Arrival of Futures ETFs Stokes Bitcoin in DeFi

Bitcoin in decentralized finance has been surging since speculation strengthened that the U.S. Securities and Exchange Commission would finally approve an exchange-traded fund to invest in the world’s largest cryptocurrency. BTC deposited into Ethereum’s DeFi ecosystem as shown on DeFi Pulse’s “Bitcoin at Work” page, jumped 2% to 284,331 BTC since Oct. 14, when one…

By: Brady Dale • Loading...

DeFi

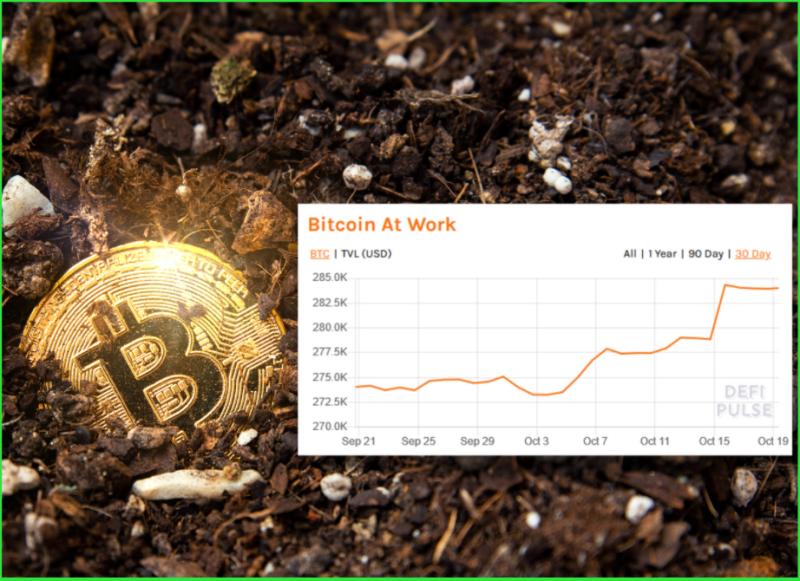

Bitcoin in decentralized finance has been surging since speculation strengthened that the U.S. Securities and Exchange Commission would finally approve an exchange-traded fund to invest in the world’s largest cryptocurrency.

BTC deposited into Ethereum’s DeFi ecosystem as shown on DeFi Pulse’s “Bitcoin at Work” page, jumped 2% to 284,331 BTC since Oct. 14, when one of the SEC’s lesser Twitter accounts sent out an inscrutable tweet. It said: “Before investing in a fund that holds Bitcoin futures contracts, make sure you carefully weigh the potential risks and benefits.” At over $57,000 at the time, that’s $308M in Bitcoin.

It seems like many investors expected the news of a Bitcoin ETF to drive its price higher and wanted to take advantage of that appreciation and deploy it to gain yield. Their anticipation was justified. An exchange-traded fund based on Bitcoin futures, from ProShares, will be available on the New York Stock Exchange on Oct. 19.

Strong Gains

Meanwhile, BTC holders seem to be looking for yield wherever they can get it.

A Bitcoin focused DeFi project, BadgerDAO, has seen strong gains since the ETF rumors began, according to DeFi Pulse. Badger is devoted to helping Bitcoin holders grow their holdings by using DeFi. It’s total value locked went up $47M on Oct. 14, to $727M by the next day.

Anyswap, the cross-chain exchange, now has almost 16,829 WBTC (wrapped Bitcoin, an ERC-20 token reflecting BTC custodied by BitGo), up from 2,126 on October 5, according to Nansen. Anyswap’s big spike came ahead of the SEC announcement, though, with most of the move happening by Oct. 9.

It’s difficult to see where WBTC ends up after it’s moved into AnySwap, however.

It makes sense that some holders would want to move BTC to other chains where the yields are stronger. For example, Geist, a money market on Fantom that forked Aave, currently has a very early stage liquidity mining program. So WBTC depositors can earn a little over 3% APY in WBTC as well as rewards in the GEIST token (which they can of course convert to WBTC if they like).

Decent Rewards

“We’ve just launched so we are still at a stage where small amounts of money can receive some decent rewards and capture some of the protocol fees,” 0xFantome, one of the anonymous developers on Geist, told The Defiant via text message

One obvious effect of a higher Bitcoin price: more DAI. According to Nansen data, MakerDAO is the largest single holders of WBTC on Ethereum, with 25,618 WBTC, up 4,154 in the last seven days.

DAI supply has gone from 6.9B on Oct. 14 to 7.3B today, a 400M DAI increase.

Curve creator Michael Egorov suggested tempering excitement about the potential for a futures ETF to move the market.

“Theoretically I can see how that is bullish,” he said. “It could be an excellent thing, but could be not as huge (remember Bakkt Bitcoin disappointment). We will see.”

Carrot and Stick

Others who see Bitcoin as much as a means to change the world as an investment vehicle took this even further.

“The regulators are coming for crypto with carrot and stick,” Amir Taaki, a long time developer and entrepreneur in Bitcoin and crypto told the Defiant via text message. Taaki is now working on a series of projects to make DeFi opaque to snoops, which he calls DarkFi. “Gary Gensler seeks to rein in the uncontrollable crypto markets. He wants to fold Bitcoin into their RegFi network of largely US-centric businesses that is the controlled opposition.”

Beyond more collateral available, Kain Warwick, CEO of the market for synthetic assets, Synthetix, told The Defiant that the ETF news could have a knock-on effect in DeFi if the price of BTC continues to rise.

“I think it is pretty much business as usual unless we moon to like $300K or something. Then we will have some weird second order effects as tokens pull up alongside that and it will maybe kick ETH DeFi out of its mini bear market,” Warwick said.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.