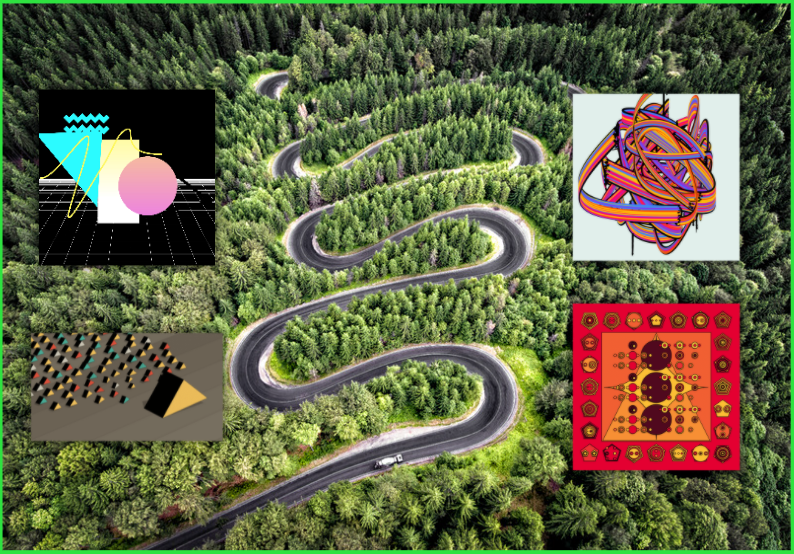

Digital Beauty, Asset Flipping, and a Bad Case of the Shakes: Inside the Chase for Art Blocks NFTs

I started chasing Art Blocks NFTs on Aug. 25 during Radix’ Eccentrics 2: Orbits drop. That may sound like gobbledygook to some, but others, including Art Blocks founder Erick Calderon, AKA Snowfro, will know that I picked the worst time to begin my quest to mint generative digital art NFT on the platform. But three…

By: Bailey Reutzel • Loading...

DeFi

I started chasing Art Blocks NFTs on Aug. 25 during Radix’ Eccentrics 2: Orbits drop.

That may sound like gobbledygook to some, but others, including Art Blocks founder Erick Calderon, AKA Snowfro, will know that I picked the worst time to begin my quest to mint generative digital art NFT on the platform. But three months ago I’d minted an Art Blocks piece and its value has skyrocketed by 5,000%. Needless to say, that made me emboldened to become a real degen, to become a flipper. It wasn’t about the art at all this time.

Legions of collectors have poured into Discord servers and hit the auction circuit as NFTs envelop crypto. While this hype cycle might have started with art — Beeple’s $69M sale via Christie’s left jaws on the floor — it’s now engulfed electronic gaming, professional sports, fine art museums, the mainstream media, and even Hollywood. And for sure, it feels more and more like the ICO boom every day. But even as detractors have laughed at the absurdity of million dollar JPEGs, Art Blocks has emerged as a sensible yet edgy platform for digital forms of expression that truly exploit the properties of technology.

Armed with Three ETH

Which is great, but I was taking the plunge at the precise moment everyone else had twigged onto Art Blocks and sent its economics to the stratosphere. And it wasn’t just in the Curated drops — those collections carefully selected by the Art Blocks team to best represent the vision of the platform. The hysteria was also shaping Playground drops and Factory drops, two other slates Art Blocks uses to organize and auction NFTs.

I was armed with three ETH — at the time, just shy of $10,000, so not chump change — during the Eccentrics 2 Playground drop. And I was amped up… I had finally decided to drop that kind of money on an Ethereum smart contract that spits out a piece of digital art.

Not long before the Aug. 25 sale, Art Blocks had instituted a Dutch Auction-style drop. This means there’s a starting price for minting one NFT of a particular collection. In Eccentrics 2, the starting price was 5 ETH and there were 500 NFTs in the collection. Then every five minutes, the price drops by a certain amount of ETH until it hits a resting price, the lowest level it costs to mint an NFT from that collection. Eccentrics 2 was set to drop by 0.5 ETH every five minutes until it hit 1.5 ETH, and then it would start dropping by 0.25 ETH until it fell to the resting price of 0.25.

I was physically shaking, my stomach turning, I haven’t smoked in a year, but I was feening because I knew I would make it into the drop with three ETH. How could I not?

I was physically shaking, my stomach turning, I haven’t smoked in a year, but I was feening because I knew I would make it into the drop with three ETH. How could I not? I’ve got $10,000 in ETH. The real question: Was this going to be another moment I kick myself for selling ETH?

The collection hit the auction block at 3 pm EST on Wednesday, Aug. 25. I refreshed the page every 10 seconds or so. And as I did, I watched the number of NFTs minted creep up. Then my anxiety from spending ten grand quickly turned into disbelief that I’d been squeezed out of this drop.

“Having to fight for a mint in a drop isn’t the end of the world,” Calderon says. “There are things in the world where there is less supply than demand, like Coachella tickets. It’s okay for there to be competition, but the level of competition happening right now is completely unreasonable. It’s very much fueled by speculation.”

I signed into Coinbase, thinking I’d transfer more ETH into my MetaMask, but before the transfer, I refreshed the drop page and got this:

“The max number of iterations/editions for this project have been minted. Please visit the project on OpenSea to see what is available on the secondary market.”

In under four minutes, Eccentrics 2 sold out all 500 editions for 5 ETH, netting somewhere around $8M.

This was a Playground drop. A Playground drop is one from an artist that has previously dropped a collection in Curated, but is now experimenting more with their work. Although, I’d soon find out, this price wasn’t far from what was happening during Factory drops as well. Factory being a less vetted category for newer artists to drop art.

The fact that digital artists are dropping 1,000 editions in Playground and Factory and garnering more money than a fine artist would make over a lifetime doesn’t just seems outrageous. Even to Calderon.

Generative Art

“I’m not saying it’s not worth the ETH, but when you put it in perspective, it feels…,” Calderon hesitates, looking for the right word. “…wrong.”

“Well, that’s not the right word,” he hastens to add. He sighs. “I guess counterintuitive. Let me put it this way, I don’t buy many Art Blocks at these prices.”

But no one should panic. Calderon is intensely aware of the implications of what he’s saying. “I know I can’t tell you what to write… but I’m fearful of that panic,” he says.

“Long-term I really think this type of art could be quite valuable,” he continues. He’s seen that firsthand in the NFT space broadly. He thought people were crazy for buying Crypto Punks at $2,000, but then he sold several Zombie Punks for $15K last year. And the cheapest Punk today is worth $100,000.

But why? Generative art, which goes back to the avant-garde of the 1960s, is work that’s created with an autonomous, self-propelling mechanism. Naturally, that’s an ideal task for computer code.

Laws of Scarcity

On Art Blocks, the artist is the programmer (or at least hires a programmer to create their vision). The art is a software protocol, coded with many different parameters — think size, shape, color, movement — inserted into an Ethereum NFT smart contract and then upon mint, those parameters are thrown together at random to create the artwork.

So neither the artist nor the art buyer know what the artwork will look like before it’s created. Although, the artist does typically mint a few pieces of the collection ahead of the drop so people can get an idea of what they will look like to some extent. Some of those combinations of parameters are rarer than others, making a piece more valuable if the laws of scarcity apply.

Calderon sees this as a new asset class, the next generation of digital art collecting.

Trading Hands

He’s not alone in his thinking. Collectors have been snapping up pieces from Art Blocks for months and on Aug. 23, a piece from the Fidenza collection created by Tyler Hobbs, sold for a whopping $3.3M. And in October, Christie’s, the venerable art auction house, will handle a sale of 31 Art Blocks pieces from its Curated collections.

Once the drop sells out, all the editions go to the secondary market OpenSea, where owners can list their works for sale and other users can bid to buy the pieces. The OpenSea user interface and search is shit, so it’s hard to tell what’s happening there, but assume that art is trading hands.

For instance, the day after Eccentrics 2 dropped, the rarest piece, #175, sold for 10 ETH. Doubling their money — not bad.

That said, the most favored Eccentrics 2 piece, #367, is being listed for 5.75 ETH right now. The highest bid that one ever received, the day of the drop, was 6.5 ETH. Two days after the drop, people were only willing to bid around 3 ETH for it. And now, the bids are down to 1 ETH. Losing 80% of its value — not good.

Colored Shards

For the whole collection, the floor price is 1.5 ETH. Remember everyone who bought one of these, spent 5 ETH.

This isn’t to call out Eccentrics 2, it’s great art. I mean I know very little about art, but I like the art.

But the point is this frenzy happened with nearly every Art Blocks drop I chased for a week.

The reason I started this adventure, though, was because back what feels like years ago in late May 2021, I bought into an Art Blocks Curated collection called Frammenti by Stefan Contiero. The design was simple, the color palette was nice, but what really sold me was the movement. These pieces seem to be static images of different colored shards making up a bigger shape. But then the shards start to dance and before you know it, the shapes have fully broken apart. In the artist statement, Contiero says the collection is about memories, and I appreciate the metaphor.

Frammenti #121

I spent about $581.95 on the mint plus Ethereum gas fees. The most recent bid I got on that piece is 6.7 WETH, equivalent to about $23,400 today. The highest ever bid I got on that piece was 10.1 WETH, which at a time was equal to more than $33,000.

The piece isn’t even terribly rare — 345 out of 555 editions.

But because of those huge gains, I was chasing Art Blocks in the hopes of flipping one fast for some cash.

So a couple days after Eccentrics 2, on Aug. 27, I watched the Curated drop called Geometry Runners by Rich Lord. Again, I was shaking at my desk thinking about the kind of money I was about to drop. And then, that one sold out at its starting price of 5 ETH in under three minutes. Okay.

Money Grab

Then Art Blocks announced it would raise the starting Dutch Auction price to between 15 ETH and 20 ETH.

I am not an economist so I don’t fully understand the forces that make humans behave in a certain way. I initially thought, “Well, that’s it for me, I guess I won’t be buying another Art Block piece. And seriously Art Blocks? What a money grab!”

But Calderon did speak to an economist. And as I came to learn, the Art Blocks founder is one of the most genuine people I’ve met in a while. He cares about his baby, and his baby is supposed to offer the world an egalitarian blockchain use-case that’s individualistic and fun and exciting and appeals to all kinds of people. I’m sure he’s thankful to be making the money he is, but that is not his first priority.

And raising the starting price: a stroke of sheer genius.

It slowed everything down. Because the price was so high, there wasn’t that initial rush to mint, which tempered people’s trigger finger throughout the whole drop.

Playing Chicken

On Aug. 30, I sat in on the Factory drop Brushpops by Matty Mariansky. Starting price 15 ETH. I came to the computer that day fully knowing there was no way I’d get into the drop. I was expecting these Art Blocks psychopaths to mint all 1,000 editions before it hit 12.5 ETH.

And then, the minutes slowly ticked by. Without panic. I continued to refresh but the number of editions minted stayed the same. One was bought at 6 ETH. Once the number of mints hit 100, I started getting nervous, so nervous I forgot to note the price we were at, even though there were plenty more. But the other drops had conditioned me to think a frenzy might start at any time.

I actually had time to go see what was being said in the Discord channel. People were saying, “Hold for 1 ETH.” Others were quiet, like me, switching between screens, playing chicken with one another. Others were sharing screenshots of their mints.

I had set gas at $14, which was never gonna be picked up by miners during an Art Blocks drop.

Around 1 ETH, every refresh showed more mints. At 0.75 ETH, I realized I was supposed to be buying and clicked purchase, which brought up my MetaMask… I fumbled around with the gas fee, and clicked Accept on more than$2,600 worth of ETH.

I refreshed the drop page and saw 1000/1000. All had been minted so now I was waiting to see if my transaction went through. A couple minutes later, the transaction failed. I had set gas at $14, which was never gonna be picked up by miners during an Art Blocks drop.

The floor price of that collection is now 0.48 ETH. The rarest is being listed by its owner at 4 ETH, but it’s only ever gotten one bid at 1 ETH.

The autoRAD drop by sgt_slaughtermelon and Tartaria Archivist started a couple hours later, and this drop happened in a similar fashion to the previous. It was slower, things felt more calm, even though I couldn’t see any of the other people I was competing with. I was fully prepared, and so at 0.75 ETH, I clicked purchase, increased my gas fee in MetaMask, and clicked Accept.

And several minutes later, I had bought another Art Blocks for $2,970.77 (including the gas fee).

I’m now the owner of autoRAD #666 (that’s right, hail Satan):

AutoRADD #666

Remember, the goal, at least initially, was to purchase an Art Block and then quickly flip it. But here I am, almost two weeks later, and I’ve gotten one offer for 0.34 WETH on this piece (that’s less than what I paid for it).

There are strategies to flipping, of course. For instance, someone told me to list this NFT for sale at a really high price, which gets it seen by more people in some way that’s unclear and if it’s seen by more people, it’ll be favorited by more people, which again gets it seen by more people in some way that’s unclear and then the bidding war begins.

I haven’t done this.

Anti-flipper

Mostly out of laziness. But then as I come back to the piece, well dammit, I’m starting to really like it. It’s cute in a pretentious way. It looks like a mustachioed face that is absolutely disappointed in me deciding to become a flipper, perversely pumping crypto markets for my own gain.

Calderon wouldn’t approve. “It feels kinda gross to me,” he’d said when talking about flipping during our interview. He’s not anti-flipper, but he is irritated by how upset people get that Art Blocks is trying to limit that behavior in any way. It’s why the platform instituted the one mint-per-wallet rule. Before that, one person could buy up the whole collection and then turn around the next day and sell each piece for 1 ETH more than they paid.

“That feels bad for the artists,” he says. Plus, he continued, Art Blocks doesn’t want to create new middlemen. It doesn’t want to act as the wholesaler, so you, me, whoever, can act as a retailer on the secondary OpenSea market.

“Scalping is the word there, not flipping,” Calderon says. “And it’s not okay for Art Blocks.”

Calderon asks how long it’ll take me to write the piece and I say I’ll finish it by Friday.

“Oh, because your piece would be different in two weeks,” he says.

It’s true.

Money-grubbing Scalper

Two weeks ago, I started out as a money-grubbing scalper and now I’m just going to appreciate the journey and the new art. And two weeks ago, I could barely get into an Art Blocks drop with 3 ETH, but now I’m watching drops fall under 1 ETH.

The PrimiLife Factory drop by Wuwa on Sept. 7 made it to its resting price of 0.25 ETH before selling out. And that took a whole hour! On Sept. 9, the High Tide Factory drop by Artem Verkhovskiy and Andy Shaw not only reached its 0.25 resting price but also didn’t sell out for nearly two hours.

“We’re getting close to where people on Art Blocks can buy art for reasonable amounts of money,” Calderon says.

That’s a good feeling. Because now it’s not a goal, not a game, not a challenge, now it can be just about me and the art I like, and if the whole market bottoms out and everything goes to zero, I’ll still have a beautiful piece to hang on my wall.

Advertisement

Get the best of The Defiant directly in your inbox 💌

Know what matters in Web3 with The Defiant Daily newsletter, every weekday

90k+ investors informed every day. Unsubscribe anytime.