Bitcoin Hashrate Continues To Hit All-time Highs

Miners Continue To Boost Capacity Ahead of Block Reward Halving, Pushing BTC’s Hashrate and Difficulty To Record Levels

By: yyctrader • Loading...

CeFi

Bitcoin miners continue to invest in upgraded hardware and new facilities despite the world’s most valuable digital asset trading sideways since March.

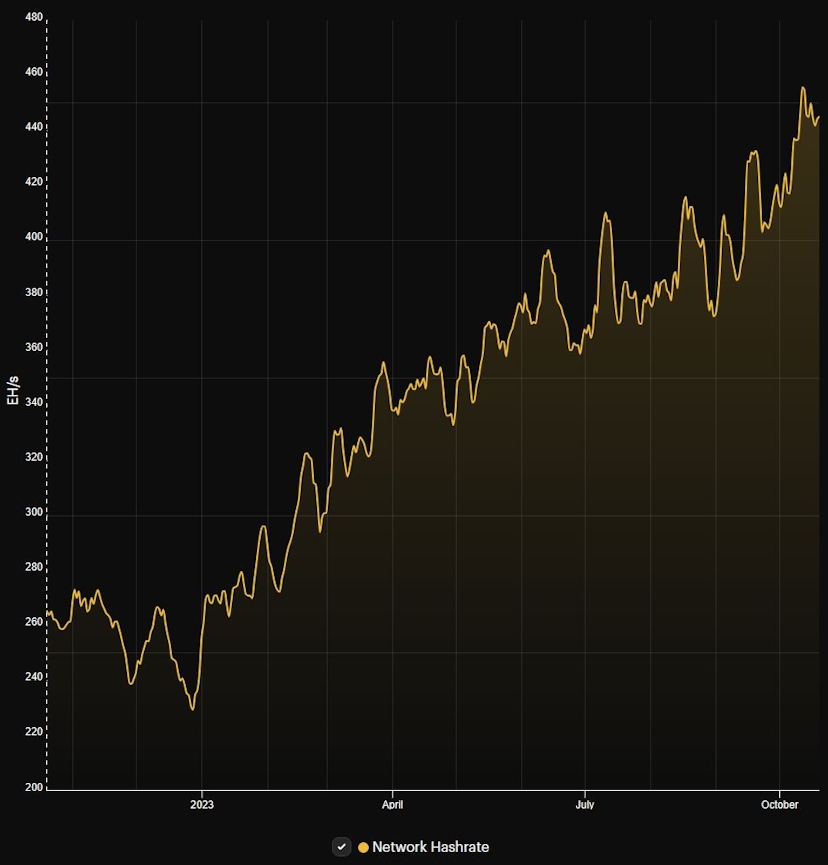

The hashrate - a measure of the processing power being contributed to the Bitcoin network – hit an all-time high of 455 exahashes per second (EH/s) on Oct. 12 and has doubled since the beginning of the year.

On Oct. 16, Bitcoin’s difficulty surpassed 61 trillion at block height 812,448, marking a new record for the network. Bitcoin difficulty is a measure of how hard it is to mine new blocks on the Bitcoin blockchain, automatically adjusting approximately every two weeks – 2016 blocks – to maintain a 10-minute block time.

Difficulty and hashrate in Bitcoin are related – as the total hashrate of the network increases, the difficulty level adjusts upwards to maintain the system's stability.

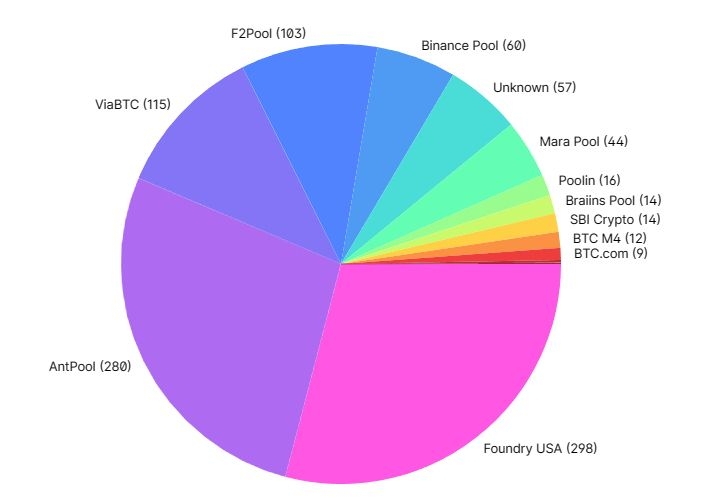

Currently, the top five mining pools are Foundry USA, Antpool, Viabtc, F2pool, and Binance Pool. Over the past week, Foundry contributed 29% of the overall network's hashrate, closely followed by Antpool with 27%.

Bitcoin Halving

Currently, once a miner successfully mines a block, they are rewarded with 6.25 BTC as well as transaction fees paid by users for including their transactions in the block.

Every four years, this block reward is reduced by half, with the next halving just six months away. Halving events are closely monitored by the crypto community and have significant effects on the economics of mining. As the block reward decreases, miners must rely more on transaction fees, which can lead to increased competition among miners and potentially higher transaction fees for users.

Halving events will continue until the maximum supply of 21 million bitcoins is reached, which is expected to occur around the year 2140. After that point, no new bitcoins will be created through mining, and miners are expected to rely solely on transaction fees for their rewards.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.