Crypto Markets Show Signs Of Froth After Torrid Rally

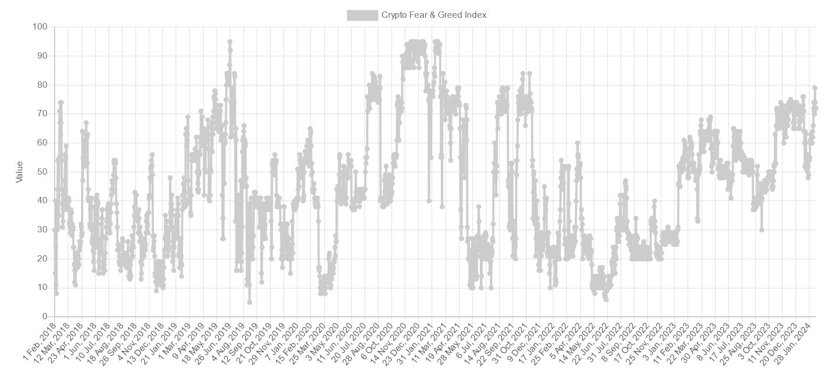

The ‘fear and greed’ index has hit its highest level since November 2021, when Bitcoin traded at an all-time high.

By: Pedro Solimano • Loading...

Markets

Warren Buffet once said, “Be fearful when others are greedy, and greedy when others are fearful.”

The Crypto Fear and Greed Index – which tracks market sentiment – is flashing signs of caution for investors. It topped 79 on Feb. 19, its highest level since Nov. 2021, when Bitcoin peaked at $69,000, and the index reached 84.

If history were to repeat itself, some downside could be around the corner.

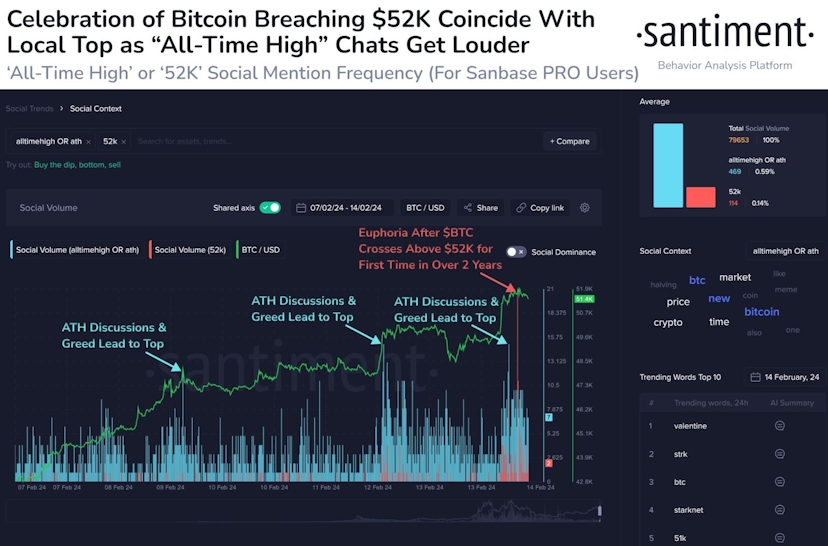

Bitcoin has been trading around the $52,000 mark for the past few days amid an intense crypto rally. Ether has also barely moved today, changing hands for $2,778, according to Coingecko. Both are up 20% over the last two weeks.

When the index last reached these levels in mid-November 2021, the market tanked shortly after, with Bitcoin plummeting 25% from $69,000 to $50,000 in the span of one month.

Bitcoin and the broader crypto markets have been heating up as Wall Street institutions accumulate record amounts of capital through the recently launched spot Bitcoin ETFs. And with the Bitcoin halving only months away, euphoria can quickly settle in.

But history shows that things can change at the drop of a hat, despite the bullish narrative pervading the industry.

According to market intelligence firm Santiment, increased calls for all-time highs on social media, as are being seen currently, have tended to mark local tops in the past.

Just a meme

Not all investors take the Fear and Greed Index seriously, however.

“I don’t look at the fear & greed index at all,” says Alex Kruger, economist and partner at Asgard Markets, an advisory firm specializing in macro, capital markets and crypto.

Kruger told The Defiant it’s “just memetic,” and should only be used as a proxy in case a trader doesn’t have the tools to properly assess the market. These tools include interest rates, funding metrics, perpetuals, open interest, and a plethora of other indicators, Kruger said.

According to Kruger, the market “is hot,” especially since Bitcoin surpassed $50,000, leading him to recommend investors “de-risk a little, but stay very long.”

Notwithstanding Kruger’s advice, anything above a 74 on the Crypto Fear and Greed Index is considered extreme greed – prompting traders and investors to proceed with caution.

Perhaps even heed Buffet’s advice.

Advertisement

The Defiant Daily

“an industry must-read”

Get an edge in Crypto with our free daily newsletter

Know what matters in Crypto and Web3 with The Defiant Daily newsletter, Mon to Fri

90k+ Defiers informed every day. Unsubscribe anytime.