Are the Bulls Back? Crypto Markets Whipsawed With Amazon News

Crypto markets were showing impressive strength to start the week, on track for a sixth straight day of gains –– until news headlined caused prices to trip mid-run. Bitcoin shot up to as high as $40,300 and Ethereum was trading above $2,400 on Tuesday. The DeFiPulse Index (DPI), a market capitalization-weighted index which consists of…

By: yyctrader • Loading...

DeFiCrypto markets were showing impressive strength to start the week, on track for a sixth straight day of gains –– until news headlined caused prices to trip mid-run.

Bitcoin shot up to as high as $40,300 and Ethereum was trading above $2,400 on Tuesday. The DeFiPulse Index (DPI), a market capitalization-weighted index which consists of the 10 most popular Ethereum-based DeFi tokens, was up 14% to $315. The major cryptocurrencies have given some of those gains back since, but are still up by over 20% in the past seven days.

Amazon Coin?

Tech giant Amazon set Crypto Twitter abuzz over the weekend with a job posting for a cryptocurrency and blockchain lead, sparking speculation that the company would soon allow users to pay with crypto. This was compounded by unconfirmed reports from a company insider that Amazon is looking to accept Bitcoin payments by the end of the year, and is also interested in launching its own native token in 2022. The rally was stopped short when the company denied its plan to launch a crypto token, while saying it will continue to explore crypto.

Short Sellers Liquidated

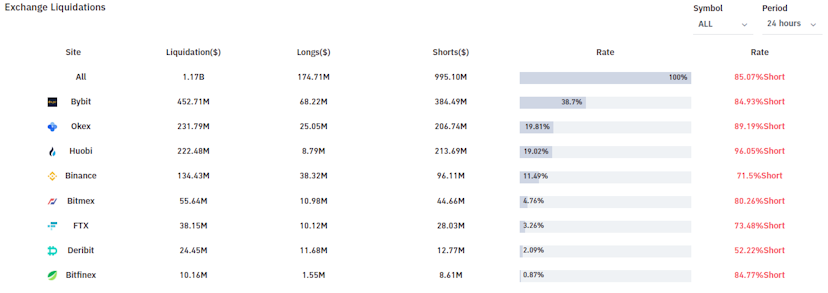

Sunday was a bad day for leveraged short traders, as nearly $1.2B in total positions were liquidated, according to data from bybt.

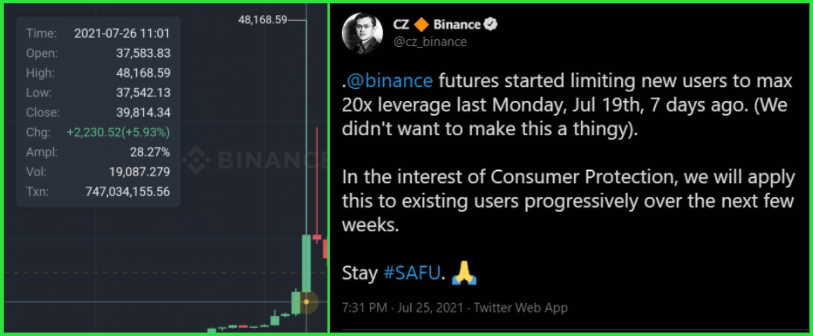

Bitcoin perpetual futures spiked as high as $48K on Binance with over $600M of forced buying in under a minute, according to crypto trader Hsaka. This may have prompted this tweet from Binance chief Changpeng Zhao (CZ), announcing that the exchange had limited leverage to 20x for new accounts a week ago and their intent to do the same for existing accounts.

More Tether FUD

And earlier today, Bloomberg reported that executives at Tether, the issuer of the USDT stablecoin, are being investigated by the U.S. Department of Justice (DOJ) for potential bank fraud.

In response, the company released a statement accusing Bloomberg of “repackaging stale claims as “news” The company also insists that “it is business as usual at Tether.”

Traders Remain Cautious

Despite the strong price action, some traders remain cautious as both Bitcoin and Ethereum approach the tops of the ranges that have contained them for the past two months.

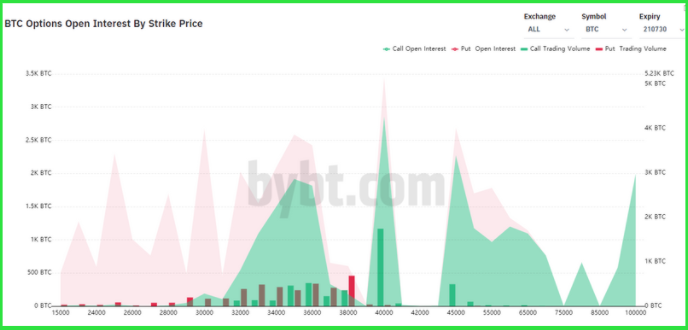

Bitcoin options data for July 30 from bybt shows a cluster of open interest in the $34K-$36K area. This indicates that market makers (option sellers) would stand to maximize their profits if Bitcoin closes at $35K on July 30, since the majority of options would expire worthless in that case.

As noted by crypto trader Altcoin Psycho in this livestream, option expiries (highlighted in blue) have tended to mark local bottoms for Bitcoin.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.