Curve Finance Launches on Layer 2 Solution Polygon

Slowly then all at once. DeFi projects’ moves to Ethereum Layer 2s are coming weekly now with Curve Finance joining Polymarket and Aave in the quest for scalability. Curve has launched a pool on Polygon, the Layer 2 network which supports multiple interoperable solutions like a Proof-of-Stake chain and a Plasma chain. The pool hosts…

By: Owen Fernau • Loading...

DeFiSlowly then all at once. DeFi projects’ moves to Ethereum Layer 2s are coming weekly now with Curve Finance joining Polymarket and Aave in the quest for scalability.

Curve has launched a pool on Polygon, the Layer 2 network which supports multiple interoperable solutions like a Proof-of-Stake chain and a Plasma chain. The pool hosts the most popular stablecoins, USDT, DAI, and USDC, making swaps orders of magnitudes cheaper than on Ethereum’s L1, where a Uniswap trade costs $100 at the time of writing.

Curve has not yet added CRV rewards for liquidity providers, but said that “will happen as well” on Twitter.

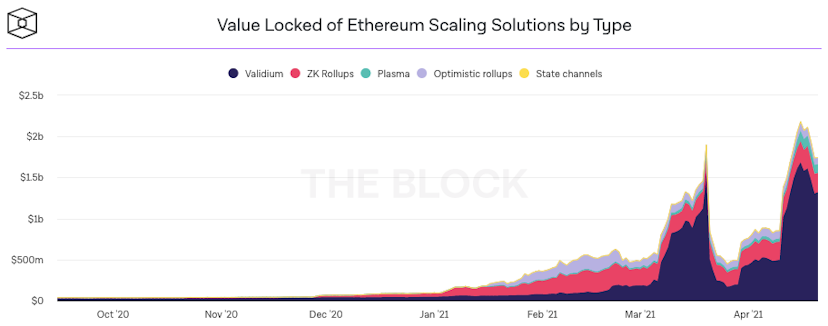

The pool has $2.5M in liquidity deposits and has $538K in daily volume at the time of writing. The deposited liquidity represents only 0.1% of the total $1.74B locked across all Layer 2 solutions according to data by The Block. Worth noting is that Curve’s Polygon pool has achieved this within hours of making the announcement and also has limited functionality in its new pool.

Source: The Block

The total value locked in scaling solutions topped out on Friday before the weekend’s drawdown. The rate at which projects are launching on Layer 2 however, make it appear imminent that the all-time high will soon again be breached.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.