DeFi Lenders Spooked By Curve Exploit

Stablecoin Borrowing Rates Spike On Aave

By: Owen Fernau • Loading...

DeFi

The fallout from a $70M exploit of Curve Finance earlier this week continues to ripple through DeFi, with major lending platforms facing a liquidity crunch.

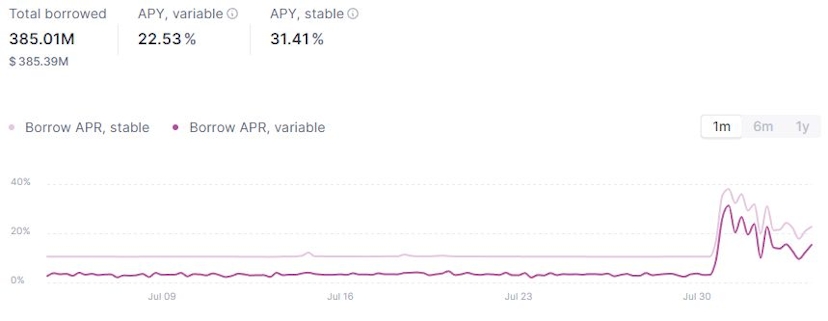

On Aave, DeFi’s leading money market with nearly $5B in total value locked (TVL), borrowing costs for major stablecoins are at their highest levels in over a year.

The borrowing rate for USDC, which is the largest stablecoin market on Aave V2 with $415M supplied, stands at over 22% after having spiked as high as 32% on July 31.

USDC is crypto’s second-largest stablecoin with a $26B market capitalization.

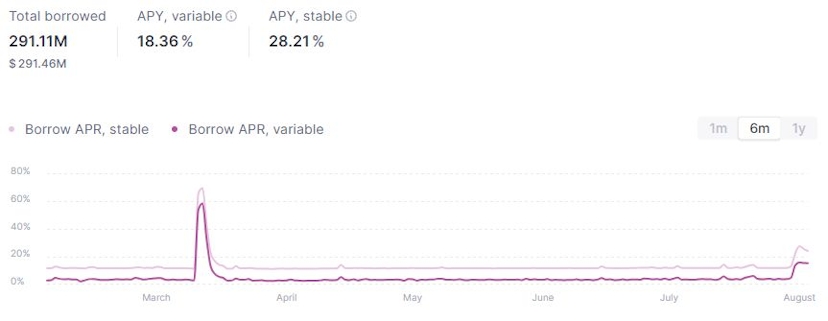

Meanwhile, the USDT borrowing rate has jumped to over 18%, its highest level since March, when concerns about USDC’s backing sent traders flocking to Tether’s USDT, crypto’s largest stablecoin with an $83.7B market capitalization.

DAI, the third-deepest stablecoin market on Aave, is also expensive to borrow at 12%.

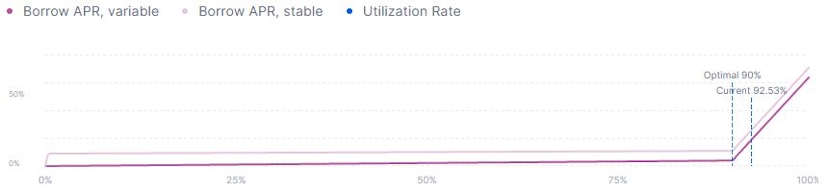

The reason for the increased rates is that users are pulling stablecoins from the platform, which is pushing up utilization rates for the dollar-pegged assets. All the stablecoin markets are currently over 90% utilized.

The utilization rate in this case refers to how much of a given asset investors are borrowing versus the available supply. As utilization rates go up, interest rates do too, encouraging borrowers to repay their loans and enticing would-be lenders to deposit more assets.

Nearly $1B Leaves Aave

Aave’s TVL has dropped nearly 15% in the past week and it’s likely that depositors are pulling assets from Aave out of concern that the protocol could be left with bad debt.

A major withdrawal came from Justin Sun, the founder of the Tron blockchain. Sun pulled $40.7M of USDT from Aave on Aug. 1, briefly pushing the interest rate on the stablecoin to 44%, according to Lookonchain.

One of the largest users of Aave is Curve co-founder Michael Egorov, who has $148M in deposited CRV tokens backing $56M in stablecoin loans.

Hackers successfully attacked Curve on July 30, pushing CRV down 20% along with draining roughly $70M from the exchange’s liquidity pools. The depressed CRV price, combined with the asset’s relatively low on-chain liquidity, has DeFi lending projects scrambling to reassess their exposure to avoid accruing bad debt.

It’s a big moment for DeFi.

While experimental projects in open finance have often blown up in the past, core DeFi protocols like Maker, Aave, Compound, Curve, and Uniswap, are generally considered to be battle-tested and safe.

Now, hackers have successfully attacked Curve for a huge sum, which could impact the perception of these DeFi “blue chips.”

Abracadabra Mulls Raising Rates

Other communities are grappling with CRV-backed loans as well — contributors to Abracadabra, a lending platform where Egorov owes $9.9M against $22M in CRV, are debating whether to raise interest rates to a base rate of 200%, a figure certainly high enough to induce repayment.

The proposal doesn’t look like it’s going to pass — voting is set to close later today and “nay” votes outweigh “yay” votes by 72% to 28%.

However another vote, set to complete on August 5, just went live today — the proposal would raise interest rates on Egorov’s positions to 80%. The interest rate would depend on the outstanding loan balance, and would also fluctuate based on the health of the position. For example, if the Curve co-founder deposited more CRV, the ratio of borrowed MIM to pledged collateral would drop, as would the interest rate.

The Abracadabra post is also factoring in the amount of CRV liquidity on the Curve exchange. Deeper liquidity means a more stable price, making it easier to liquidate the position if necessary. There’s currently $11.5M of liquidity on Curve, according to DeFi Llama.

Abracadabra voted to freeze the CRV market on July 31.

The concerns around Egorov’s positions aren’t new. Risk management firm Gauntlet Network recommended that Aave freeze the CRV lending market last month, but the proposal was shot down by AAVE holders.

And Avraham Eisenberg, the infamous proponent of ‘highly profitable trading strategies,’ tried to liquidate the Curve co-founder last year.

With this weekend’s hack, however, the Curve’s co-founder’s borrowing positions have once again come under the microscope.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.