Curve Looks To Expand crvUSD Collateral Assets

DAO Is Voting On Onboarding wBTC and Native ETH

By: Samuel Haig • Loading...

DeFi

Curve, a popular stablecoin-focused decentralized exchange (DEX), is seeking to expand the set of collateral assets supported by its crvUSD stablecoin beyond Ethereum liquid staking tokens, starting with wrapped Bitcoin.

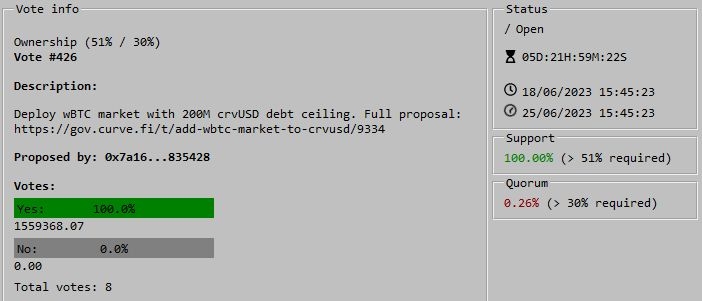

Should the proposal pass, Curve would launch a wBTC vault with a $200M debt ceiling and a maximum loan-to-value ratio of 89%. Voting began yesterday and will end on June 25.

On Sunday, Curve also launched a proposal to onboard native Ether as crvUSD collateral with a $200M debt limit on Sunday. Voting is currently underway. Curve is DeFi’s second-largest DEX with nearly $4B in total value locked. Its CRV token has shed a quarter of its value in the past month.

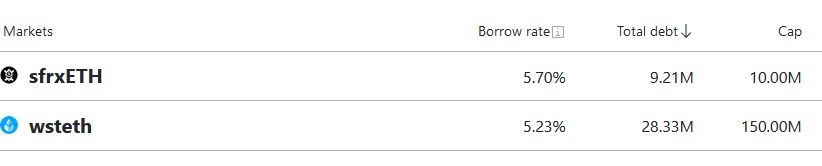

Curve launched crvUSD on mainnet in early May. Users could initially mint the stablecoin against Frax’s liquid staking token (LST), sfrxETH. Curve then rolled out support for the leading LST, Lido’s stETH, two weeks ago.

However, it remains to be seen whether crvUSD will be able to compete with other money market protocols. crvUSD borrowers are currently paying interest rates of more than 5% (which can be offset by the staking rewards accrued by LSTs), twice the current interest rate for wBTC on Aave.

Stablecoin Shakeup

The proposals come as Curve sees opportunities in the stablecoin sector.

The centralized stablecoin landscape was shaken up in February when the New York Department of Financial Services ordered Paxos to cease issuing new Binance USD tokens.

The following month, USDC, the second largest stablecoin, depegged amid fears regarding its exposure to the failure of Silvergate and Silicon Valley Bank. USDC’s market capitalization is down 36% since the start of the year.

MakerDAO’s DAI stablecoin also depegged due to its heavy reliance on USDC. MakerDAO is currently restructuring per its Endgame roadmap, with founder Rune Christensen recently advocating for DAI to freely float against the dollar, creating possible openings in the decentralized stablecoin sector.

Peg Maintenance

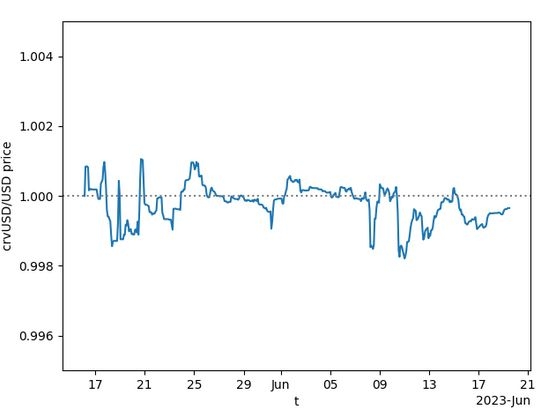

CrvUSD maintains its peg by combining overcollateralization requirements with Stability Pools and PegKeepers.

Stability Pools take inspiration from MakerDAO'sPeg Stability Module, comprising liquidity pools that enable low-slippage swaps between crvUSD and top centralized stablecoins USDC, USDT, USDP, and TUSD.

Curve ties each Stability Pool to a PegKeepers smart contract, which mints or burns crvUSD when the token trades above or below its peg to push the stablecoin’s price back toward $1. This mechanism underpins many algorithmic stablecoins.

The system has been very effective at maintaining the stablecoin’s price so far, despite crvUSD’s collateral comprising volatile crypto assets. On Saturday, Curve shared data indicating the token has traded within a 0.3% price range since mid-May.

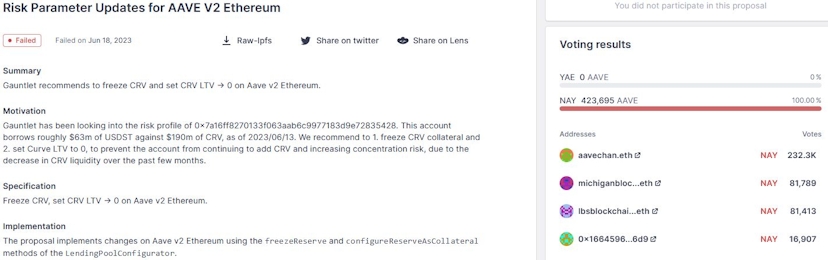

Aave Nixes Proposal To Freeze CRV Market

In other Curve news, the Aave community has unanimously voted down a proposal from Gauntlet, a risk management firm, to freeze the CRV lending market on Aave V2.

Gauntlet had flagged the potential risks posed by Curve founder Michael Egorov’s outsized CRV position on Aave, which is too large to be efficiently liquidated on-chain should the need arise.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.