from the 0.13 range. In both cases Uniswap netflows marked decisive moves from market participants.

The recent run-up had many crypto insiders anticipating DeFi summer 2.0 prior to the market-wide 30% drop. In spite of the hefty correction, however, DeFi protocols remain largely unchanged. Unlike Black Thursday, procedures to weather severe volatility managed to limit the impact from the market crash, avoiding incidents like the previous liquidations for $0 at MakerDAO.

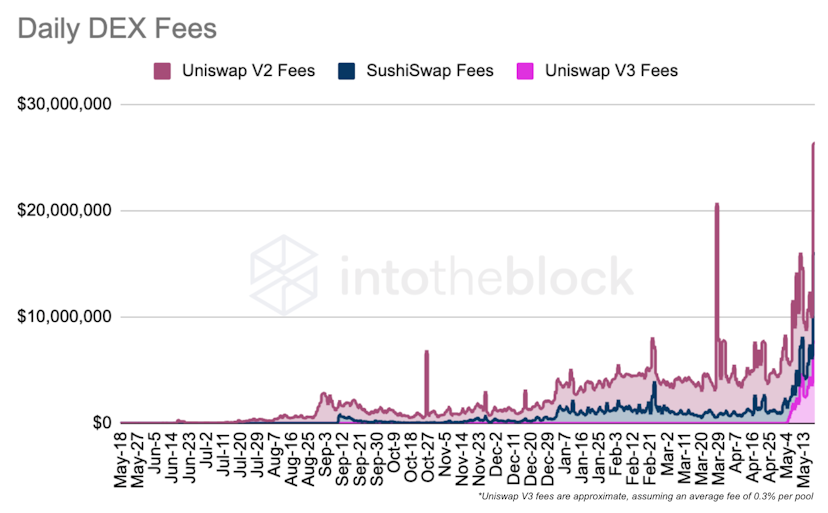

Instead, many DeFi protocols were able to benefit from the volatile trading session. DEXs in particular had already been on an up-trend in terms of volumes and fees and managed to set new record highs on May 19.

As of May 19, 2021 using data from IntoTheBlock’s Uniswap and SushiSwap protocol insights

Based on the 7-day moving average of these fees, Uniswap V2, SushiSwap and Uniswap V3 are projected to amass $4.8 billion in annualized fees between them, excluding SushiSwap’s fees obtained in Polygon and Fantom.

Overall, the recent crash acted as a stress test for DeFi protocols; it demonstrated that they can withstand severe conditions, and with 100% uptime. While the drop may have slowed down the recovery in DPI’s price relative to ETH, on-chain activity remains strong, led by record-setting DEX demand.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.