Compound Assets Locked Jump After Single Whale Deposits 629k ETH

Compound has become the number one DeFi protocol by value locked. Compound had already been leading in terms of liquidity supplied—with over $15 billion deposited at the time of writing—but lagged behind MakerDAO in TVL. And one notable wallet recently made a significant contribution to those assets. The reason for this difference boils down to the…

By: Lucas Outumuro • Loading...

DeFiCompound has become the number one DeFi protocol by value locked. Compound had already been leading in terms of liquidity supplied—with over $15 billion deposited at the time of writing—but lagged behind MakerDAO in TVL. And one notable wallet recently made a significant contribution to those assets.

The reason for this difference boils down to the way DeFi Pulse calculates TVL. Total value locked monitors the total amount held in a set of smart contracts pertaining to a protocol.

In Compound’s case borrowers decrease TVL by removing assets from these smart contracts, whereas in Maker, where DAI is minted instead of funds being withdrawn, TVL does not decrease when users take out a loan.

As of April 7, 2021 using IntoTheBlock’s Compound Protocol insights, excluding new WBTC market*

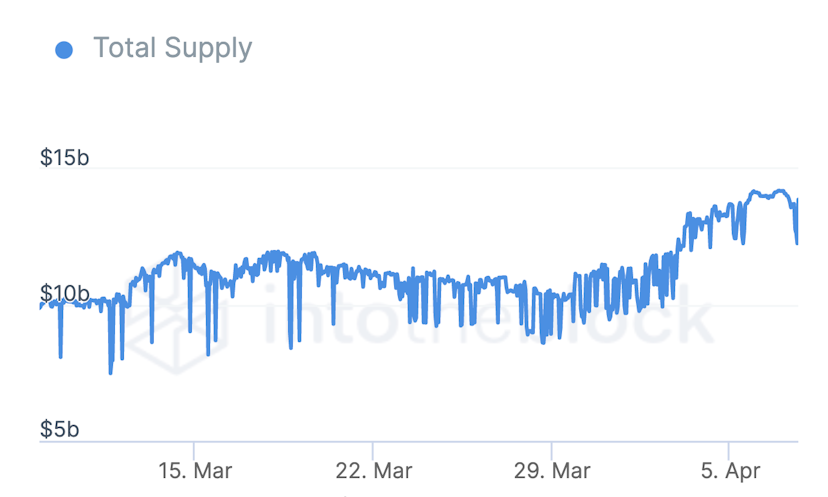

When diving into solely liquidity deposited, Compound has been ahead of other DeFi protocols, with over $ 10 billion supplied since March. It is worth noting, though, that Compound provides depositors incentives through COMP farming while Maker does not.

The recent rise in Compound’s deposits comes after a whale deposited over 629,000 Ether in a single transaction. The address has since been linked with Justin Sun and his deposit is expected to be earning him roughly $80,000 worth of COMP per day.

As of April 7, 2021 using IntoTheBlock’s Compound Protocol insights

The $1.2 billion invested by Justin Sun in the pool brought the total to over $5 billion.

Recall that borrow and lending rates are updated dynamically in protocols such as Compound based on demand and supply. In this case, the high influx of supply resulted in reduced earnings for other depositors, but also lower borrowing rates for Ether. Total amount of ETH borrowed quickly spiked as a result, but has since dropped.

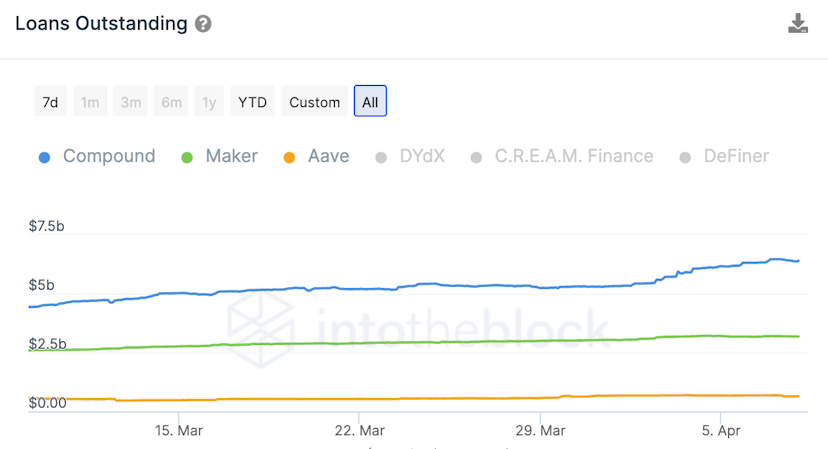

In general, however, the total amount borrowed from Compound has been growing steadily, reaching over $6 billion compared to Maker’s $3 billion and Aave’s $600 million.

As of April 7, 2021 using IntoTheBlock’s lending insights

While the COMP rewards are certainly a factor in the growth in Compound loans, it is worth noting that borrowing rates for Maker have on average been lower even after accounting for farming earnings.

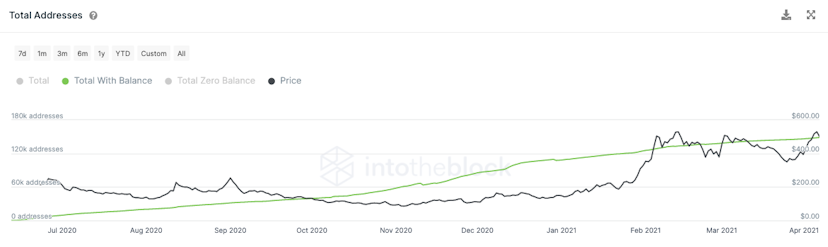

The steady growth in loans and deposits is also reflected in the total number of COMP holders, which is on the brink of reaching 150,000.

As of April 7, 2021 using IntoTheBlock’s COMP analytics

Overall, Compound has recorded consistent growth across key indicators throughout the last few months. This has allowed Compound to become the protocol with the highest TVL, despite having it’s loans borrowed deducted from this value. As the total number of COMP holders approaches 150,000 it is yet to be seen the impact Justin Sun will have on the protocol as its most recent billionaire depositor.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.