DeFi is Deleveraging After Liquidations

Crypto markets experienced a severe correction over the weekend, with most assets dropping double digits. While difficult to pinpoint a specific cause for the drop, it is evident that the high amounts of liquidations arise from an overleveraged market. Both derivatives markets and decentralized lending markets experienced tumultuous action during the weekend. On-chain activity points…

By: Lucas Outumuro • Loading...

MarketsCrypto markets experienced a severe correction over the weekend, with most assets dropping double digits. While difficult to pinpoint a specific cause for the drop, it is evident that the high amounts of liquidations arise from an overleveraged market.

Both derivatives markets and decentralized lending markets experienced tumultuous action during the weekend. On-chain activity points to markets deleveraging and investor repositioning amid the crash.

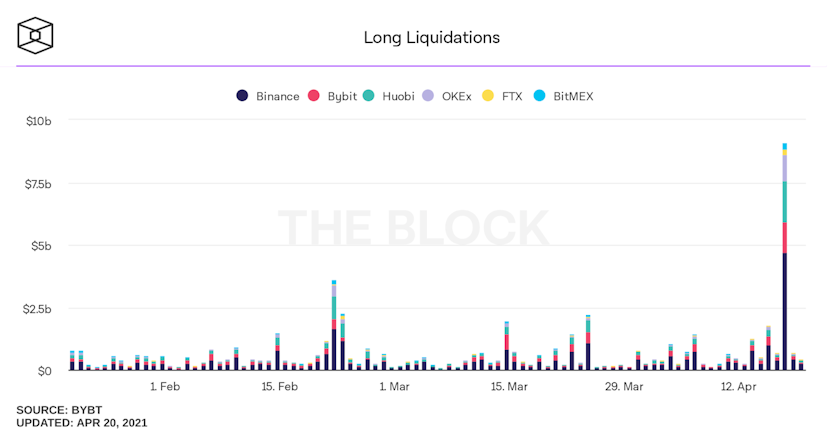

On the derivatives end, perpetual swaps recorded over $9 billion worth of liquidations, making it one of the largest amounts of liquidations to date.

Source: TheBlock Data

The high amounts of liquidations is a result of the risk perpetual swaps traders incur with their positions. Binance previously stated that 60% of its futures users trade with 20x leverage or higher, with 21% of traders using 125x. This type of leverage can lead to cascading liquidations, exacerbating price volatility.

DeFi Loans Decline

DeFi markets are no stranger to leverage either. While making loans overcollateralized certainly limits the availability of credit for traders in DeFi, there are still billions of dollars taken out through lending protocols like Compound and Aave.

Compound experienced $5.6 million worth of liquidations on April 18. Even though this is meager in comparison to the liquidations in derivatives, it is one of the five highest liquidating days in the Compound protocol.

Perhaps more telling is the net amount of loans originated the past few days. Net loans originated subtracts the amount of loans carried out minus those repaid in a given day.

As of April 20, 2021 using IntoTheBlock’s Compound Protocol insights

As seen in the graph above, net loans originated in Compound dropped sharply on Sunday. In other words, the amount of loans repaid were $767 million greater than the loans taken out on April 18, a much higher amount than the $5 million of forced repayments through liquidations.

On April 19, net loans originated were still over $600 million, despite under $50,000 being liquidated. This trend points to investors closing out loans and deleveraging in light of the recent correction.

From Lenders to Yield Aggregators

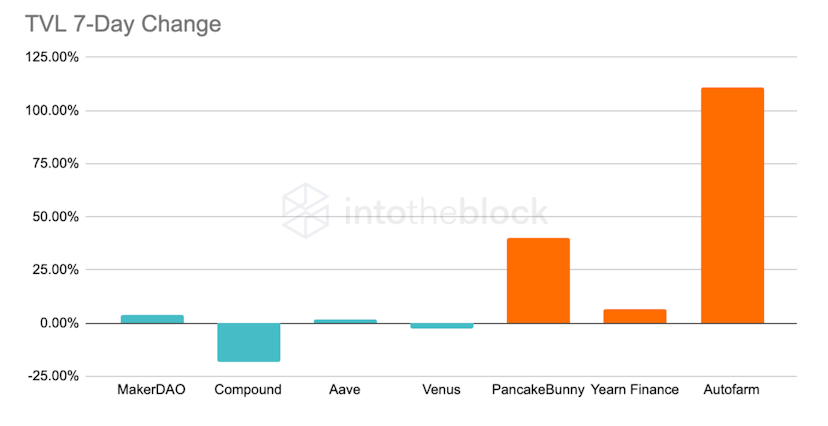

Following a remarkable quarter—with ETH and most DeFi tokens at least doubling—it is possible that investors are reallocating their positions. This pattern can be observed in TVL shifting from lending platforms into yield aggregators.

As of April 20, 2021 via DeFi Llama

One hypothesis to explain this trend is that traders in crypto are moving out of leveraged investing into passive earning. Potentially, this could suggest less of a risk-on stance as investors forego leveraged speculation for autopilot returns. It is also worth noting the high liquidity mining rewards provided by yield aggregators in BSC is likely incentivizing the TVL increase in PancakeBunny and Autofarm.

Overall, despite being a volatile weekend for crypto, it certainly is not the worst the market has experienced. As market participants—particularly in derivatives markets—take out highly leveraged opportunities it is likely that volatility and liquidations like this will persist.

At the same time, though, the increasing amount of debt repaid in Compound and the change in TVL in lending protocols and yield aggregators appears to suggest that the market is deleveraging and repositioning. This does not mean that the bull market is over, but rather that investors may be adopting a more cautious stance following this weekend’s correction.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.