Binance Slapped With Hefty $4.3B Fine – Can It Actually Pay It?

The world’s largest cryptocurrency exchange has been charged with one of the largest corporate penalties in U.S. history.

By: Pedro Solimano • Loading...

CeFi

Cryptocurrency behemoth Binance and its CEO, Changpeng Zhao (CZ), pled guilty to charges of money laundering, settling with the U.S. Department of Justice to pay $4.3B.

Does it have the cash?

The company was fined $1.805B, discounted for partial cooperation, payable over 15 months after sentencing. An extra $2.51 billion was tacked on top connected to a wide variety of laws that the company broke – from lacking anti-money laundering practices to sanctions violations.

Notwithstanding many prominent crypto figures cheering on the enforcement action, a multi-billion dollar fine poses a threat – even if the company has months to pay it back. The company might have to sell some of its crypto assets, sparking a drop in prices, just as the industry is gearing up to leave the bear market behind.

It also triggers FTX-induced fears as to whether the company will dip into customer funds to pay back the significant sum of money. Some call for caution.

“I think Binance has sufficient balance sheet to pay the fine,” says Nic Carter, a partner at Castle Island Ventures, a VC firm that invests in blockchain-based companies, telling The Defiant that he thinks “they wouldn’t have settled otherwise.”

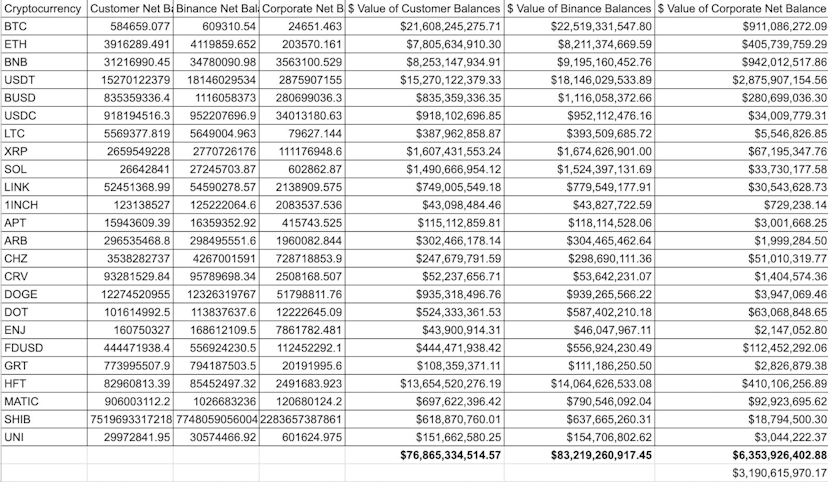

As of writing, Binance’s latest proof-of-reserves published on Nov. 7 showcases $76.8B in customer funds versus $83.2B in Binance’s wallets. This translates into a net positive balance of $6.35 billion in favor of the company, of which roughly half sits in a variety of stablecoins.

Additionally, as Conor Grogan, director for Coinbase, points out, these numbers don’t include off-chain cash balances nor funds held in wallets that might not appear in proof-of-reserve statements. Grogan reckons that the company shouldn’t have any issue paying the penalty to U.S. authorities.

CZ and the company have accepted the criminal charges put forth by the DOJ, FinCEN, CFTC, and OFAC. According to a press conference by authorities yesterday, Binance enabled large-scale crypto transactions from U.S.-based customers to clients in sanctioned countries, along with not enforcing proper anti-money laundering protocols.

Nansen Analytics published its latest update Wednesday, highlighting that token holdings for the company have increased to $65.2 billion from $64.6 billion following the coordinated action from U.S. authorities. As of today, that number sits at $65.3 billion.

Some investors aren’t rushing to give Binance the benefit of the doubt, however.

“Seems weird to take their self-reported PoR at face value when the CEO is in cuffs for money laundering though,” said crypto investor Adam Cochran.

On the other hand, whether the company will be able to fulfill its penalties is not really a cause for concern, said Carter. He told The Defiant that it’s unlikely Binance will resort to dipping into client assets to pay the fine, in no small part because they will be under intense scrutiny.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.