Basis Cash Revives Shuttered Stablecoin With 10,000% Yields

Basis Cash, a fork of shuttered algorithmic cryptocurrency Basis, is touting DeFi-summer like APYs as the newly launched stablecoin – BAC – trades at $64 despite targeting a $1 peg. With ~10,000% APYs on the BAC stablecoin liquidity pools, DeFi traders rushed to provide liquidity to the project which seeks to revive Basis without the…

By: Cooper Turley • Loading...

DeFi

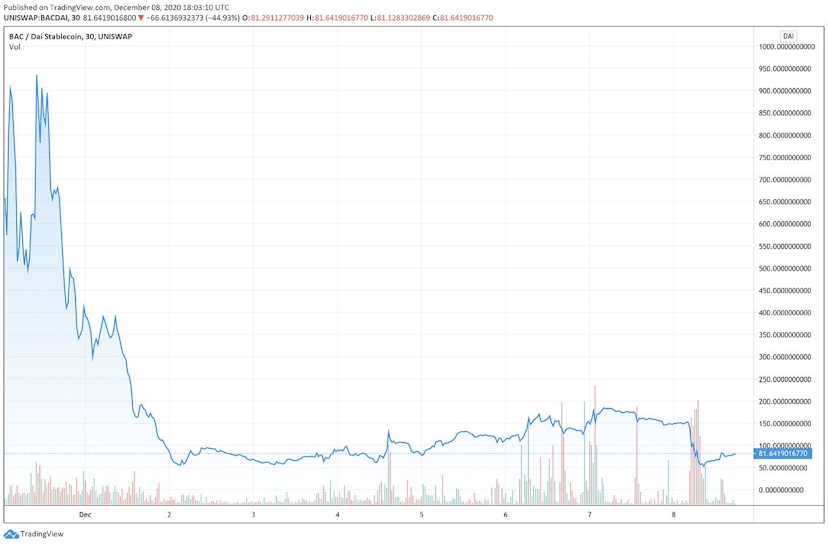

Basis Cash, a fork of shuttered algorithmic cryptocurrency Basis, is touting DeFi-summer like APYs as the newly launched stablecoin – BAC – trades at $64 despite targeting a $1 peg.

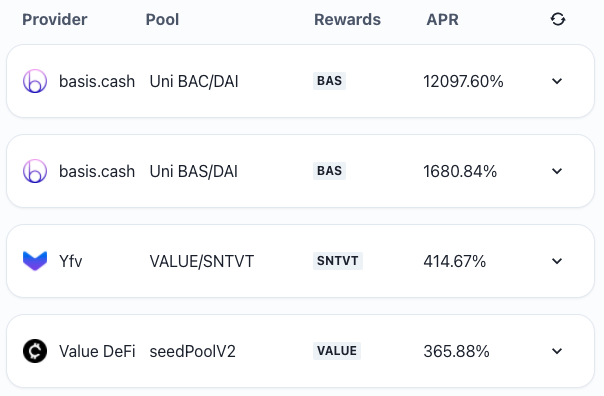

With ~10,000% APYs on the BAC stablecoin liquidity pools, DeFi traders rushed to provide liquidity to the project which seeks to revive Basis without the SEC, VCs, or Bullshit, the anonymous founders wrote in the project’s Twitter bio. Peaking at nearly $200M in TVL, liquidity has since dropped to $2.5M according to DeFi Llama.

What is Basis?

Basis.io, the original project, launched “with the ambitious goal of creating a better monetary system: one that would be resistant to hyperinflation, free from centralized control, and more stable and robust than the monetary systems that came before it.”

Despite raising $133M the project closed its doors, citing US securities laws and transfer restrictions as major blockers to execute on their vision. Basis returned all capital to investors before shutting down in December of 2018.

Enter Basis Cash

Now, Basis is seeing a second life on the back of a completely anonymous team, presenting an MVP stablecoin called Basis Cash (BAC) and a governance token called Basis Shares (BAS). To maintain its peg, a third token called Basis Bonds (BAB) is issued whenever the price of BAC drops below a dollar. Users can claim BAB’s should BAC trade below a dollar, and redeem them when BAC trades above a dollar. In its current form, users are incentivized to sell BAC down to its target peg of $1.

However, the hype around the fair launch instead led BAC to trade at above $900 on Nov. 30 the day of the launch, before quickly plunging and hovering between $80 and $150 since, according to TradingView.

While things cooled off, farmers have been riding home with profits reminiscent of the early days of SUSHI and YAM.

Now, Basis is gearing up for the launch of its governance ‘Boardroom’ this Friday, using BAS earned from staking LP tokens for voting. There are two active proposals live on the project’s Github. Basis Cash shows that a 2017 project with $130M in funding that was unable to overcome legal risk, can now roam free in the land of DeFi – at least for now.

While it’s unclear whether the experiment will amount to anything meaningful, the excitement shows that the days of 10,000% yields are far from over for those willing to take on unprecedented amounts of risk. Stay safe out there!

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.