Blur Token Doubles As NFT Market Picks Up

Leading NFT Marketplace Facilitated Nearly $170M Of Trades In The Past Four Weeks

By: yyctrader • Loading...

NFTs & Web3

Blur, the leading NFT marketplace by volume, is seeing renewed interest from crypto investors amid rising trading volumes across the non-fungibles sector.

BLUR has surged over 150% since hitting an all-time low of $0.15 on October 12.

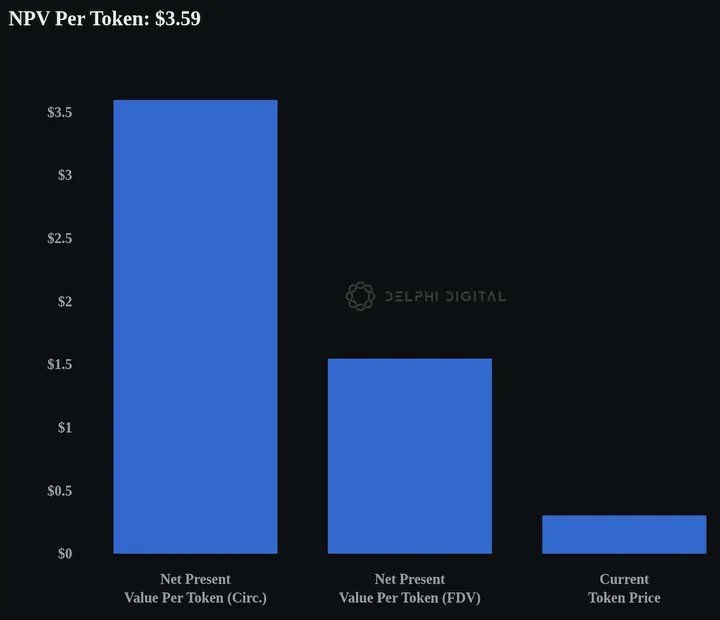

Crypto research firm Delphi Digital expects BLUR to continue its outperformance if NFTs see a resurgence next year.

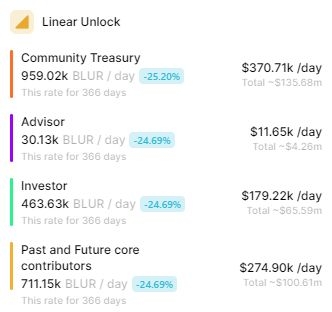

However, with Season 2 of Blur’s airdrop campaign set to end on Nov. 20, the token could see increased selling pressure as participants look to cash in their rewards. Many traders have booked substantial losses on NFTs while attempting to maximize their airdrops, and will likely be trying to recoup them by selling their newly acquired BLUR.

As of Nov. 8, roughly 38% of BLUR’s total supply of 3B tokens is in circulation, with over 2M BLUR unlocked on a daily basis.

From Upstart To Market Leader

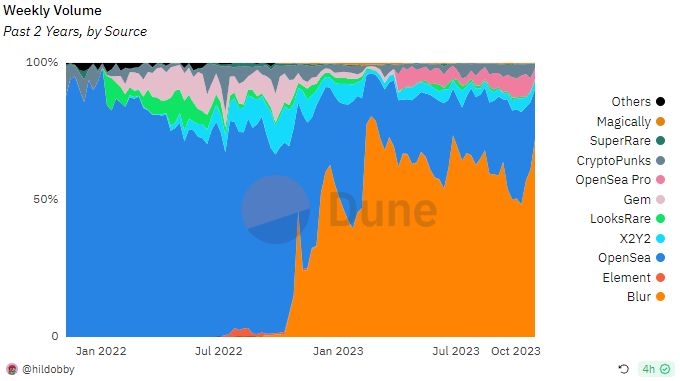

Since launching in October 2022, Blur has completely changed the dynamics of the NFT market through a series of often controversial moves.

Back then, OpenSea dominated the market despite being constantly criticized by the community for its extractive fees. At the peak of NFT mania in January 2022, the company raised $300M at a $13B valuation.

In a campaign reminiscent of Sushi’s vampire attack on Uniswap, Blur immediately started eating away at OpenSea’s market share by charging zero marketplace fees and airdropping $400M worth of BLUR tokens to early adopters.

Trading volume on Blur surpassed OpenSea’s shortly after the airdrop, and the marketplace now routinely processes over 70% of NFT trades on any given day.

Meanwhile, OpenSea has laid off half its staff, and a major investor has written down its stake in the once-leading marketplace by 90%.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.