Comparing Layer 2 Launches: An On-chain Analysis of Liquidity Providers

Keyrock analyzes the on-chain performance of high-profile layer 2 (L2) networks in their earliest days after mainnet launch.

By: Keyrock • Loading...

Research & Opinion

Welcome to Part 2 of our in-depth data report series where we unravel the on-chain performance of high-profile layer 2 (L2) networks in their earliest days after mainnet launch.

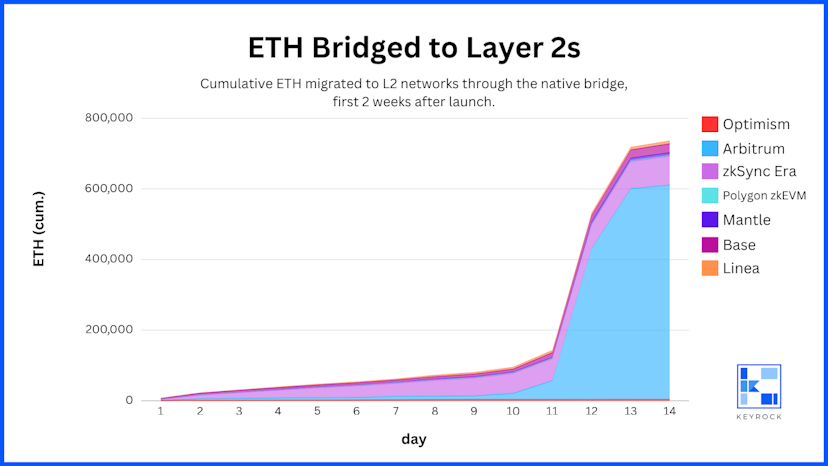

In our Part 1 analysis, we observed the migration of ETH as it flowed from Ethereum into L2 networks during the first 24 hours and subsequent 2 weeks after their respective mainnet launches. Part 1 provided us with an understanding of how these networks fared in capturing liquidity, attention, and early adoption taking into account: the market (bear or bull), the underlying technology (ZK vs. not), and varying brand recognition (from established to nascent).

We arrived at three primary conclusions from Part 1:

- The anticipation of a future token distribution is a pivotal factor in driving early ETH migration to a new L2.

- The initial 24 hour migration pattern serves as a reliable gauge for the following 2 weeks.

- The networks that deviated from the conclusion #2 saw a sluggish start followed by explosive growth. These abnormal patterns are the result of large-volume deposits by whales rather than broad, organic uptake.

With these insights in hand, we arrived at the next major question: once ETH is migrated to these L2s, what happens to it? It’s not enough for L2s to merely attract ETH; the applications on these networks must also attract liquidity to ensure an attractive ecosystem for users and traders.

In Part 1, we learned which L2s attracted the most liquidity in their earliest hours and days. In Part 2, we are able to answer which apps within those L2s were most successful in attracting bridged ETH in the first two weeks after each network’s launch.

TL;DR Data Conclusions

Our analysis of app TVL among the seven observed L2 networks during the first 2 weeks after mainnet launch led us to the following conclusions:

- DEXes attract by far the most TVL initially compared to perpetual, lending, and other DeFi protocols. DEXes have demonstrated how fundamental they are to any new network’s early success, and user liquidity continues to flow to these applications immediately after a mainnet launch.

- Liquidity tends to flow to the apps that are incubated by or aligned with the primary L2. Liquidity concentrates here before diversifying into other protocols.

- Potential airdrops of L2 DEXes help attract significant liquidity, as LPs seek to “dual farm” — earning yield from LPing while also aiming for a future airdrop.

- Yield farming opportunities can significantly increase an L2’s TVL by driving liquidity to a particular app that promises short-term returns. The result is a significant concentration of the L2’s TVL in that app. If the yield farming opportunity is not lined up with the L2’s mainnet launch day, then the increase in the network’s TVL can seem sudden and extreme.

- The best known and most popular DeFi applications across web3 tend to lag a bit before launching on L2 networks. These DeFi apps appear to wait for other apps to test out the L2 before launching. The notable exception here is when the company developing the L2 mainnet has a significant reputation. Battle-tested companies like Consensys and Coinbase attract a higher quality of DeFi projects initially.

Layer 2 Data Approach

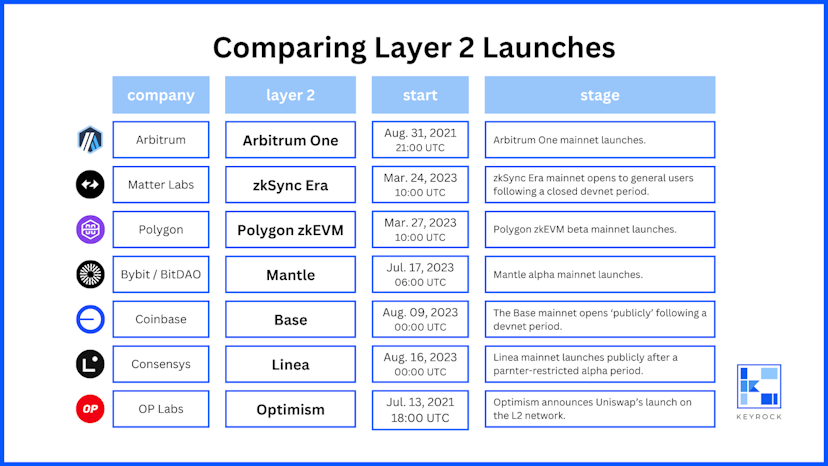

As in Part 1, we observed the on-chain ETH movement of 7 different L2 networks that launched between 2021 and 2023. We tracked to which apps bridged ETH was transferred in order to provide liquidity during the first two weeks after each L2’s public mainnet launch.

For L2 networks that attracted many apps in their first two weeks after launch, we looked only at the 10 apps that had the most TVL after two weeks.

Arbitrum Analysis

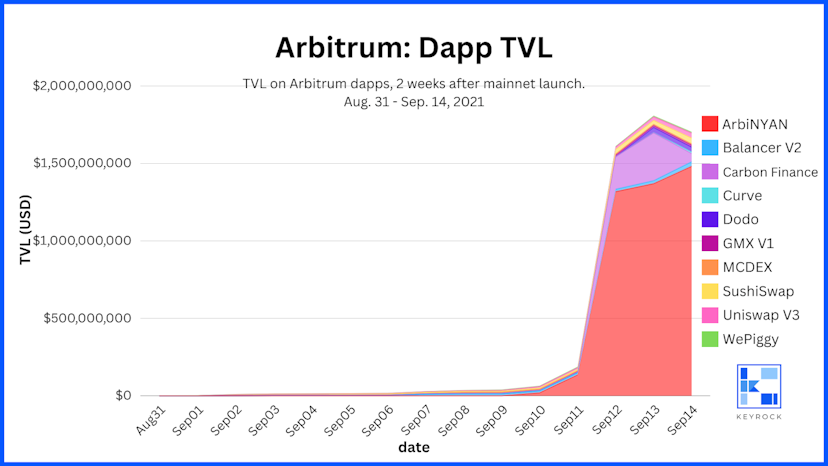

We observed app TVL during the first 2 weeks after the Arbitrum One mainnet launch on August 31, 2021.

Despite launching on August 31, it wasn’t until September 11th that the data shows a significant increase in TVL among Arbitrum applications. This app activity aligns with our original observation from Part 1, showing that Arbitrum experienced a huge influx of ETH from Ethereum at the same time.

On September 11, 180,000 ETH was deposited to Arbitrum in less than one hour, nearly doubling the total amount of ETH bridged to Arbitrum at that time to 360,000. By September 12, nearly 600,000 ETH had been deposited to the Arbitrum mainnet from Ethereum.

In Part 1, we did not conclude what drove the significant uptick in bridged ETH. Looking at app TVL data, however, reveals the motivation behind the huge deposit of ETH onto the Arbitrum mainnet on September 11: ArbiNYAN.

ArbiNYAN was a memecoin liquidity mining scheme that exploded onto the scene in September 2021. It was the first native Arbitrum application to attract major attention. Just as BALD had done for Base in 2023, ArbiNYAN launched Arbitrum into a web3 frenzy.

On September 10, the TVL across the top 10 apps on Arbitrum was $61,929,474 USD. ArbiNYAN was responsible for 31% of that TVL ($19.34MM). By September 12, Arbitrum’s TVL among the top 10 apps had skyrocketed to $1,609,246,339 USD — a 2,500% increase in 48 hours. By that time, ArbiNYAN was responsible for 82% of that TVL ($1.31bn USD).

To state it differently, on September 12, ArbiNYAN’s TVL alone was 21x larger than the TVL of the entire Arbitrum network just 2 days prior.

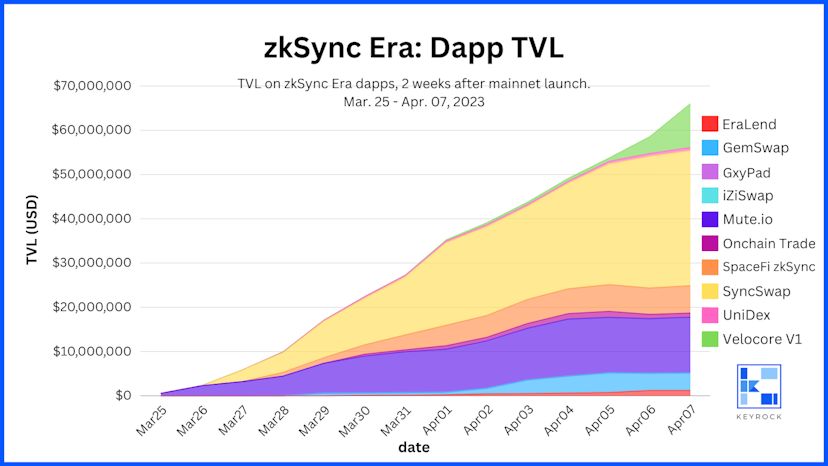

zkSync Era Analysis

We observed app TVL during the first 2 weeks after the zkSync Era mainnet launch on March 23, 2023.

ZkSync Era experienced a steady growth of ETH migrated to its mainnet from Ethereum during its first two weeks after launch. On the “other side” of the migration, we can see similar steady growth in TVL among zkSync Era’s DeFi applications as this ETH was distributed across the ecosystem.

By the end of 2 weeks, one app (SyncSwap) stood out with 46% of zkSyncEra’s TVL (as measured by the top 10 apps). We also see two other protocols — Mute.io and Velocore — each commanding double digit TVL by the end of two weeks.

SyncSwap is a DEX built on top of zkSync Era. It was the first native DEX to go live on SyncSwap, and thus attracted significant liquidity in the first two weeks after zkSync Era’s launch. Paved by Ethereum leaders like Uniswap, DEXes remain some of the most widely-adopted and familiar DeFi protocols, providing a familiar home for early LPs to swap, provide liquidity, and yield farm.

We concluded that part of zkSync Era’s breakout success in its first two weeks (in terms of ETH migrated) was the possibility of a token distribution. ETH holders who migrated their funds to the zkSync Era appear to have taken their actions a step further, and provided liquidity to SyncSwap after bridging their ETH. Their motivation likely was to try to “double dip” — either by multiplying their zkSync Era token distribution, or setting themselves up for a separate SyncSwap token distribution.

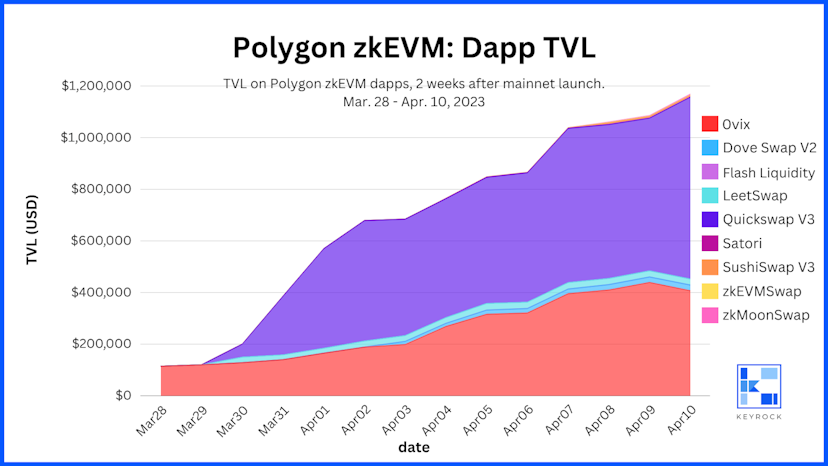

Polygon zkEVM Analysis

We observed app TVL during the first 2 weeks after the Polygon zkEVM mainnet launch on March 27, 2023.

At the end of these first two weeks, two applications had emerged with the most TVL on Polygon zkEVM: Quickswap and 0vix.

Quickswap V3, in particular, had established a commanding presence, accounting for 60% of the TVL within Polygon zkEVM ($704k of $1.17MM USD). This success by Quickswap makes sense. Prior to the zkEVM launch, Quickswap was already the dominant DEX on Polygon, historically beating out Uniswap for TVL on mainnet. Polygon could ensure that Quickswap’s launch on zkEVM was prioritized, and early zkEVM users could rest assured they were using a DEX already proven elsewhere in web3.

0vix, a lending platform, is also native to the Polygon ecosystem. Although 0vix is a relatively small player on POlygon among the lending platforms (falling beneath Aave and Compound), its early launch on zkEVM offering a non-DEX DeFi primitive (lending) gave it the upper hand in zkEVM’s earliest days.

This distribution of TVL on Polygon reveals the advantage of apps that have a natural alignment with the company building the L2. A curious absence on zkEVM in the first two weeks after mainnet launch are any of the “major” DeFi applications (Uniswap, Aave, Compound). Polygon is a veteran in web3, with strong brand recognition and developer adoption.

One possibility could be that zkEVM is a zk-powered L2, and major DeFi applications held back in the first two weeks in order to see how other apps fared. This is anecdotally supported by a quick look at Base and Linera, both of which were also build by highly-respected entities (Coinbase and Consensys, respectively). However, Base attracted major DeFi applications in its first two weeks, whereas Linea did not. Linea, like zkEVM, is a zk-powered L2.

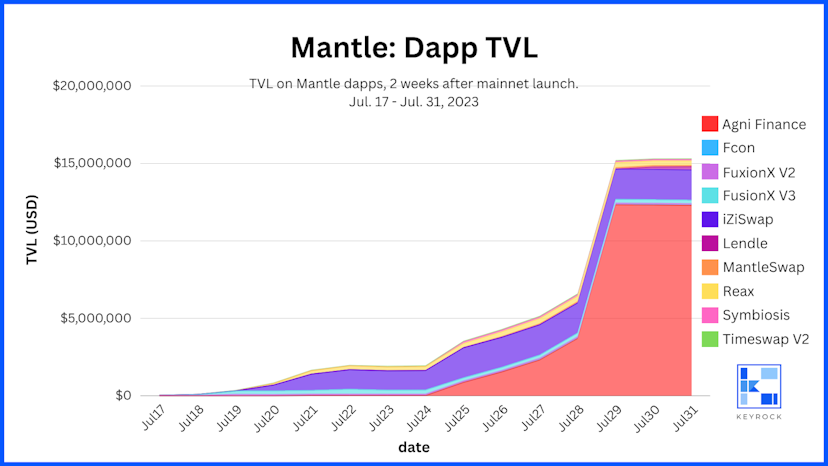

Mantle Analysis

We observed app TVL during the first 2 weeks after the Mantle mainnet launch on July 17, 2023.

By the end of two weeks, apps AgniFinance and iZiSwap were responsible for most of Mantle’s TVL. On July 31, AgniFinance owned over 80% of Mantle’s TVL (as measured by the top 10 apps) ($12.3MM of $15.3MM). iZiSwap owned 12.6% ($1.95MM).

AgniFinance and iZiSwap are both AMMs, again suggesting that DEXes are situated to capture the majority of early LP ETH after an L2 launch.

In Part 1, we discussed Mantle’s curious ETH migration pattern. Mantle was undergoing relatively sluggish ETH migration in the first days after its mainnet launch. Then, on July 28th, a single address migrated 5,000 ETH to Mantle, increasing the total ETH bridged from 2,500 to 7,500.

In the graph above, we can see the TVL among Mantle’s top apps skyrocket on July 28th. The data shows that the TVL of AgniFinance in particular shot up, suggesting that the vast majority, if not all, of the 5,000 ETH deposited on July 28th went directly to AgniFinance.

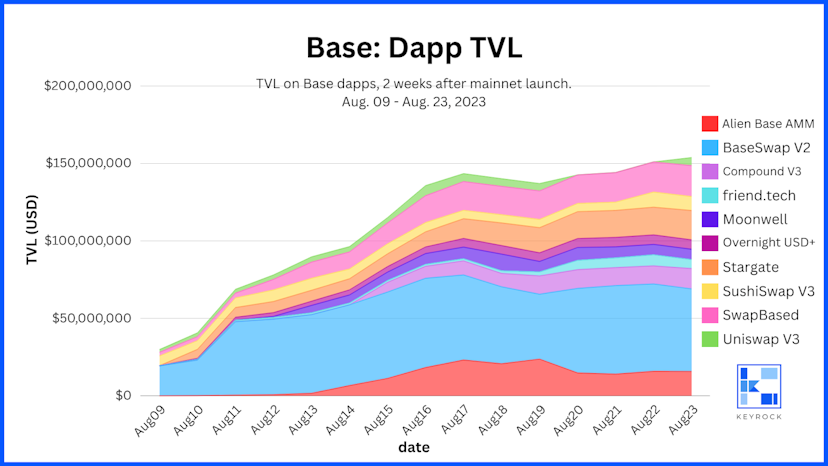

Base Analysis

We observed app TVL during the first 2 weeks after the Base mainnet launch on August 09, 2023.

At the end of two weeks, six apps had greater than 5% of the base TVL, and no app controlled more than 35% of the network’s TVL.

Of the six apps responsible for more than 5% of Base’s TVL after 2 weeks, four of them are DEXes — again supporting the conclusion that DEXes are most prone to attract liquidity on a brand new L2. BaseSwap was responsible for the most TVL after 2 weeks (~35%), supporting the conclusion that apps closely aligned with the L2 development company have a leg up in the networks’ earliest days.

Of all the L2 launches observed, Base attracted the most pre-existing, high-profile DeFi applications (Uniswap, SushisWap, Compound). This is likely attributed to the reputation of Coinbase, and to the fact that Base was built with the OP Stack, which had already been battle tested for years with the Optimism network.

Interestingly, Stargate is one of the only bridges we observed in our 2 week analysis of these seven L2s. This anomaly is perhaps because non-native bridges typically require more time before going live on brand new networks.

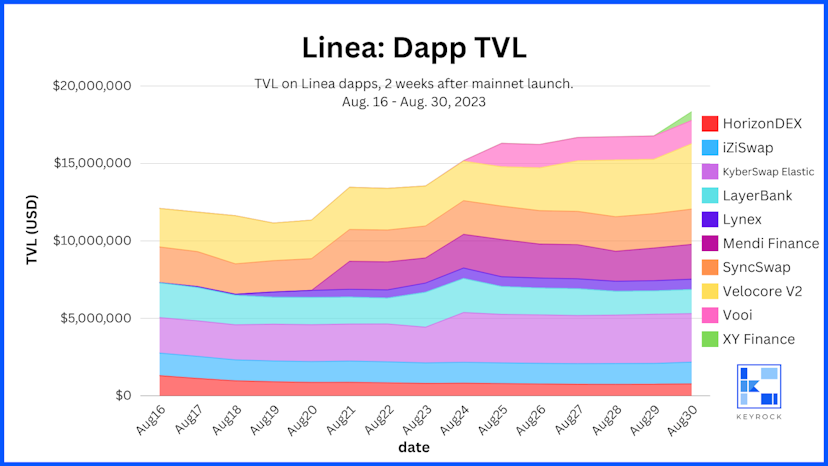

Linea Analysis

We observed app TVL during the first 2 weeks after the Linea mainnet launch on August 16, 2023.

At the end of 2 weeks, seven apps had greater than 5% of the Linea TVL, and no app controlled more than 25% of the network’s TVL.

Of all the observed L2 launches, Base and Linea had the most TVL diversity and balance among apps by the two week mark — led by Linea. Both Linea and Coinbase launched in a bear market, but the two networks are different in their architecture and their branding. Base is a more ‘classic’ L2 rollup, built on top of the Optimism OP Stack. Linea is a ZK-rollup, and had leaned more heavily into its zk branding prior to launch.

The compelling similarity between these two chains is the reputations of the companies that built them: Coinbase and Consensys. Both companies have vast recognition, funding, and pre-existing adoption.

A relatively straightforward conclusion for both Base’s and Linea’s TVL diversity so soon after launch has to do with their reputation. Coinbase’s and Consensys’ respective reputations could have attracted more developer interest prior to their mainnet launches than other L2s. Devs could have spent more time preparing their applications to go live on Base and Linea as soon after mainnet launch as possible, anticipating an influx of users. This could have resulted in liquidity being spread across a wider number of applications so soon after mainnet launch, compared to other L2s which saw high TVL concentration in just a handful of apps.

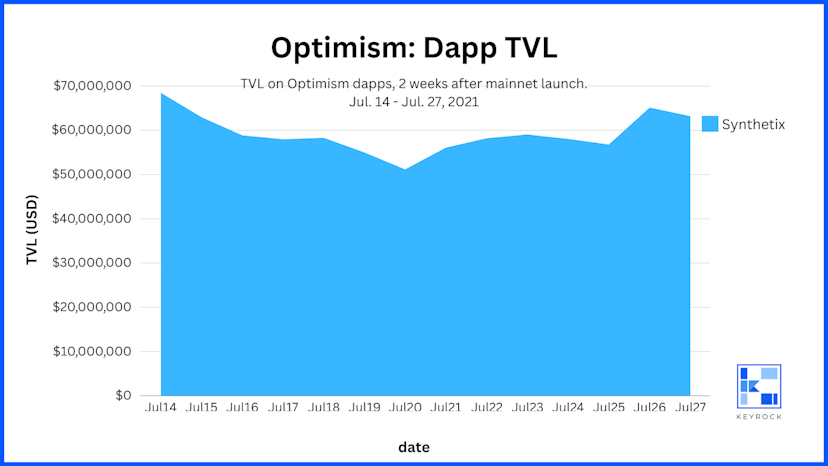

Optimism Analysis

Optimism rolled out its layer 2 network in stages throughout 2021. July 14 was a major moment when Optimism announced its alpha support of Uniswap. Interestingly, for the two weeks after this announcement, Optimism’s app TVL was still entirely dominated by Synthetix.

Optimism was actively building in public throughout 2021, and developed a uniquely close relationship with Synthetix early in its roadmap. Dating back to early 2021, incentive programs existed to incentivize liquidity onto Synthetix. By July, we can see these incentives paid off, with the TVL of Synthetix surpassing $60MM USD the two weeks after Optimism announced Uniswap.

Conclusion

This liquidity report series uncovered trends in the allocation of TVL among the apps of newly-launched layer 2 networks. We’ve demonstrated that:

- DEXes are key to early L2 success, capturing the majority of initial TVL.

- Apps developed or endorsed by the L2 team itself receive early and concentrated liquidity.

- Anticipation of airdrops from L2 apps (DEXes in particular) draws significant liquidity.

- Yield farming can cause sharp upticks in TVL that shock an L2 with sudden liquidity.

- Major DeFi apps often delay their L2 launch, except when the L2 is backed by a reputable company.

This series has provided a snapshot of the formative days of layer 2 networks, offering insights into the factors that drive early adoption and liquidity. As these networks mature, we’ll continue to observe how early trends evolve and what they may predict for the future of L2s.

Keyrock is a market making firm building scalable, self-adaptive technologies to support efficient markets.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.